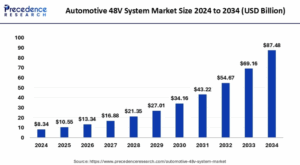

According to Precedence Research, the global Automotive 48V System Market is experiencing a seismic shift, rocketing from a valuation of USD 8.34 billion in 2024 to an anticipated USD 87.48 billion by 2034, at a phenomenal CAGR of 26.50% from 2025 to 2034.

This surge is underpinned by electrification waves, escalating demand for luxury and hybrid vehicles, and robust government support for cleaner mobility solutions. Electrification isn’t just a buzzword; it’s a market imperative transforming how manufacturers, regulators, and consumers gauge the value and performance of modern automobiles.

Quick Insights: Key Data Points Behind the Trend

- The market value is projected to soar to USD 87.48 billion by 2034, growing at a 26.50% CAGR.

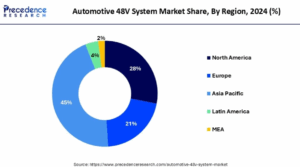

- In 2024, Asia Pacific was the top-grossing region with USD 3.75 billion and is expected to reach USD 39.37 billion by 2034.

- Leading players include Robert Bosch GmbH, BorgWarner Inc., Continental AG, Delphi Technologies, Dana Limited, GKN, Magna International Inc., Lear Corporation, MAHLE Powertrain Ltd, Valeo SA, among others.

- Asia Pacific, led by China, Japan, and India, remains the fastest-growing hub due to consumer base and EV adoption initiatives.

- Luxury and hybrid vehicle segments are fueling demand for advanced electronic architectures and sustainability features.

Revenue Table

| Year | Global Market Value (USD Billion) | Asia Pacific Market Value (USD Billion) |

|---|---|---|

| 2024 | 8.34 | 3.75 |

| 2025 | 10.55 | 4.75 |

| 2034 | 87.48 | 39.37 |

How AI Accelerates the 48V Revolution

Artificial intelligence is rapidly redefining automotive power management. By integrating AI-driven algorithms with 48V systems, manufacturers can optimize battery usage, monitor real-time energy consumption, and enable predictive vehicle diagnostics. This not only extends battery life but supports complex ADAS (Advanced Driver Assistance Systems), making vehicles smarter, safer, and exceptionally responsive.

AI’s analytical prowess also aids in vehicle-to-infrastructure communications, ensuring seamless operation of electric superchargers, regenerative braking, and dynamic energy recovery technologies indispensable in new-era 48V platforms. As digital innovation propels 48V architectures, AI becomes the silent catalyst transforming raw data into energy savings and enhanced driving experiences.

What Powers the Market’s Relentless Growth?

Electrification and Hybridization: Growing popularity of hybrid vehicles, with 48V systems serving as an ideal interface for transitioning from internal combustion to electric propulsion.

Stringent Emission Regulations: Governments globally are raising the bar on emissions, making 48V integration a route to compliance and market relevance.

Luxury Car Electrification: Next-generation infotainment, climate control, and autonomous features demand power that outpaces 12V systems—thus driving the adoption of 48V voltages in premium vehicles.

Consumer Demand in Asia Pacific: Governments in China and India deliver taxes and subsidies to boost electric and hybrid vehicle adoption, accelerating market uptake.

Are There Hidden Opportunities and Emerging Trends?

- Could the next boom stem from fast-growing partnerships between tech and auto giants?

- Will AI-powered energy management set new standards for vehicle efficiency and customer satisfaction?

- Are regulatory incentives for mild-hybrid technologies about to reshape the competitive landscape?

- How soon before 48V systems become industry-standard, even in entry-level vehicles?

Regional and Segmentation Analysis: Who’s Driving What, and Where?

Regional Leaders: The Powerhouses Shaping the Market

Asia Pacific:

Asia Pacific stands at the forefront of the global automotive 48V system market, capturing the highest revenue share in 2024 with a market size of USD 3.75 billion projected to leap to USD 39.37 billion by 2034 at a swift CAGR of 26.70%. This dominance is attributed to a large consumer base, rapid adoption of battery-powered vehicles, and government-backed incentives.

China leads the region as the world’s largest automotive market. Aggressive government efforts like slashing subsidies for EVs and plug-in hybrids have made 48V technology an increasingly attractive and cost-effective option. The region’s focus on emission reduction and affordable electrification is resulting in an accelerated adoption curve for 48V platforms.

Europe:

Europe is charting an ambitious trajectory driven by resolute environmental regulations and robust EV policies. The European Commission’s plans to cut vehicle emissions by 37.5% by 2030 have prompted OEMs to ramp up the integration of 48V systems especially in Germany and Italy, where over 10% of new vehicles in 2025 are anticipated to feature this technology. Stricter requirements for lower carbon emissions and greener transport are fuelling a fundamental transition to advanced electrical architectures across European automakers.

Vehicle Segments: Where Demand Is Surging

In 2024, mid-sized vehicles led in value share in the global automotive 48V technology market. The surging preference for vehicles with better fuel economy, together with rising public awareness about the environmental benefits of battery-powered cars, are chief drivers behind this trend.

Premium segments luxury and sports cars also hold substantial shares, as these vehicles increasingly require more power for advanced features like infotainment, safety, and semi-autonomous systems. Mild hybrid vehicles, in particular, benefit from 48V systems that offer improved efficiency and performance at a cost below that of full hybrids or electric cars. This makes 48V technology an attractive “bridge” between traditional and fully electric automobiles.

Technology & Architecture: What’s Under the Hood?

The evolution of the automotive 48V landscape is propelled by notable technological advances:

- Battery Innovations: Greater penetration of lithium-ion batteries is driving up performance and efficiency, while bringing costs down.

- Energy Recovery Modules: Advanced energy regeneration, particularly through start-stop systems and recuperative braking, is cutting operational expenses for both drivers and manufacturers.

- Automatic Start-Stop & Supercharger Technologies: These features, enabled by 48V systems, are now common in mild hybrids, offering seamless transition between electric boost and internal combustion. This not only enhances acceleration but substantially reduces emissions during idling or low-speed operation.

- Architecture Segmentation: The belt-driven (P0) architecture is the entry point capturing around 40% of revenue in 2024. Belt-driven P0 systems couple the electric machine and internal combustion engine via an accessory belt, making them ideal for mild hybrids. However, they suffer some efficiency losses due to mechanical linkage. More advanced configurations (dual-clutch/P2, input shaft of transmission/P3, rear axle/P4) position electric motors after the transmission clutch, allowing superior energy flow, higher overall efficiency, and better performance for premium vehicles.

Top Companies Enlisted:

- Robert Bosch GmbH

- BorgWarner Inc.

- Continental AG

- Delphi Technologies

- Dana Limited

- GKN (Melrose Industries PLC)

- Magna International Inc.

- Lear Corporation

- MAHLE Powertrain Ltd

- Valeo SA

Breakthroughs and Latest Moves by Top Companies

- Volkswagen amplified its EV investment strategy in China, targeting higher 48V adoption.

- Mercedes-Benz, Continental, and Bosch continue evolving best-in-class 48V components for luxury and hybrid vehicles.

- GKN and Magna roll out new mild-hybrid solutions, leveraging integrated AI for enhanced energy management.

What Are the Key Challenges and Cost Pressures?

- System Cost and Complexity: Incorporating specialized batteries, alternators, and power electronics raises vehicle prices and engineering complexity.

- Consumer Education: Lack of consumer awareness regarding 48V advantages can hinder widespread adoption, especially where traditional 12V and full EVs remain established.

- Retrofit Barriers: Adapting legacy vehicle designs for 48V architectures involves substantial redesign and integration costs.

Case in Point: India’s EV Milestone

India’s EV revolution over 1.16 million electric vehicles sold in just March 2023 demonstrates the power of government incentives and consumer enthusiasm in transforming regional markets and accelerating 48V system uptake.

Discussion about this post