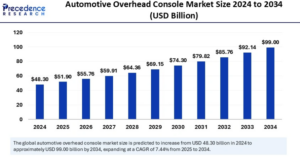

The global automotive overhead console market was valued at USD 48.30 billion in 2024 and is projected to reach approximately USD 99.00 billion by 2034, with a CAGR of 7.44%.

The automotive overhead console market is experiencing steady growth, driven by advancements in vehicle interior technology and increasing consumer demand for enhanced convenience and aesthetics. Overhead consoles, which house features like lighting controls, storage compartments, infotainment systems, and connectivity modules, are becoming more sophisticated with the integration of smart sensors and AI-powered functionalities.

The rise in luxury vehicle production and the growing adoption of electric and autonomous vehicles further fuel market expansion. Additionally, automakers are focusing on lightweight materials and customizable designs to improve efficiency and passenger comfort. However, high costs associated with advanced electronic components and design complexities pose challenges. Asia-Pacific, particularly China and India, is emerging as a key market due to increasing vehicle production and rising consumer preferences for premium interiors.

Automotive Overhead Console Market Key Takeaways

- Asia Pacific dominated the market with the largest market share in 2024.

- North America is expected to grow at the fastest CAGR in the coming years.

- By vehicle type, the passenger vehicles segment led the market in 2024.

- By vehicle type, the light commercial vehicles segment is anticipated to grow at a notable CAGR during the forecast period.

- By technology, the electro-mechanical segment accounted for the significant share in 2024.

- By technology, the displays segment is likely to grow rapidly during the projection period.

- By type, the front-end console segment dominated the market in 2024.

- By type, the rear end console is expected to be the fastest-growing segment in the foreseeable future.

- By sales channel, the OEM segment led the market in 2024.

- By sales channel, the aftermarket segment is anticipated to expand at the fastest rate between 2025 and 2034.

- By application, the driver monitoring segment dominated the market in 2024.

- By application, the vehicle telematics segment is projected to grow at the fastest rate in the coming years.

Impacts of Artificial Intelligence on Automotive Overhead Console Market

AI is transforming the automotive overhead console market by enhancing functionality, personalization, and safety features. With AI-driven voice assistants and gesture recognition, overhead consoles now offer seamless hands-free control of infotainment, lighting, and climate systems, improving user convenience. Machine learning algorithms enable predictive maintenance and real-time diagnostics, reducing the risk of system failures.

AI-powered ambient lighting adapts to driving conditions and moods, enhancing passenger comfort. Additionally, AI-driven sensors integrated into overhead consoles assist with driver monitoring systems, improving safety by detecting fatigue or distractions. Automakers are also using AI to optimize material selection and design, reducing weight while maintaining durability. As autonomous and connected vehicles advance, AI-enabled overhead consoles will play a crucial role in enhancing the in-car experience and driving market growth.

Regional Outlook of Automotive Overhead Console Market

North America: Driven by the demand for luxury and high-tech vehicles, with major automakers integrating AI-powered consoles and smart features. Strong presence of key automotive manufacturers and technology providers.

Europe: A mature market with a focus on premium vehicle interiors, smart lighting, and advanced connectivity. Stricter regulations on vehicle safety and environmental sustainability drive innovation in lightweight materials.

Asia-Pacific: The fastest-growing region due to increasing vehicle production, rising disposable income, and a growing preference for advanced in-car technologies. China, India, and Japan are key markets, with strong investments in electric and autonomous vehicles.

Latin America: Gradual growth, supported by rising automobile sales and improving economic conditions. The demand for mid-range vehicles with enhanced interior features is increasing.

Middle East & Africa: A developing market, with growth led by luxury car sales and rising investments in automotive infrastructure. The adoption of smart vehicle technologies is expanding, particularly in the UAE and South Africa.

Automotive Overhead Console Market Report Coverage

| Report Coverage | Details |

| Market Size by 2034 | USD 99.00 Billion |

| Market Size in 2025 | USD 51.90 Billion |

| Market Size in 2024 | USD 48.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.44% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Technology, Type, Sales Channel, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics of Automotive Overhead Console Market

Drivers

The increasing production and adoption of electric vehicles (EVs) worldwide are significantly driving the growth of the automotive overhead console market. Factors such as government incentives, environmental concerns, and technological advancements contribute to the rising demand for EVs. Since EVs emphasize user-friendly interfaces and advanced in-car features, overhead consoles play a crucial role in their interiors.

Additionally, as EV manufacturers prioritize minimalistic and lightweight designs, multifunctional overhead consoles are becoming essential for enhancing vehicle performance, user experience, and aesthetics. With a strong focus on energy efficiency and modernization, automakers are accelerating the development of innovative, energy-efficient overhead consoles.

The demand for advanced overhead consoles is also propelling market growth. Modern overhead consoles integrate cutting-edge technologies such as voice control, touchscreen displays, and Bluetooth connectivity. Gesture recognition has become a standard feature in next-generation in-vehicle interfaces, allowing drivers to interact with vehicle controls more intuitively, thereby improving the overall driving experience.

Restraint

The high cost of integrating advanced features presents a significant challenge in the automotive overhead console market. The incorporation of sophisticated electronic systems increases manufacturing expenses, making these consoles more expensive. Additionally, designing overhead consoles that seamlessly integrate multiple features and controllers adds complexity, potentially making it difficult for users to manage operations efficiently.

Opportunity

The rising popularity of augmented reality (AR)-enabled head-up displays (HUDs) is expected to create lucrative opportunities in the market. AR integration in automotive HUDs enhances the driving experience by improving situational awareness and interaction with autonomous technology. These displays project navigation directions, weather alerts, and speed limits onto the windshield, offering drivers real-time information.

Furthermore, AR-enabled HUDs, combined with advanced driver assistance systems (ADAS), enhance driver confidence and comfort. As the adoption of AR-HUDs increases, the demand for sophisticated overhead consoles will grow to accommodate these evolving technologies.

Vehicle Type Insights

In 2024, the passenger vehicle segment held the largest market share, primarily due to the increasing production of passenger cars. These vehicles prioritize passenger comfort by incorporating user-friendly overhead consoles with advanced functionalities. SUVs have gained popularity, featuring safety systems such as automatic emergency braking and infotainment systems, which rely on overhead consoles for optimal operation.

The light commercial vehicle (LCV) segment is expected to witness the fastest growth in the coming years. Designed for efficiency and adaptability, LCVs are widely used in sectors such as construction, delivery, and services. They are equipped with infotainment systems, communication features, and various safety components, all of which rely on overhead consoles. As LCV production increases, the demand for overhead consoles is expected to rise.

Technology Insights

The electro-mechanical segment dominated the market in 2024 due to its cost-effectiveness and superior functionality. These systems combine electronic components, such as buttons and sensors, with mechanical elements like actuators. Electro-mechanical overhead consoles offer enhanced control, making them ideal for integrating advanced features such as automated lighting systems, touchscreens, and voice control. Their smooth and precise functionality enhances vehicle performance.

The display segment is projected to grow rapidly during the forecast period. Modern overhead consoles increasingly incorporate touchscreens and digital displays to provide an intuitive user interface. These screens display essential information, such as speed, fuel levels, and warnings, improving road safety and overall driving experience.

Type Insights

The front-end console segment led the market in 2024, primarily due to its design flexibility. Positioned at the front of the vehicle, these consoles provide easy access to drivers, allowing for quick operation of essential functions, particularly in emergency situations. The growing emphasis on vehicle safety has further boosted demand for front-end consoles.

The rear-end console segment is anticipated to grow at the fastest rate during the forecast period. Rear-end consoles enhance passenger convenience by allowing control over lighting, temperature, and infotainment systems. Additionally, they offer extra storage space, improving accessibility for passengers. The increasing focus on passenger comfort and safety is a key factor driving the expansion of this segment.

Sales Channel Insights

The OEM segment dominated the market in 2024, as overhead consoles produced by original equipment manufacturers (OEMs) are specifically designed to integrate seamlessly with vehicle models. OEMs provide warranties, ensuring product quality and reliability, which appeals to customers looking to minimize maintenance costs. The rising demand for factory-installed safety features has further strengthened this segment’s growth.

The aftermarket segment is expected to expand at the fastest rate in the coming years, driven by growing demand for vehicle customization. The aftermarket sector offers a variety of overhead consoles that allow car owners to personalize their vehicles. Additionally, post-purchase services such as repairs and maintenance contribute to customer satisfaction and brand loyalty.

Application Insights

The driver monitoring segment held the largest market share in 2024, as these systems enhance driver safety, reduce accident risks, and support proactive fleet maintenance. Driver monitoring systems use sensors and cameras to track driver behavior, detecting distractions and fatigue in real time. With a heightened focus on driver safety, the adoption of these systems has increased, driving demand for automotive overhead consoles.

The vehicle telematics systems segment is expected to grow at the fastest rate in the coming years. These systems use GPS technology to track vehicle activities and provide real-time data on speed, fuel consumption, and braking patterns. By leveraging cellular communication, telematics systems transmit data to remote servers for analysis, supporting applications such as vehicle tracking, security monitoring, and optimized maintenance scheduling. Integrating telematics control within the overhead console enhances convenience and safety for drivers, contributing to market growth.

Automotive Overhead Console Market Companies

- Johnson Controls International plc

- Magna International Inc.

- Visteon Corporation

- Continental AG

- Grupo Antolin

- Gentex Corporation

- Lear Corporation

- Faurecia

Recent Developments in Automotive Overhead Console Market

The automotive overhead console market has witnessed several notable developments recently,

- Technological Innovations: Companies are focusing on integrating advanced technologies into overhead consoles. For instance, in November 2022, Grupo Antolin-Irausa S.A. introduced an Advanced Upper Trim concept featuring a user-centric design for overhead console mechanisms.

- Lightweight Designs for EVs: Manufacturers are developing lightweight overhead consoles to enhance energy efficiency in electric vehicles. Valeo SA introduced a new lightweight overhead console aimed at reducing vehicle weight, thereby improving energy efficiency.

- Enhanced User Interaction: The integration of gesture control and modular designs is becoming more prevalent. Denso Corporation expanded its overhead console portfolio to include advanced features like gesture control, enhancing user interaction within vehicles.

- Market Growth Projections: The global overhead console market is projected to reach approximately USD 20.68 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.5%. This growth is attributed to technological advancements, increased luxury car purchases, and the widespread adoption of electric and hybrid vehicles.

- In-Car Gaming Features: Automakers are integrating gaming options into their infotainment systems. For example, BMW’s AirConsole platform offers a range of games, allowing passengers to use their phones as controllers, enhancing the in-car entertainment experience.

- AI Assistants and Holographic Displays: At the Consumer Electronics Show (CES) 2025, automakers showcased in-cabin innovations such as AI-powered voice assistants and full-windshield holographic displays. These technologies aim to enhance comfort and reduce driver distractions, indicating a trend towards more interactive and immersive in-car experiences.

These developments reflect the industry’s commitment to enhancing functionality, user experience, and efficiency in automotive overhead consoles.

Segments Covered in the Report

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Trucks

- Buses and Coach

By Technology

- Electro-mechanical

- Display

- Capacitive

By Type

- Front-End Console

- Rear End Console

By Sales Channel

- OEM

- Aftermarket

By Application

- Driver Monitoring

- Vehicle Telematics

- Infotainment

- HVAC

- Sunroof

- e-call

- Airbag control

- Microphone

- Lighting

- Interior lighting

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America