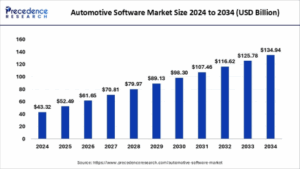

The global automotive software market size was evaluated at USD 43.32 billion in 2024, and is predicted to cross around USD 134.94 billion by 2034, expanding at a CAGR of 11.10% from 2025 to 2034.

The automotive industry is undergoing a revolutionary transformation, rom purely mechanical machines to intelligent, connected, and increasingly autonomous systems. At the center of this transformation is automotive software, a critical enabler of next-generation vehicle functionality. No longer confined to supporting infotainment or navigation, software now plays a dominant role in controlling vehicle safety, diagnostics, powertrain, ADAS (Advanced Driver-Assistance Systems), autonomous driving, and over-the-air (OTA) capabilities. As the world shifts toward software-defined vehicles (SDVs), the importance of robust, secure, and upgradable automotive software has skyrocketed.

Key Highlights of the Automotive Software Market (2024)

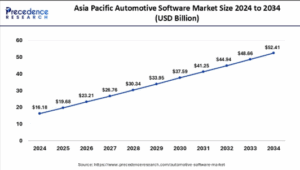

- Asia Pacific emerged as the leading regional market, capturing approximately 37.35% of the total revenue share in 2024.

- North America is poised for robust growth, exhibiting a projected CAGR of 13.46% throughout the forecast period.

- Based on the software layer, the application software segment dominated the market with an estimated 51.60% share.

- In terms of vehicle type, passenger cars accounted for the largest revenue portion, reaching around 55.01%.

- Within the application segment, autonomous driving held a significant position with a 13.50% share of the total market revenue.

Regional Insights: A Global Shift Driven by Local Leaders

Asia Pacific dominates the global automotive software landscape with a projected market value of $1,714.90 billion in 2024 and a CAGR of 11.5% through 2034. Accounting for 37.35% of global market share, the region benefits from a combination of large-scale automotive manufacturing, rapid electrification, and strong government push toward intelligent transportation systems. China leads this growth, holding a 30.27% share in Asia’s automotive software market, followed by India (23.42%) and Japan (18.80%). Notably, India’s role is growing rapidly due to its robust IT services industry and increasing R&D investment by global OEMs and Tier-1 suppliers.

North America, while smaller in absolute volume at $1,321.10 billion, leads in technological innovation and growth pace, boasting the highest CAGR of 13.5% from 2025 to 2034. The United States dominates the North American market, contributing 76.02% of the region’s total share in 2024, driven by a strong ecosystem of autonomous driving startups, software providers, and legacy automakers pivoting to SDVs. Canada (19.23%) and Mexico (4.75%) also contribute to growth through cross-border manufacturing and software exports.

In Europe, valued at $783.40 billion in 2024, growth is steady at 9.3% CAGR, anchored by nations like Germany, the U.K., and France. The continent benefits from strong regulatory frameworks for safety, emissions, and data protection, which necessitate the integration of sophisticated software systems. Additionally, initiatives like UNECE WP.29 cybersecurity regulations are compelling OEMs to invest more in secure and update-ready architectures.

Latin America and the Middle East & Africa (MEA) are emerging regions with smaller market bases, $161.10 billion and $201.3 billion respectively in 2024, but notable CAGRs of 9.3% and 5.5%. Their contributions are driven by the gradual adoption of fleet telematics, logistics software, and urban smart mobility infrastructure.

Automotive Software Market Revenue, By Region 2021-2024 (USD Billion)

| By Region | 2021 | 2022 | 2023 | 2024 |

| North America | 5.15 | 6.09 | 8.53 | 11.08 |

| Europe | 3.92 | 4.45 | 5.99 | 7.49 |

| Asia Pacific | 8.01 | 9.26 | 12.71 | 16.18 |

| Latin America | 2.46 | 2.79 | 3.76 | 4.70 |

| Middle East & Africa | 2.17 | 2.41 | 3.17 | 3.87 |

Key Software Segments: What’s Driving Adoption?

The automotive software landscape comprises several key verticals:

- ADAS and Autonomous Driving Software: These systems enhance safety and driving experience through features such as adaptive cruise control, automated braking, lane centering, and, eventually, full autonomy. As Level 3 and Level 4 autonomous driving gains traction, the complexity and scale of software will multiply.

- Infotainment and HMI (Human-Machine Interface): Consumers demand seamless smartphone integration (Apple CarPlay, Android Auto), voice controls, and personalized interfaces. This drives OEMs to integrate sophisticated UI/UX software and cloud-connected services.

- Powertrain and Battery Management: In EVs, software manages battery health, charging behavior, thermal regulation, and power distribution—critical to performance and longevity. This segment is rapidly evolving alongside battery innovations.

- Vehicle Telematics and Connectivity: Real-time vehicle tracking, predictive maintenance, remote diagnostics, and usage-based insurance (UBI) models all depend on embedded telematics platforms.

- Over-the-Air (OTA) Updates: OTA capabilities are now a core requirement for modern vehicles, enabling manufacturers to remotely deliver security patches, firmware upgrades, and even unlock premium features post-sale.

Automotive Software Market Key Players

- ATEGO SYSTEMS INC. (PTC)

- AUTONET MOBILE, INC.

- ADOBE

- AIRBIQUITY INC

- BLACKBERRY LIMITED

- GOOGLE (ALPHABET INC.)

- MONTAVISTA SOFTWARE, LLC

- GREEN HILLS SOFTWARE

- MICROSOFT CORPORATION

- WIND RIVER SYSTEMS, INC

Key Growth Drivers: Why the Market is Accelerating

Several forces are propelling the automotive software market forward:

Electrification of Vehicles: As EV adoption accelerates globally, the demand for software controlling battery management systems (BMS), motor controllers, and EV-specific features also rises.

Shift to Software-Defined Vehicles: Legacy hardware architectures are giving way to centralized, service-oriented vehicle operating systems. This modular approach allows manufacturers to continuously improve functionality through software.

Government Regulations & Safety Mandates: Regulatory bodies worldwide are mandating the inclusion of ADAS features, cybersecurity measures, and digital emissions monitoring, all of which require complex software integration.

Demand for Personalized Experiences: Software allows for real-time adaptation of driving profiles, entertainment preferences, and navigation behavior, creating differentiated brand experiences.

Rise of Connected and Autonomous Fleets: Fleet operators are investing in telematics and driver-assistance software to reduce accidents, cut fuel consumption, and enhance operational visibility.

Growth of Mobility-as-a-Service (MaaS): Ride-sharing and vehicle subscription models depend on sophisticated backend software for fleet orchestration, user authentication, payment, and vehicle access.

Key Challenges: Navigating the Roadblocks

Despite growth potential, several challenges exist:

Cybersecurity Threats: As cars become increasingly connected, they become more vulnerable to cyberattacks. Software must meet rigorous cybersecurity standards (like ISO/SAE 21434).

Complexity of Integration: Harmonizing multiple software modules from different vendors across heterogeneous vehicle platforms increases integration cost and timeline.

Lack of Skilled Workforce: There is a shortage of engineers proficient in embedded systems, automotive safety standards (ISO 26262), and automotive-grade Linux or QNX platforms.

High Development Costs: Building and validating automotive-grade software is capital-intensive, requiring extensive simulation, testing, and certification.

Future Outlook: The Software-First Era of Mobility

Looking ahead, the automotive industry is set to undergo a monumental software renaissance. With market size expected to reach $134.94 billion by 2034, automakers are increasingly transforming into mobility tech providers. Partnerships between OEMs, tech giants (like Google, Apple, Amazon), and semiconductor companies are giving rise to digital ecosystems within the vehicle.

We can also expect the widespread adoption of automotive operating systems (e.g., Android Automotive OS, Volkswagen’s CARIAD), AI-based perception and decision engines, and cloud-native vehicle orchestration platforms.

Furthermore, 5G and edge computing will make real-time software updates, remote diagnostics, and cooperative driving (V2V, V2I) viable at scale. This transformation will demand continuous investments not just in software capabilities, but in architecture, security, and talent.

Automotive Software Market Recent Developments

Strategic Investments & Funding

Bosch Software Investment Expansion (2025): Bosch announced a major investment to scale its automotive software capabilities, focusing on autonomous driving platforms and centralized vehicle computing. This includes extending development hubs across Europe and India.

Continental’s $250M Commitment to Automotive Software: Continental has committed $250 million in 2025 toward upgrading its software stack, especially in the areas of ADAS and cloud-based vehicle architecture.

NVIDIA and Mercedes-Benz Expanded Partnership: In early 2025, NVIDIA and Mercedes-Benz expanded their partnership to roll out a fully upgradable software-defined vehicle architecture. This includes OTA updates for autonomous features and AI-based driver experiences.

BMW + Amazon Web Services (AWS): BMW is partnering with AWS to build a cloud-native automotive software development platform. The partnership aims to fast-track SDV (Software-Defined Vehicle) initiatives and reduce time-to-market.