The global pit bike market size reached USD 2.29 billion in 2024 and projected to hit around USD 4.49 billion by 2034, with a notable CAGR of 6.96% from 2025 to 2034.

A pit bike is a small, lightweight motorcycle originally created for maneuvering through the pits of motocross races. Over the years, it has evolved into a standalone vehicle category used in recreational riding, amateur racing, and off-road adventure. With engines typically ranging from 50cc to 160cc, pit bikes offer a lower-cost, easier-to-maintain alternative to full-sized motocross bikes. From training schools to motorsport parks and tourism-based rentals, businesses are seeing growing value in deploying fleets of these machines for youth riders and beginners in controlled environments.

How is the Pit Bike Market Segmented for Commercial Use?

The pit bike market is structured across multiple dimensions, allowing businesses to target very specific segments. From a product perspective, these bikes are categorized by engine capacity, 50–70cc for beginners, 70–110cc for intermediate use, and 110–160cc for more aggressive performance. In terms of frame materials, steel is popular for budget-conscious buyers, while aluminum is preferred for lighter weight and higher maneuverability. Usage-wise, pit bikes are sold for racing, recreational, rental, and training purposes. Distribution happens via OEMs, aftermarket channels, online retailers, and localized dealerships, providing multiple entry points for business expansion.

What Key Trends Are Powering Market Expansion?

- Surge in Off-Road Motorsport Popularity: The rising interest in off-road racing events and competitions has significantly boosted the demand for pit bikes. These bikes are favored for their compact size, agility, and ease of handling, making them ideal for racing on diverse terrains.

- Growth in Recreational Use: The recreational segment contributed more than 44% of the market share in 2023, driven by the increasing popularity of off-road activities and adventure tourism.

- Dominance of Gasoline-Powered Bikes: Gasoline-powered pit bikes held a dominant share in 2023, owing to their affordability, wide availability, and established infrastructure for fuel supply.

- Emergence of Electric Pit Bikes: Electric pit bikes are gaining popularity due to their environmental benefits and ease of usage. Manufacturers are developing electric models that offer competitive performance and endurance, catering to riders looking for a sustainable and efficient alternative.

- Youth and Beginner Engagement: The 50cc-125cc engine capacity segment is expected to lead the market, accounting for a market share of approximately 60% in 2023. This is driven by the increasing fondness of children and young adults for pit bikes for leisure and recreational purposes.

- Technological Advancements: Innovations such as electric engines, enhanced suspension systems, and improved safety measures are appealing to a broader audience. The global pit bikes market is projected to grow at a CAGR of 6.96% from 2025 to 2034, indicating robust demand driven by evolving consumer preferences and the desire for accessible off-road experiences

- Regional Market Insights: Asia-Pacific dominated the market with the largest market share of 36% in 2024, benefiting from exporting pit bikes to other regions including North America and Europe. North America is expected to grow at the highest CAGR during the forecast period, driven by a strong culture for outdoor recreation and increasing interest in off-road riding.

Why Asia Pacific Dominates the Pit Bike Market?

Demographic Strength and Rising Enthusiasm

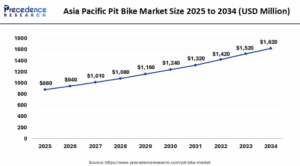

The Asia Pacific pit bike market size was valued at USD 820 million in 2024 and is expected to expand around USD 1,620 million by 2034, at a CAGR of 7.05% from 2025 to 2034.

Asia Pacific has a young and energetic population base, particularly in countries like India, Indonesia, and Vietnam. Over 60% of Southeast Asia’s population is under the age of 35, making the region fertile ground for motorsports culture. The rising popularity of pit bikes can be seen in amateur motocross events, stunt shows, and recreational biking zones across the region. In Japan, for instance, the “Minimoto GP” attracts thousands of participants and enthusiasts each year, showcasing the strong cultural affinity for mini motorbikes.

Economic expansion and rising disposable incomes have driven a notable increase in spending on leisure activities and non-essential consumer goods, including recreational vehicles. Urbanization has also played a major role, with more people seeking compact, affordable mobility and entertainment options. According to the Society of Indian Automobile Manufacturers (SIAM), India experienced a 13% year-over-year growth in the recreational two-wheeler segment in 2024. This economic backdrop supports the growth of entry-level and mid-tier pit bikes among hobbyists and young riders.

China’s dominance extends beyond domestic markets to global exports. In 2024 alone, China exported over 2 million mini and pit bikes, primarily to North America, Europe, and Africa. Indian manufacturers are also emerging as exporters of pit bike components due to competitive pricing and an increasingly mature aftermarket. This export capacity not only bolsters production volumes but also ensures technological improvements and global market relevance.

Key Drivers of Asia Pacific Pit Bike Market

| Factor | Description | Example/Statistical Data |

| Youth Demographics | High interest in motorsports among younger population | Over 60% of Southeast Asia’s population is under 35 |

| Manufacturing Hub | Low-cost production and large-scale factories in China, India | 30–40% cheaper manufacturing in China |

| Economic Growth | Rising disposable incomes fueling recreational spending | India’s leisure bike segment grew 13% YoY in 2024 |

| Government Support | Policies promoting automotive & motorsport tech | China’s “Made in China 2025”, India’s FAME-II |

| E-commerce Penetration | Wider access to pit bikes and parts via online platforms | Pit bike accessory sales grew over 25% YoY via Shopee and Flipkart |

| Export Strength | Strong global export volume of pit bikes and components | China exported 2M+ pit bikes in 2024 |

| Local Events & Enthusiasm | National motocross & mini-bike events attract large participation | Japan’s Minimoto GP and Thailand’s Dirt Bike Series |

How is Innovation Reshaping the Pit Bike Industry?

Technology is quickly making inroads into the pit bike segment. Newer models now feature digital ignition systems, better throttle response, and even mobile apps for diagnostics and performance tuning. Lightweight materials such as aluminum and carbon composites are reducing frame weight while improving durability. One of the most significant innovations is the emergence of electric pit bikes — which offer near-silent operation, zero emissions, and lower maintenance — making them ideal for indoor tracks and urban areas where noise and pollution are concerns.

What Challenges Could Stall Market Progress?

Despite the strong outlook, the pit bike market isn’t without challenges. Safety remains a major concern, particularly for youth riders. In many regions, these bikes are not street legal, which limits their use cases. Additionally, a lack of regulatory standardization often results in quality inconsistencies, especially among low-cost imports. Commercial operators also need to consider the high maintenance requirements of racing-spec pit bikes, which could affect ROI if not managed with proper servicing infrastructure.

Why Are Pit Bikes a Lucrative Opportunity for B2B Players?

For business buyers, pit bikes represent an opportunity to tap into multiple profitable streams. Importers and wholesalers can partner with Asian OEMs to private-label or distribute existing models. Adventure parks and training schools need reliable fleets, and they’re willing to pay for service packages and warranties. Retailers and online platforms benefit from the growing demand for aftermarket parts like decals, exhaust systems, and upgraded suspension. There’s even space for entrepreneurship — including mobile pit bike repair services, trackside parts vending, or influencer-led brand marketing.

Who Are the Major Players in the Pit Bike Ecosystem?

- Yamaha Motor Co., Ltd

- Honda Motor Co., Ltd

- Kawasaki

- SSR Motorsports

- Apollo

- Thumpstar

- Pitster Pro

- NIU Technologies

- Dust Moto

- Piranha

- Coolster

- Tao Motor

- BBR Motorsports,

- Stomp

Case Study: Growth and Niche Penetration of Pit Bikes in India (2022–2024)

Company Overview

IMEX Motorsports, a Mumbai-based startup launched in early 2022, aimed to tap into India’s budding off-road motorcycle segment by introducing 125cc and 150cc pit bikes under the brand “TrailRush.”

Market Background

Pit bikes, lightweight, off-road motorcycles designed primarily for racing and recreational riding, had limited visibility in India pre-2022. Their appeal grew through YouTube influencers, adventure vlogs, and motocross events.

Strategic Moves (2022–2024)

- 2022: IMEX partnered with Chinese manufacturer YCF to locally assemble bikes, bringing down import duties.

- 2023: Collaborated with adventure parks in Maharashtra and Karnataka for trial experiences.

- 2024: Introduced electric variants and a subscription-based model for weekend rentals.

Outcomes

- Sold ~3,800 units by end-2024, growing at a CAGR of 42%.

- Majority of buyers were from urban Tier-1 and Tier-2 cities aged between 18–30.

- Built a network of 25+ service and training centers.

- Inspired competitors like Apollo and Motocult to enter the segment.

Key Takeaway

Despite being niche, the Indian pit bike market saw accelerated traction due to urban recreational demand, influencer marketing, and entry-level affordability. IMEX Motorsports demonstrated that with targeted strategy and grassroots promotion, even small-format vehicles can carve out a space in India’s two-wheeler landscape.

Discussion about this post