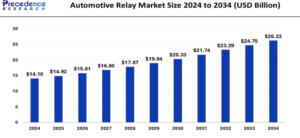

According to Precedence Research, the global automotive relay market size is calculated at USD 14.92 billion in 2025 and is expected to reach around USD 26.23 billion by 2034, growing at a CAGR of 7.30% from 2025 to 2034.

The automotive relay market plays a vital role in the modern vehicle ecosystem, offering critical switching functions for a wide range of electrical and electronic systems. These relays are essential for controlling high-current components like headlights, fuel pumps, cooling fans, and power windows with low-current signals. With the rapid advancement of automotive technologies, including electric vehicles (EVs), advanced driver-assistance systems (ADAS), and connected car features, the demand for reliable and efficient relays is growing. The market is also influenced by trends such as vehicle electrification, increased safety regulations, and the integration of smart electronics. Key players in the industry are focusing on developing compact, durable, and energy-efficient relays to meet evolving automotive standards. Overall, the automotive relay market is expected to witness steady growth driven by innovation, rising vehicle production, and the global shift toward sustainable mobility solutions.

Automotive Relay Market Key Points

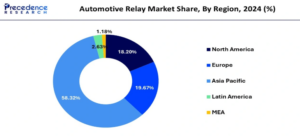

- Asia Pacific dominated the global market with the largest market share of 58.32% in 2024.

- The plug-in-relay contributed the highest market share of 46.93% in 2024.

- The convenience segment captured the biggest market share of 37.48% in 2024.

- The passenger cars segment generated the major market share of 54.64% in 2024.

- The ICE segment has held the largest market share of 71.59% in 2024.

Will Asia Dominate the Automotive Relay Market?

In 2024, the global automotive relay market is estimated to reach USD 14.10 billion, with Asia Pacific dominating the landscape by capturing a substantial 58.32% share, equivalent to USD 8.23 billion. This growth is primarily driven by the rapid expansion of the automotive industry in countries like China, India, and Japan, coupled with increasing demand for advanced vehicle electronics and electric vehicles. Europe holds the second-largest share at 19.67% (USD 2.77 billion), thanks to strong regulatory support for vehicle safety and energy efficiency.

North America follows closely with USD 2.57 billion (18.20%), reflecting steady demand for technologically advanced automotive systems. Meanwhile, Latin America and the Middle East & Africa (MEA) account for relatively smaller portions—USD 0.37 billion and USD 0.17 billion, respectively—indicating emerging opportunities as automotive production gradually rises in these regions.

Automotive Relay Market Trends

- Growing Adoption of Electric Vehicles (EVs):

- As of 2024, global EV sales crossed 14 million units, up from 10.5 million in 2022.

- This increase in EV adoption boosts demand for high-voltage relays used in battery management systems and EV powertrains.

- Rising Demand for Advanced Safety and Comfort Features:

- Over 80% of new vehicles manufactured globally in 2023 included features like ADAS (Advanced Driver Assistance Systems), power windows, infotainment systems, and climate control—each requiring relay-based switching systems.

- Shift Toward PCB (Printed Circuit Board) Relays:

- PCB relays now constitute more than 65% of automotive relay usage, due to their compact size and compatibility with electronic control units (ECUs).

- Increased Use of Solid-State Relays (SSR):

- Though still emerging, SSRs are seeing 20–25% YoY growth in applications where silent operation and high-speed switching are critical, such as EV battery disconnect units.

- Integration of Smart Relays:

- Smart relays with diagnostic and communication functions are gaining traction, especially in premium and connected vehicles.

- By 2024, over 30% of luxury vehicles were equipped with smart relay systems.

- Focus on Relay Miniaturization:

- Automotive OEMs are increasingly demanding mini relays (below 10g) for space efficiency, particularly in autonomous and hybrid vehicles.

- Rise of Relay Use in Powertrain and Thermal Management:

- Modern vehicles feature up to 20–50 relays per vehicle, with powertrain systems accounting for the highest usage, especially in hybrid and electric models.

- Growing Emphasis on Relay Reliability and Lifecycle:

- Current-generation automotive relays are expected to exceed 10 million switching cycles, aligning with vehicle life spans of 15+ years.

Product Type Analysis

The automotive relay market can be segmented by product type into PCB relays, plug-in relays, high voltage relays, and others. PCB (Printed Circuit Board) relays are compact and designed to be mounted directly onto circuit boards, making them ideal for applications where space-saving and high-density configurations are required. They are commonly used in control modules and various in-vehicle electronics. Plug-in relays, on the other hand, are socket-based and offer the advantage of easy replacement, making them suitable for applications such as lighting, HVAC systems, and powertrain components where maintenance access is necessary. High voltage relays are designed to manage the increased electrical loads found in electric and hybrid vehicles. These relays play a crucial role in battery systems, inverters, and high-voltage circuits. The ‘others’ category includes specialized relays such as solid-state relays and signal relays used in niche automotive applications.

Global Automotive Relay Market Revenue, By Product Type, 2022-2024 (USD Billion)

| Product Type | 2022 | 2023 | 2024 |

| PCB | 4,190.2 | 4,371.1 | 4,556.8 |

| Plug-in-Relay | 5,868.9 | 6,233.7 | 6,617.9 |

| High Voltage Relay | 1,413.6 | 1,507.0 | 1,605.8 |

| Others | 1,159.7 | 1,237.9 | 1,320.9 |

Application Analysis

In terms of application, the automotive relay market is segmented into powertrain, body & chassis, convenience, safety & security, and others. The powertrain segment includes relays used in engine control, transmission, and emission systems, essential for ensuring optimal vehicle performance. Body & chassis applications include lighting systems, door control, wipers, and suspension systems, where relays enable the automation and functioning of key mechanical components. The convenience segment covers comfort and lifestyle features such as infotainment systems, electric seat adjustments, sunroofs, and HVAC systems, which are increasingly present in mid-to-high-end vehicles. In the safety & security category, relays are critical in systems like ABS, airbags, and anti-theft mechanisms, where rapid and reliable switching is vital for occupant protection. The others category encompasses areas like telematics, diagnostics, and emerging connected car technologies.

Global Automotive Relay Market Revenue, By Application Type, 2022-2024 (USD Billion)

| Application Type | 2022 | 2023 | 2024 |

| Powertrain | 3,120.5 | 3,305.3 | 3,484.9 |

| Body and Chassis | 2,002.8 | 2,104.2 | 2,208.8 |

| Convenience | 4,641.3 | 4,947.8 | 5,284.6 |

| Safety and Security | 1,991.8 | 2,081.0 | 2,173.6 |

| Others | 875.8 | 911.5 | 949.4 |

Vehicle Type analysis

Based on vehicle type, the market is divided into passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). Passenger cars represent the largest share of the market due to the high volume of global production and the increasing integration of electronic features in even economy-class vehicles. As consumer demand rises for advanced features and safety systems, the use of automotive relays in this segment continues to grow. Light commercial vehicles, such as delivery vans and utility trucks, also require relays for operational efficiency and safety, especially with the rise in last-mile logistics. Heavy commercial vehicles, including trucks and buses, demand highly durable and heat-resistant relays due to their exposure to rugged environments and the need to handle higher electrical loads.

Global Automotive Relay Market Revenue, By Vehicle Type, 2022-2024 (USD Billion)

| Vehicle Type | 2022 | 2023 | 2024 |

| Passenger Cars | 7,100.6 | 7,400.0 | 7,705.0 |

| Light Commercial Vehicles | 3,900.6 | 4,220.7 | 4,564.5 |

| Heavy Commercial Vehicles | 1,631.2 | 1,729.1 | 1,831.9 |

Automotive Relay Market Key Players

- Denso

- Eaton

- Fujitsu

- ABB Ltd.

- Idec Corporation

- Littelfuse Inc.

- TE Connectivity

- Omron Corporation

- Sharp Corporation

- NEC Corporation

- Nippon-Aleph

- Daesung Electric