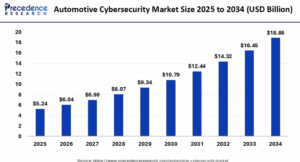

According to Precedence Research, the global automotive cybersecurity market size reached USD 4.56 billion in 2024 and is predicted to surge around USD 18.88 billion by 2034 with a CAGR of 15.30%.

In 2025, cybersecurity is no longer optional it is fundamental to the design and operation of modern vehicles. As automakers transition to connected, software-defined, and autonomous platforms, the ability to pre-empt, detect, and respond to cyber threats in real time will define both brand value and consumer trust. Security is now a competitive differentiator across the automotive value chain.

Automotive Cybersecurity Market Key Highlights

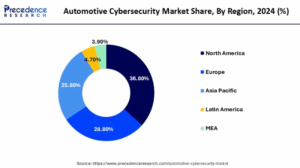

- North America held the largest market share of 36.80% in 2024, leading the global landscape.

- Asia Pacific is projected to experience the fastest growth, registering a CAGR of 16.4% from 2025 to 2034.

- Based on vehicle type, passenger cars dominated the market in 2024, accounting for 43.18% of the global share.

- The electric vehicle (EV) segment is forecasted to expand significantly, with a CAGR of 16.2% through the forecast period.

- In terms of application, advanced driver assistance systems (ADAS) emerged as the leading segment in 2024, contributing 25.10% of the total market share.

Key Technology & Security Trends

Software-Centric Security & OTA Updates

- The shift toward software-defined vehicles is making cybersecurity a core part of product design. Software holds the largest market share due to the need for continuous threat mitigation.

- OTA security ensures safe and secure delivery of updates and patches, which is essential for maintaining vehicle integrity throughout its lifecycle.

Intrusion Detection & Network Security

- Real-time intrusion detection systems (IDS) are being widely adopted to monitor in-vehicle communication protocols like CAN, LIN, and Ethernet.

- Network security, particularly for application programming interfaces (APIs) and vehicle gateways, is gaining prominence due to rising attack vectors.

AI, Adaptive Security & Zero Trust

- Artificial intelligence and machine learning are used to identify unusual behavior patterns, automate threat response, and improve detection efficiency.

- The Zero Trust model is increasingly being applied to vehicle communications, requiring constant verification regardless of origin or location.

Infrastructure-Level Security via SOAR

- Integration of security orchestration and automated response (SOAR) systems within EV charging infrastructure is reducing latency in event handling and improving real-time threat responses.

Blockchain & Data Integrity

- Blockchain is being explored for secure vehicle data logging, authentication, and tamper-proof records, especially in shared mobility and fleet applications.

Threat Landscape & High-Profile Incidents

- Real-world vulnerabilities have highlighted gaps in both embedded systems and backend infrastructure:

- Some automakers faced exploits that allowed vehicle control using VIN numbers.

- Web-based vulnerabilities exposed millions of vehicles to tracking or remote manipulation.

- Global cybersecurity contests like Pwn2Own Automotive revealed multiple zero-day exploits in major brands’ infotainment and telematics systems.

- The rise in connected vehicle vulnerabilities has resulted in an increasing number of reported CVEs (Common Vulnerabilities and Exposures), with most targeting in-vehicle systems.

Operational Challenges & Industry Collaboration

- Fragmented automotive supply chains and the presence of legacy systems present challenges in ensuring consistent cybersecurity across components.

- There is a growing shortage of skilled cybersecurity professionals with automotive-specific expertise.

- Collaboration via industry consortiums (e.g., Auto-ISAC) and standardized frameworks is critical to building a unified and secure mobility ecosystem.

Regulatory & Compliance Imperatives

- The global enforcement of standards such as ISO/SAE 21434 and UNECE WP.29 R-155/156 is making cybersecurity compliance mandatory for OEMs and Tier 1 suppliers.

- China has implemented its own standards requiring real-time anomaly detection and cybersecurity management systems.

- European regulations now enforce vehicle cybersecurity while also allowing independent repair shops access to diagnostic data, balancing security and user rights.

How is AI Revolutionizing Automotive Cybersecurity?

Artificial Intelligence (AI) plays a pivotal role in strengthening automotive cybersecurity by enabling real-time threat detection, predictive analysis, and automated response systems. With vehicles becoming increasingly software-driven and connected, AI helps identify anomalies across in-vehicle networks (like CAN or Ethernet) by analyzing vast volumes of sensor data, communication logs, and user behavior patterns. Machine learning algorithms are trained to detect emerging attack vectors, such as spoofing, malware injection, or unauthorized access, that traditional security systems might miss.

AI also powers adaptive security frameworks in connected and autonomous vehicles, allowing cybersecurity systems to evolve dynamically as threats become more sophisticated. From intrusion detection and prevention systems (IDPS) to behavioral biometrics and endpoint protection, AI-driven tools can automatically isolate compromised components, trigger security patches over-the-air (OTA), and secure vehicle-to-everything (V2X) communications. This not only improves response times but also reduces reliance on human monitoring, ensuring a proactive, intelligent defense against evolving cyber threats.

Regional Outlook of Automotive Cybersecurity Market

North America

How Is North America Shaping the Automotive Cybersecurity Market?

North America dominates the global automotive cybersecurity market, driven by the region’s rapid adoption of automated passenger vehicles and a strong regulatory approach to vehicle emissions.

The U.S. market is set to grow from $1.62 billion in 2025 to about $5.54 billion by 2034, at a CAGR of 14.6%. Stringent emission standards, the shift to hybrid and electric vehicles, and a mature automotive industry ecosystem are key factors fueling this growth. Regulatory frameworks and rising consumer awareness about vehicle data protection are ensuring a steady demand for cybersecurity solutions in the automotive sector.

Asia Pacific

Why Is Asia Pacific the Fastest Growing Market?

Asia Pacific is the fastest-growing region in the automotive cybersecurity landscape, largely due to increasing cyber threats and the surge of connected vehicles. The frequency of malware and ransomware attacks is 1.6 times higher here than the global average, driven by the expanding digitalization of vehicles and work-from-home trends. Despite gaps in security measures, the region’s increasing vehicle connectivity and popularization of electric vehicles underpin growth. Government incentives for electric vehicle adoption and rising awareness about cyber risks among OEMs bolster the need for automotive cybersecurity solutions.

Europe

What Are Europe’s Key Trends in Automotive Cybersecurity?

Europe continues to invest in advanced vehicle technologies, regulatory compliance, and safety. The region’s mature automotive industry and strong emphasis on privacy and cybersecurity regulations drive the uptake of vehicle security solutions. The escalating complexity of automotive electronics in European vehicles, especially with the rise of electric and hybrid cars, makes cybersecurity essential. European OEMs are proactively integrating cybersecurity measures to protect both vehicle operations and consumer data.

Latin America and the Middle East & Africa

How Do Latin America and the Middle East & Africa Contribute?

Countries in Latin America and the Middle East & Africa are also seeing increased adoption of automotive cybersecurity solutions, though growth is moderate compared to their North American and Asia Pacific counterparts. As these regions enhance digitalization and connectivity in the automotive sector, awareness of cybersecurity vulnerabilities is rising. Efforts to improve local regulatory and infrastructure frameworks are expected to gradually accelerate market growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18.88 Billion |

| Market Size in 2025 | USD 5.24 Billion |

| Market Size in 2024 | USD 4.56 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.30% |

| Largest Market | North America |

| Fastest Growing | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Security Type, Vehicle Type, Application, Form and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Key Companies in the Automotive Cybersecurity Market

Sheelds

- Sheelds (formerly Arilou Automotive Cybersecurity) specializes in cloud-based cybersecurity solutions designed specifically for heavy commercial and bus fleets. They pioneer advanced patented technology for securing commercial vehicles and are recognized for leveraging deep cybersecurity knowledge from Israeli defense backgrounds to address industry-specific threats.

Vector Informatik GmbH

- Vector Informatik provides comprehensive tools, embedded software, and consulting for automotive electrical/electronic (E/E) system development. Their vHSM (vehicle Hardware Security Module) stack addresses both current and upcoming vehicle security requirements, featuring modular cryptographic solutions. Vector supports OEMs and suppliers with system security integration, testing, and AUTOSAR-conformant security architectures for ECUs.

NXP Semiconductors N.V.

- NXP is a global leader in automotive semiconductors, offering hardware trust anchors, secure microcontrollers, and advanced edge AI cybersecurity. Their collaborations, such as with VicOne and Clavister, focus on integrating AI-driven cyber defense and real-time cyberattack detection in software-defined vehicles, making NXP critical to proactive in-vehicle and cloud-connected security systems.

Harman International

- Harman delivers automotive cybersecurity products that protect both vehicles and passengers. They offer consulting, penetration testing, and compliance support—such as ISO/SAE 21434 certification and alignment with regulatory frameworks (e.g., UNR 155). Harman’s platform ensures risk-based management for OEM partners, enhancing end-to-end vehicle lifecycle security.

Broadcom Inc.

- Broadcom enables secure automotive Ethernet and E/E (electrical/electronic) architectures by partnering with cybersecurity vendors to incorporate critical network protections, such as intrusion detection and firewalls, at the hardware and platform level for connected vehicles.

Denso Corporation

- Denso develops layered in-vehicle cybersecurity defense systems, focusing on message authentication, attack resilience, anomaly detection, and electronic control unit (ECU) protection. Denso collaborates with IT leaders such as NTT to launch vehicle Security Operation Centers (VSOCs) that enable proactive monitoring and response for connected and autonomous vehicles.

Honeywell International, Inc.

- Honeywell pairs its cybersecurity technologies with partners (like LG) to provide comprehensive in-vehicle security—from gateways and ECUs to fleet-wide security monitoring and analytics. Their solutions cover intrusion detection, anomaly response, and secure over-the-air updates, particularly for passenger and commercial vehicles.

Continental AG

- Continental strengthens its cybersecurity capabilities through acquisitions (e.g., Argus Cyber Security, PlaxidityX), integrating dedicated cyber defense platforms into its automotive software portfolio. Continental develops detection and prevention systems for vehicular networks, supporting OEMs in meeting evolving regulatory and security requirements.

Guard Knox Cyber-Technologies Ltd.

- Guard Knox innovates in vehicle architecture security, delivering high-performance computing platforms and cybersecurity solutions for secure communications, zone controllers, and automotive service-oriented architectures (SOA). Their offerings support next-generation, customizable, cybersecure software-defined vehicles.

Robert Bosch GmbH

- Robert Bosch integrates comprehensive cybersecurity measures across its automotive electronics and mobility technologies. Bosch delivers secure ECUs and provides ongoing security updates, supporting both preventive and responsive measures against cyber threats. Bosch is active in industry alliances and regulatory initiatives related to automotive cybersecurity.

Segments Covered

By Security Type

- Endpoint Security

- Application Security

- Wireless Network Security

By Vehicle Type

- Passenger Car

- Commercial Vehicle

- Electrical Vehicle

By Application

- ADAS & Safety System

- Infotainment

- Body Electronics

- Powertrain

- Telematics

By Form

- In-Vehicle Services

- External Cloud Services

Discussion about this post