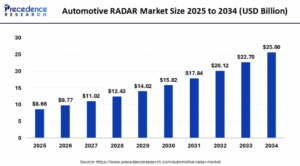

According to Precedence Research, the global automotive RADAR market, valued at $8.66 billion in 2025, is forecast to reach approximately $25.6 billion by 2034, riding a robust CAGR of 12.8% (2025–2034). This dynamic sector is powered by the proliferation of advanced driver safety mandates, transformative AI integration, and relentless global demand for ADAS and autonomous driving technologies.

Automotive RADAR systems are fast becoming a standard for modern vehicles as regulatory policies tighten across regions. Safety-centric innovation, mass adoption of electric vehicles, and the relentless push for green and smart mobility especially in Asia-Pacific and Europe are at the market’s core. Strict ADAS mandates, rising purchasing power, and real-world environmental challenges are pushing manufacturers to integrate radar seamlessly in new models.

Automotive RADAR Market Quick Insights

- 2025 Market Size: $8.66 billion globally.

- 2034 Market Forecast: $25.6 billion at 12.8% CAGR.

- Asia-Pacific 2024 Revenue: $3.15 billion, expected to reach $10.62 billion by 2034.

- Top Players: Robert Bosch GmbH, Continental AG, Aptiv, Denso Corporation, NXP Semiconductors, Valeo, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA.

- Asia-Pacific dominates: Driven by China, India, South Korea, and Japan’s rapid adoption of safety and green mobility tech.

- Major Applications: Adaptive cruise control, blind spot detection, autonomous emergency braking, intelligent park assist.

- Key Frequency: Shift toward high-resolution, 77–79GHz radar for enhanced performance.

- Revenue Leader: APAC holds the largest regional share as of 2024 (over 41%), Europe is next with the fastest forecasted CAGR.

Revenue Table: Automotive Radar Market

| Year | Global Market Size (USD Billion) | Asia-Pacific Market (USD Billion) |

|---|---|---|

| 2024 | 7.68 | 3.15 |

| 2025 | 8.66 | 3.55 |

| 2034 | 25.6 | 10.62 |

AI’s Transformative Role in Automotive RADAR

Artificial Intelligence is evolving RADAR from “simple sensing” to predictive, multi-layered perception. With AI-powered signal processing, today’s RADAR systems can accurately detect moving and stationary objects in busy and low-visibility scenarios, optimize object classification, and reduce false alarms. Next-gen systems blend RADAR with cameras and LiDAR via sensor fusion allowed by real-time AI delivering full 360-degree coverage and actionable insights for both drivers and autonomous vehicles.

AI also underpins advanced features like driver monitoring, gesture recognition, and adaptive system tuning, making automotive environments not just safer, but smarter and more human-oriented.

What Is Driving Market Acceleration?

- Government Safety Policies: Regulatory compulsion for ADAS/vehicle safety features worldwide.

- EV & Green Mobility Push: Incentives and environmental standards accelerate adoption in Asia-Pacific and Europe, especially for electric vehicles now demanding more sensors per car.

- Consumer Awareness: Safety as a deciding driver in car purchase decisions.

- Technology Leap: High-frequency, energy-efficient radar modules (77–79GHz) offer enhanced detection at lower cost.

Opportunities & Trends: How Is Radar Tech Advancing Defensive Driving?

Are 4D and high-frequency radars expanding the scope beyond safety?

Absolutely. The growth of 4D imaging radar enables vehicles to map the road in greater detail including elevation resulting in smarter navigation, advanced parking, and improved collision avoidance. The rollout of such systems in both premium vehicles and mass-market electric cars signals exponential potential, especially as 5G-V2X connectivity grows.

Regional & Segmentation Analysis

Regional Breakdown

Asia-Pacific: Largest 2024–2025 market share (41%), expected ~$10.62B by 2034. Key drivers: rising income, rapid adoption of ADAS and EVs, strong safety standards in China, India, Japan, and South Korea.

Europe: Projected fastest CAGR. Focus: green mobility, incentives for EVs, government-backed accident reduction initiatives, smart cities.

Other regions: North America and emerging markets show strong growth via EV uptake and regulatory alignment with global standards.

Segmentation

By Application: Adaptive cruise control (52% of 2024 revenue in intelligent park assist), blind spot detection, emergency braking.

By Range: Short & Medium Range Radar (S&MRR) dominates; long-range gaining ground in high-end vehicles.

By Frequency: 77–79GHz segment rapidly becoming industry standard.

By Vehicle Type: Passenger vehicles lead; commercial, electric, and hybrid vehicles increasingly adopting multi-radar layouts.

Top Companies and Latest Breakthroughs

- Robert Bosch GmbH: Launched radar with RF CMOS tech in 2025 for enhanced efficiency, collaborating globally for edge AI processing in radar.

- Continental AG, Aptiv, Denso Corporation, NXP Semiconductors, Valeo, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA: Leading mass deployment of AI-based and 4D radar.

- Latest Breakthroughs: 4D imaging radar, radar-on-chip modules, strategic partnerships for sensor fusion, radar units optimized for EVs.

Challenges & Cost Pressures

- Cost: High-performance radar still pricey for entry-level vehicles.

- Environmental Impact: Signal interference and reduced accuracy in adverse weather remains an issue, though AI mitigation is improving performance.

- Competition: LiDAR and camera-based systems gaining traction, pressuring radar prices and differentiation.

Case Study: Asia-Pacific’s EV Radar Surge

China, India, and Japan are deploying multi-radar and 4D systems in EVs to power advanced ADAS and smart transport. Policy incentives, localized manufacturing, and cross-sector innovations in APAC are lowering costs, increasing domestic adoption, and shaping the global standard for next-gen radar deployment, rapidly closing the technology gap with the West.

Discussion about this post