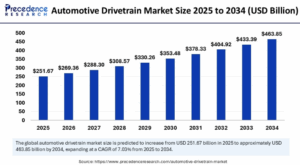

The global automotive drivetrain market size is expected to surge around USD 463.85 billion by 2034 increasing from USD 235.14 billion in 2024, growing at a CAGR of 7.03%.

Automotive Drivetrain Market Key Points

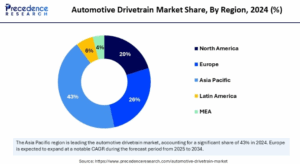

- Asia Pacific generated the largest revenue share of 43% in 2024.

- Europe automotive drivetrain market is expected to grow at a CAGR of 6.94% from 2025 to 2034.

- By propulsion type, the internal combustion engine (ICE) segment held the major market revenue share of 77% in 2024.

- By propulsion type, the electric motor segment is projected to grow at a double-digit CAGR of 18.54% during the forecast period.

- By drive type, the FWD segment accounted for the major revenue share of 52% in 2024.

- By drive type, the AWD segment is expected to grow at the highest CAGR in the coming years.

- By vehicle type, the passenger cars segment contributed the biggest revenue share of 74% in 2024.

- By vehicle type, the commercial vehicles segment is expected to expand at the fastest CAGR in the upcoming period.

Core Mechanics of Mobility: The Automotive Drivetrain System

The automotive drivetrain refers to the group of components that deliver power from the engine or motor to the wheels, enabling vehicle movement. It includes parts such as the transmission, driveshaft, axles, and wheels. Drivetrain systems vary depending on the type of vehicle and its propulsion system internal combustion engine (ICE), electric, or hybrid and the drive type, including front-wheel drive (FWD), rear-wheel drive (RWD), and all-wheel drive (AWD).

In recent years, the market has witnessed significant technological advancements driven by the global shift toward electrification, stricter emission norms, and increasing demand for high-performance and fuel-efficient vehicles. As electric vehicles (EVs) gain traction, the demand for innovative and integrated drivetrain solutions is growing, particularly those that reduce energy loss and improve overall efficiency.

Additionally, lightweight materials and modular designs are being adopted to enhance vehicle performance and meet regulatory standards. The automotive drivetrain market is expected to grow steadily, supported by developments in electric mobility and rising vehicle production across emerging economies.

How Is AI Transforming the Automotive Drivetrain Market?

Artificial Intelligence (AI) is playing a transformative role in the automotive drivetrain market by enhancing performance, efficiency, and predictive maintenance capabilities. AI algorithms are being integrated into drivetrain systems to optimize gear shifting, torque distribution, and power management in real time, based on driving conditions and driver behaviour. This results in improved fuel economy, smoother rides, and better handling, particularly in electric and hybrid vehicles where energy efficiency is critical.

Additionally, AI-driven analytics enable predictive maintenance by monitoring drivetrain components and identifying wear or potential failures before they occur. This minimizes downtime and extends the lifespan of drivetrain parts. In electric vehicles, AI supports the development of smart drivetrains that adapt to usage patterns, road types, and environmental conditions, further enhancing efficiency and driving experience. As the industry moves toward autonomous and connected vehicles, AI will continue to play a central role in the evolution of intelligent, self-optimizing drivetrain systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 463.85 Billion |

| Market Size in 2025 | USD 251.67 Billion |

| Market Size in 2024 | USD 235.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.03% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Propulsion Type, Drive Type, Vehicle Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The automotive drivetrain market is primarily driven by the rising demand for fuel-efficient and high-performance vehicles. Growth in global vehicle production, especially in emerging markets, and the shift toward electric and hybrid vehicles are boosting the demand for advanced drivetrain systems. Additionally, stricter emission regulations are compelling automakers to adopt lightweight and efficient drivetrain technologies to enhance overall vehicle performance.

Market Opportunities

The transition toward electrification presents major opportunities for the development of next-generation drivetrain systems, including electric drive units and integrated e-axles. Advancements in AI, machine learning, and smart mobility solutions also open doors for intelligent and adaptive drivetrain technologies. Growing investments in autonomous vehicles and connected car ecosystems further expand the potential for innovative drivetrain designs and control systems.

Market Challenges

Despite its growth, the market faces challenges such as high development and integration costs associated with advanced drivetrain systems, particularly in electric vehicles. The need for standardization across different vehicle platforms and drivetrain architectures also poses difficulties. Furthermore, global supply chain disruptions and fluctuating raw material costs can impact production timelines and profitability for manufacturers.

Regional Outlook of the Automotive Drivetrain Market

Asia Pacific

Asia Pacific leads the global automotive drivetrain market, holding the largest share at 43% in 2024. The region’s dominance is driven by a robust automotive industry, rapid electrification, and strong government support for electric vehicle (EV) production and adoption.

China, as the world’s largest vehicle producer, significantly boosts drivetrain demand through high vehicle output and supportive policies. India is emerging as a key market, propelled by a swift transition to electric and hybrid vehicles, government incentives, and increased investment in local manufacturing.

Notably, the Indian government’s recent budget allocations and policies, such as the “PM E-DRIVE Scheme” and “PLI Auto Scheme,” further accelerate EV adoption and drivetrain market growth in the region.

Europe

Europe is the second-largest and fastest-growing market for automotive drivetrains, fueled by a surge in EV adoption, stringent emission regulations, and a focus on technological advancement. Countries like Germany, France, and the UK are at the forefront, with high investments in EV technology and infrastructure.

The European Commission’s action plans and emission reduction targets are pushing automakers toward zero-emission mobility, increasing demand for electric drivetrains. Germany, in particular, stands out due to its advanced automotive sector and rapid adoption of cutting-edge drivetrain technologies, especially all-wheel-drive (AWD) and electric powertrains.

North America

North America remains a significant market, with growth driven by the shift toward electrification, stringent emission regulations, and evolving consumer preferences for high-performance and autonomous vehicles. The U.S. leads the region, supported by regulatory measures, advancements in battery technology, and growing EV adoption.

There is a notable trend toward integrated drive e-powertrain systems and increased adoption of AWD and four-wheel-drive (4WD) systems, especially in response to consumer demand for enhanced vehicle efficiency, range, and safety.

Segmental Insights of the Automotive Drivetrain Market

Propulsion Type Insights

The internal combustion engine (ICE) segment dominated the market in 2024, accounting for 77% of revenue. This dominance is due to established infrastructure, cost-effectiveness, and high performance of ICE vehicles, especially for long-distance travel. Despite the global shift toward electrification, ICE vehicles remain prevalent in regions with limited charging infrastructure and fluctuating energy prices.

The electric motor segment is projected to grow at the fastest rate, driven by the rising adoption of electric vehicles (EVs), technological advancements, and the growing need for efficient, compact, and powerful electric motors in automotive applications.

Drive Type Insights

Front Wheel Drive (FWD) led the market in 2024 with a 52% revenue share. FWD systems are favored for their affordability, compact design, fuel efficiency, and superior traction, making them ideal for passenger cars and compact vehicles, especially in urban environments.

The All-Wheel Drive (AWD) segment is expected to see the fastest growth, fueled by increasing demand for SUVs and crossovers, as well as advancements in AWD technology that enhance vehicle stability, performance, and energy efficiency.

Vehicle Type Insights

Passenger vehicles held the largest market share in 2024, generating 74% of total revenue. This is attributed to the high production and sales volumes of passenger cars, particularly in urban areas, and the integration of advanced drivetrain technologies, such as smart transmission systems and drive-assistance features.

The commercial vehicles segment is anticipated to expand rapidly, as demand grows for specialized drivetrain technologies like AWD in medium and heavy-duty vehicles, and as governments promote cleaner alternatives through policies supporting electric and hybrid commercial vehicles.

Roles of Major Companies in the Automotive Drivetrain Market

BorgWarner Inc.: BorgWarner is a global leader in drivetrain solutions, specializing in advanced transmission systems, all-wheel drive (AWD) technologies, and electrified drivetrain components. The company is pivotal in driving innovation, especially in electric and hybrid drivetrains, supporting the industry’s shift toward electrification and efficiency.

Magna International: Magna International is a key supplier of complete drivetrain systems, including transmissions, transfer cases, and e-drive solutions. Magna is recognized for its focus on lightweight, efficient, and integrated drivetrain technologies for both traditional internal combustion engine (ICE) vehicles and electric vehicles (EVs).

General Motors: General Motors (GM) integrates advanced drivetrain technologies across its wide range of vehicles, including ICE, hybrid, and electric models. GM is actively investing in electrification, developing proprietary electric drive units and e-axle systems to support its expanding EV lineup.

TOYOTA MOTOR CORPORATION: Toyota is renowned for pioneering hybrid drivetrain technology with its Hybrid Synergy Drive system. The company leads in hybrid and fuel cell drivetrain innovation and is expanding its focus on battery electric vehicle (BEV) drivetrains for future mobility.

Schaeffler AG: Schaeffler AG is a prominent supplier of drivetrain components and systems, such as bearings, clutches, and transmission modules. Schaeffler is at the forefront of developing efficient, lightweight, and electrified drivetrain solutions for both conventional and electric vehicles.

Volkswagen Group: Volkswagen Group invests heavily in the development and integration of advanced drivetrain technologies across its brands. The group is accelerating the adoption of electric drivetrains, focusing on modular electric drive matrices (MEB) and AWD systems for its growing EV portfolio.

Stellantis NV: Stellantis NV, formed from the merger of FCA and PSA, develops and deploys a wide range of drivetrain technologies, including platforms supporting ICE, hybrid, and electric powertrains. The company is committed to electrification and innovation to meet diverse market needs.

American Axle & Manufacturing, Inc.: American Axle & Manufacturing specializes in the design and manufacture of driveline and drivetrain systems, including axles, driveshafts, and e-drivetrain solutions. The company is a key supplier to global automakers, focusing on both traditional and electrified vehicle platforms.

Aisin Seiki Co., Ltd.: Aisin Seiki (Aisin Corporation) is a major supplier of drivetrain components such as transmissions, clutches, and e-axles. The company is known for its innovation in both conventional and electrified drivetrain systems, serving a wide range of global OEMs.

ZF Friedrichshafen AG: ZF is a global leader in drivetrain and transmission technologies, providing advanced automatic transmissions, e-drives, and hybrid modules. ZF is at the forefront of electrification, offering integrated drivetrain solutions for both passenger and commercial vehicles.

Hyundai Motor Company: Hyundai Motor Company integrates advanced drivetrain systems into its vehicles, including ICE, hybrid, and electric models. Hyundai is investing in next-generation electric drivetrains and e-axle technologies to support its global EV strategy.