The Europe L7 electric micro cars market is driven by urbanization, environmental concerns, and technological advancements. These compact electric vehicles offer eco-friendly solutions for urban mobility, reducing CO2 emissions by 50% compared to conventional cars. With government incentives and innovations in battery technology, the market is poised for significant growth.

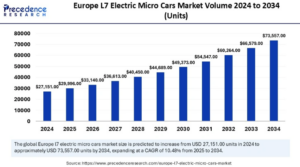

According to Precedence Research, the Europe L7 electric micro cars market volume was valued at 27,151 units in 2024 and is expected to touch 73,556 units by 2034, registering a double digit CAGR of 10.48% between 2025 and 2034. The increased demand for personal mobility solutions is driving the Europe L7 electric micro cars market.

Production Data:

| Years | Market Volume (Units) |

| 2024 | 27,151 |

| 2025 | 29,996 |

| 2026 | 33,140 |

| 2027 | 36,413 |

| 2028 | 40,450 |

| 2029 | 44,689 |

| 2030 | 49,373 |

| 2031 | 54,547 |

| 2032 | 60,264 |

| 2033 | 66,579 |

| 2034 | 73,557 |

Germany leads the market, while the UK is emerging as the fastest-growing region. Key challenges include limited charging infrastructure and high initial costs, but advancements in lithium-ion batteries and AI integration are boosting adoption across Europe

Europe L7 Electric Micro Cars Market Key Takeaways

- Germany dominated the market by holding the largest market share in 2024.

- UK is expected to grow at the fastest CAGR in the foreseeable period.

- By range per charge, the medium range (61-100KM) segment held a major market share of 45.55% in 2024.

- By range per charge, the extended range (Above 100KM) segment is expected to grow at a notable CAGR in the upcoming period.

- By battery type, the lithium-ion battery segment dominated the market with the biggest market share of 72.31% in 2024.

- By seats, the 2 seats segment led the market with the highest market share of 54.34% in 2024.

Europe L7 Electric Micro Cars Market Key Drivers of Growth

Urbanization and Environmental Awareness

The increase in urban populations has heightened the need for smaller, more maneuverable vehicles. L7 electric micro cars emit 50% less CO2 compared to conventional vehicles, making them an attractive option for environmentally conscious consumers. The trend towards micromobility aligns with broader goals of achieving clean urban transport solutions1.

Government Initiatives

European governments are actively promoting the adoption of electric vehicles through favorable policies and incentives. These include tax credits, subsidies, and regulations aimed at reducing carbon emissions. Such initiatives are crucial in encouraging consumers to transition from traditional vehicles to electric microcars12.

Technological Advancements

Innovations in battery technology and vehicle design are enhancing the appeal of L7 electric micro cars. The integration of lithium-ion batteries, which accounted for 72.31% of the market share in 2024, allows for longer ranges and improved performance1. Additionally, advancements such as regenerative braking systems and autonomous driving features are making these vehicles safer and more efficient.

Country Analysis of Europe L7 Electric Micro Cars Market

| Region/Country | Key Insights |

| Germany | Germany dominates the market due to its strong automotive industry, extensive charging infrastructure, and government incentives like tax credits and subsidies. The country is a leader in sustainable mobility solutions and has a high production value for electric microcars. |

| United Kingdom | The UK is the fastest-growing market, driven by government initiatives to phase out petrol and diesel cars by 2030. It boasts a well-established charging infrastructure and significant government funding for electric vehicle adoption. |

| France | France is a key player, with regulations allowing microcars to be driven from as young as 14 years old. The country promotes urban mobility with compact vehicles like Citroën Ami. |

| Italy | Italy has a growing market for electric microcars, supported by urban mobility demand and government incentives for eco-friendly transportation solutions. |

| Spain | Spain’s market growth is fueled by urbanization and increasing awareness of environmental sustainability. It is emerging as a significant adopter of electric microcars. |

| Belgium & Netherlands | These countries are leveraging advanced urban planning and environmental policies to support the adoption of electric microcars. Both have strong regulatory frameworks encouraging sustainable transportation46. |

| Switzerland | Switzerland focuses on eco-friendly mobility solutions, with increasing investments in green transportation technologies |

Regional Trends

- Urban Mobility Solutions: Countries like Germany, UK, and France are prioritizing compact vehicles for urban areas to reduce congestion and emissions.

- Government Incentives: Tax credits, subsidies, and favorable regulations across Europe are driving adoption.

- Charging Infrastructure: Western Europe has well-developed charging networks, while Eastern Europe faces challenges in infrastructure development.

- Youth-Friendly Policies: France stands out with policies allowing younger drivers to operate microcars, boosting demand among teenagers.

What are the main competitors of L7 electric micro cars in the market

The main competitors in the Europe L7 Electric Micro Cars market include several established automotive manufacturers and emerging players focusing on compact electric vehicles. Here are the key competitors:

| Company | Overview |

| Citroën | A well-known French automotive brand, Citroën offers models like the Ami, which is popular for urban mobility. |

| Renault | Renault is a significant player in the electric vehicle sector, with models such as the Twizy targeting microcar consumers. |

| Fiat | Fiat’s 500e model is a compact electric vehicle that competes in the microcar segment, focusing on style and efficiency. |

| Aixam | Specializing in microcars, Aixam offers a range of electric models designed for urban environments, appealing to younger drivers. |

| Volkswagen | Volkswagen is expanding its electric lineup, including compact models that compete with L7 electric micro cars. |

| Micro Mobility Systems AG | This company focuses on innovative micro-mobility solutions, including electric vehicles designed for urban commuting. |

| Daihatsu | Known for its small cars, Daihatsu is also venturing into the electric microcar space, appealing to budget-conscious consumers. |

| e.GO Mobile AG | A German manufacturer focused on affordable electric vehicles, e.GO offers compact models suitable for city driving. |

| Smart (Mercedes-Benz) | Smart’s EQ series includes compact electric vehicles that cater to urban mobility needs and compete directly with L7 microcars. |

Emerging Competitors

- Xiaomi: The tech giant has announced plans to enter the EV market with a focus on affordable electric vehicles.

- Apple: While still in development phases, Apple’s Project Titan aims to create innovative electric vehicles that could disrupt the market.

- Alibaba Group: Through its joint venture with IM Group, Alibaba is developing electrified vehicles tailored for urban use.

Europe L7 Electric Micro Cars Market Segments Analysis:

| Segment | Key Insights | Market Share (2024) | Growth Trend |

| Medium Range (61-100 km) | Ideal for daily urban transportation; Smaller batteries reduce costs and environmental impact; High demand for sustainable solutions. | 45.55% | Dominant segment in 2024 |

| Extended Range (Above 100 km) | Suitable for longer travel; Driven by increased demand for sustainable and urban mobility solutions; Reduces carbon footprint. | N/A | Rapid growth expected during the forecast period |

By Battery Type

| Segment | Key Insights | Market Share (2024) | Growth Trend |

| Lithium-ion | High energy density enables longer ranges; Excellent thermal stability ensures safety; Cost-effective and long cycle life drives adoption. | 72.31% | Dominant segment in 2024; Continuous R&D expected to enhance energy density, charging speed, and cost reduction. |

By Seats

| Segment | Key Insights | Market Share (2024) | Growth Trend |

| 2 Seats | Convenient for urban mobility; Popular among young groups (16+ years); Cost-effective compared to 4-seat microcars; Easier to park in congested areas; Personalized mobility. | 54.34% | Largest market share in 2024; Government initiatives encouraging electric vehicle adoption are enhancing segment expansion. |

Key Player Analysis: Europe L7 Electric Micro Cars Market

| Company | Key Strengths | Strategic Focus | Market Position |

| Citroën | -Innovative Design (Ami) -Strong Brand Recognition -Affordable pricing | -Urban Mobility Solutions -Targeting Young Drivers -Expanding Electric Vehicle Lineup | Leader in the microcar segment with a focus on affordable and accessible urban transportation. |

| Renault | -Established EV Technology -Diverse Product Portfolio -Strong Presence in Europe | -Expanding EV Offerings -Focusing on Compact and Efficient Vehicles -Leveraging existing infrastructure and partnerships | Significant player with the Twizy, aiming to capture a substantial share of the electric microcar market. |

| Fiat | -Stylish Design (500e) -Compact Size -Strong Brand Heritage | -Electric Vehicle Conversion -Focusing on Style and Urban Appeal -Leveraging iconic design for electric microcars | Growing presence, targeting customers looking for fashionable and eco-friendly urban vehicles. |

| Aixam | -Specialized in Microcars -Wide Range of Electric Models -Focus on Younger Drivers | -Maintaining Leadership in Microcar Segment -Developing Advanced Electric Technologies -Adapting to Regulatory Changes | Leader in the microcar market, particularly among younger drivers and in regions with favorable microcar regulations. |

| Volkswagen | -Technological Innovation -Scalable EV Platforms -Strong Manufacturing Capabilities | -Expanding EV Portfolio -Introducing Compact Electric Models -Leveraging MEB platform for efficiency and cost-effectiveness | Emerging competitor leveraging its technological strengths to enter the electric microcar market. |

| Micro Mobility Systems AG | -Innovative Micro-Mobility Solutions -Focus on Electric Mobility -Unique Vehicle Designs | -Developing Unique Urban Mobility Solutions -Expanding Product Portfolio -Focusing on sustainable urban transportation | Niche player with innovative designs, targeting urban commuters seeking efficient and eco-friendly solutions. |

| Smart (Mercedes-Benz) | -Premium Brand Image -Compact Design

-Electric Focus |

-Electric-Only Strategy -Premium Urban Mobility -Focusing on High-End Electric Microcars |

Positioned as a premium option in the electric microcar market, appealing to customers seeking luxury and convenience. |