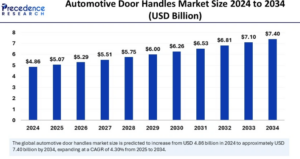

The global automotive door handles market size was estimated at USD 4.86 billion in 2024 and is expected to hit around USD 7.40 billion by 2034, growing at a CAGR of 4.30%.

The Automotive Door Handles Market is driven by evolving vehicle designs, technological advancements, and rising demand for enhanced security features. Manufacturers are focusing on lightweight, durable materials like aluminium and ABS plastic to improve efficiency. Innovations such as keyless entry, sensor-based, and retractable handles are gaining traction, especially in luxury and electric vehicles.

Growth is influenced by increasing vehicle production, aftermarket demand, and stringent safety regulations. The Asia-Pacific region, led by China and India, dominates due to booming automobile manufacturing. However, high costs of advanced handles and integration challenges may restrain market expansion.

Automotive Door Handles Market Key Takeaways

- Asia Pacific dominated the automotive door handles market in 2024.

- North America is expected to grow at a significant CAGR over the forecast period.

- By type, the exterior door handles segment held the biggest market share in 2024.

- By type, the interior door handles segment is expected to grow at the fastest CAGR over the forecast period.

- By vehicle type, the passenger vehicle segment led the market in 2024.

- By vehicle type, the commercial vehicles segment is estimated to grow at the fastest CAGR over the forecast period.

- By handle type, the mechanical handle segment contributed the highest market share in 2024.

- By handle type, the automatic handle type segment is expected to show the fastest growth over the projected period.

- By sales channel, the original equipment manufacturer (OEM) segment dominated the market in 2024.

- By sales channel, the aftermarket segment is projected to grow at the fastest rate during the forecast period.

Impacts of Artificial Intelligence on Automotive Door Handles Market

Artificial Intelligence (AI) is significantly impacting the automotive door handles market by enhancing security, convenience, and innovation. AI-powered keyless entry systems with facial or fingerprint recognition are improving vehicle security, while touchless and gesture-controlled handles offer a seamless user experience. Predictive maintenance enabled by AI sensors helps detect wear and tear, reducing failures and ensuring timely replacements. AI also enhances safety by integrating with crash detection systems, allowing automatic door unlocking in emergencies. Additionally, AI enables personalized user preferences, adjusting handle responses based on driver habits. These advancements are driving the demand for smart and automated door handles, especially in luxury and electric vehicles.

Regional Outlook of Automotive Door Handles Market

Asia-Pacific: Leading the market due to high vehicle production in China, India, and Japan, along with growing demand for advanced automotive features.

North America: Witnessing steady growth driven by increasing adoption of smart, keyless, and touchless entry systems, especially in luxury and electric vehicles.

Europe: Strong presence of premium car manufacturers and adherence to stringent safety regulations support market expansion.

Latin America: Moderate growth influenced by rising vehicle ownership and increasing adoption of modernized automotive components.

Middle East & Africa: Gradual market development fuelled by urbanization, economic growth, and a shift toward advanced automotive technologies.

Automotive Door Handles Market Report Coverage

| Report Coverage | Details |

| Market Size by 2034 | USD 7.40 Billion |

| Market Size in 2025 | USD 5.07 Billion |

| Market Size in 2024 | USD 4.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.30% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 to 2034 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Handle Type, Vehicle Type, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics of Automotive Door Handles Market

Driver: Stringent Government Regulations

Global safety regulations are driving the demand for high-quality automotive door handles with impact resistance and pollution prevention features. Governments mandate the use of safety-enhanced door handles that can withstand collisions and minimize emissions during accidents. For instance, Hyundai’s upcoming 2024 Alcazar SUV, set for launch in September 2024, features NFC-enabled Digital Key technology, smartphone-operated door handles, and over 70 connected car features, showcasing the growing adoption of smart and secure door handle technologies.

Restraint: High Manufacturing Costs

The high production costs associated with advanced automotive door handles pose a challenge to market growth. These handles require specialized manufacturing, custom designs, and high-quality materials, leading to higher expenses compared to traditional door handles. The added costs of integrating advanced features may hinder widespread adoption, especially in budget-friendly vehicle segments.

Opportunity: Development of Lightweight Door Handles

Leading industry players are focusing on lightweight materials such as aluminum, carbon fiber, and magnesium to enhance fuel efficiency and reduce vehicle weight. Additionally, retractable handles improve aerodynamics by minimizing drag, enhancing both the vehicle’s aesthetics and energy efficiency. These advancements align with the growing demand for fuel-efficient and environmentally friendly vehicles.

Market Insights by Segment

Type Insights

The exterior door handles segment led the automotive door handles market in 2024, driven by their widespread use in vehicle manufacturing. Available in various styles, including doorknobs and lever handles, these handles are crafted from diverse materials such as wood and composite materials. Meanwhile, the interior door handles segment is anticipated to experience the fastest growth, as they offer superior grip, stability, and ease of access for passengers.

Vehicle Type Insights

Passenger vehicles accounted for the largest market share in 2024, supported by the increasing incorporation of advanced technologies like artificial intelligence (AI) and virtual reality (VR) in vehicle design and manufacturing. Enhanced passenger comfort, including ergonomic seating, entertainment systems, and air conditioning, is further fueling demand. The commercial vehicle segment is projected to grow at the fastest pace, benefiting from AI-driven security systems and advanced driver-assistance technologies that enhance safety and efficiency.

Handle Type Insights

Mechanical door handles dominated the market in 2024 due to their reliability, cost-effectiveness, and safety benefits. Predictive maintenance capabilities also contribute to operational efficiency by reducing mechanical failures. However, automatic door handles are expected to witness the highest growth rate during the forecast period, as features like flush door handles improve aerodynamics, fuel efficiency, and vehicle performance. Notably, Citroën India introduced the new Citroën C3 in August 2024, featuring a 6-speed automatic transmission, power window switches, and auto-folding ORVMs, reflecting the rising trend of smart vehicle components.

Sales Channel Insights

The Original Equipment Manufacturer (OEM) segment dominated the market in 2024, as OEMs provide high-quality, durable components at competitive prices while ensuring compliance with safety standards. However, the aftermarket segment is anticipated to grow rapidly due to its strong adherence to industry regulations and certifications, ensuring product reliability. Additionally, aftermarket services such as proactive maintenance and repair solutions help enhance customer loyalty and extend vehicle longevity.

Automotive Door Handles Market Companies

- CI Car International

- Dorman Products

- Guangzhou Yishan Auto Parts

- Huf

- OMIX

- Quadratec

- Magna International

- Minda VAST Access Systems

Recent Developments in Automotive Door Handles Market

- Hyundai’s 2024 Alcazar Launch (August 2024) – Hyundai announced the launch of the 2024 Alcazar SUV, featuring advanced door handle technology, including smartphone-operated handles and NFC-enabled Digital Key for seamless access.

- Citroën India Introduces New C3 (August 2024) – Citroën India unveiled the updated C3 model, equipped with auto-folding ORVMs, power window switches on doors, and enhanced door handle ergonomics, aligning with the demand for modernized vehicle components.

- Growing Adoption of Flush Door Handles – Leading automakers such as Tesla, Mercedes-Benz, and BMW are increasingly incorporating flush door handles to enhance vehicle aerodynamics and fuel efficiency, contributing to a shift towards sleek, retractable handle designs.

- Lightweight Materials Revolutionizing Door Handles – Automakers are investing in aluminum, carbon fiber, and magnesium-based door handles to reduce vehicle weight, improve fuel efficiency, and meet stringent environmental regulations.

- AI-Driven Security Features Gaining Popularity – The integration of AI-powered biometric authentication, gesture-controlled entry, and predictive maintenance sensors in door handles is becoming a key trend, especially in luxury and electric vehicles.

- OEM and Aftermarket Expansion – The demand for high-quality, OEM-manufactured door handles remains strong, while the aftermarket segment is growing rapidly, driven by increasing consumer preference for customizable and upgraded door handle solutions.

These developments indicate a strong push toward technologically advanced, lightweight, and smart door handles, catering to evolving automotive industry trends.

Segments Covered in the Report

By Type

- Exterior Door Handles

- Interior Door Handles

By Handle Type

- Mechanical

- Automatic

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa