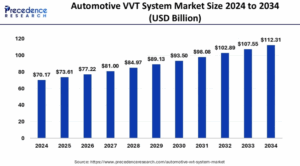

According to Precedence Research, the global automotive VVT system market size was estimated at USD 70.17 billion in 2024 and is expected to cross around USD 112.31 billion by 2034 with a CAGR of 4.82%.

What is an Automotive VVT System?

An Automotive Variable Valve Timing (VVT) system is a technology used in internal combustion engines to optimize the timing of the opening and closing of engine valves. By adjusting valve operation based on engine speed, load, and other factors, the VVT system enhances engine performance, fuel efficiency, and emissions control. It ensures that the engine breathes efficiently under different operating conditions, resulting in better power delivery and reduced environmental impact.

Why is VVT Important in Modern Vehicles?

VVT systems are crucial in meeting today’s demanding automotive standards for fuel economy and emission regulations. They help engines adapt to both high-performance and fuel-saving driving styles. VVT technologies like Single Overhead Camshaft (SOHC), Double Overhead Camshaft (DOHC), and Cam Phasing are widely implemented by manufacturers to achieve optimal engine behavior. As hybrid and electric vehicles gain popularity, VVT continues to evolve to integrate with advanced powertrain systems for greater efficiency and sustainability.

Automotive VVT System Market Key Highlights

- Asia Pacific dominated the market with the largest share in 2024.

- The Double Overhead Cam (DOHC) segment led the Valve Train category in 2024.

- Passenger vehicles accounted for over 65% of the total revenue in 2024.

Automotive VVT System Market Technological Trends

Electrically Actuated VVT Systems

These systems provide faster and more precise control than traditional hydraulic systems, making them ideal for hybrid and high-efficiency engines.

Advanced Control Algorithms

Engine Control Units (ECUs) now use real-time software to adjust VVT systems more dynamically, increasing fuel savings and reducing wear.

Camless or Free-Valve Technologies

Though still in early stages, camless systems enable fully variable valve timing, duration, and lift, offering even greater flexibility—though currently costly and complex.

Material and Design Innovations

Manufacturers are adopting lighter materials and miniaturized VVT modules to reduce weight and improve compatibility with compact engine designs.

How is AI Enhancing Efficiency in Automotive VVT Systems?

Artificial Intelligence (AI) is revolutionizing automotive Variable Valve Timing (VVT) systems by enabling real-time optimization of engine performance. Through machine learning algorithms and sensor data analysis, AI can precisely adjust valve timing based on driving conditions, engine load, and fuel quality. This results in improved fuel efficiency, reduced emissions, and enhanced engine responsiveness, supporting the industry’s shift toward smarter and greener powertrains.

Can AI Predict and Prevent VVT System Failures?

Yes, AI plays a critical role in predictive maintenance of VVT systems. By continuously monitoring engine parameters and historical performance data, AI algorithms can detect anomalies and forecast potential system failures before they occur. This proactive approach not only minimizes downtime and repair costs but also ensures greater reliability and longevity of engine components, making AI an indispensable tool in modern automotive engineering.

Regional Outlook

Asia-Pacific is the largest and fastest-growing region, driven by increasing vehicle production and strict emission laws in countries like China and India.

North America and Europe are mature markets with high VVT adoption, influenced by strong regulatory compliance and demand for high-performance vehicles.

Latin America, Middle East, and Africa are emerging markets seeing steady growth as car ownership and emission policies evolve.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 112.31 Billion |

| Market Size in 2025 | USD 73.61 Billion |

| Market Size in 2024 | USD 70.17 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.82% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fuel Type, Methods, System, Number of Valves, Valve Train, Technology, Vehicle Type, Actuation Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Players in Automotive Variable Valve Timing (VVT) System Market

Mikuni American Corporation

Mikuni is involved in manufacturing and supplying engine components such as carburetors and fuel injection systems. While not a major global supplier of complete VVT systems, Mikuni contributes supporting engine technologies that enable efficient valve timing integration in internal combustion engines.

Johnson Controls, Inc.

Johnson Controls has historically been active in automotive electronics and powertrain solutions. However, its role in the VVT market is limited, and it is not currently recognized as a leading supplier of VVT-specific systems or components. Its contributions are more peripheral, connected to broader vehicle systems.

Federal-Mogul LLC

Now part of Tenneco, Federal-Mogul is a known manufacturer of valvetrain components such as valves, lifters, and camshafts. Although it does not produce complete VVT systems, it plays a key supporting role in the supply of precision-engineered components used in variable valve timing assemblies.

Camcraft, Inc.

Camcraft focuses on precision machining of engine components, including camshafts and other critical parts used in VVT systems. While it may not design full VVT units, it supports OEMs and Tier 1 suppliers with high-quality machined components essential for VVT functionality.

Aisin Seiki Co., Ltd.

Aisin Seiki is one of the leading providers of VVT systems, particularly in Asia. It supplies advanced VVT systems like the Variable Valve Timing – intelligent by Electric motor (VVT-iE) to major automakers including Toyota. Aisin is known for its innovation in hybrid and energy-efficient powertrain technologies.

BorgWarner Inc.

BorgWarner is a global leader in VVT technology, offering advanced cam phasing systems like its CamTrac and Dual Independent Variable Cam Timing systems. It provides solutions to a wide range of global automakers and is heavily involved in developing next-generation VVT systems suited for hybrid and efficient engines.

Eaton Corporation

Eaton is a key global supplier of engine components and valvetrain technologies. It designs robust VVT mechanisms aimed at improving engine performance, reducing emissions, and boosting fuel efficiency. Its focus is on reducing complexity while enhancing the reliability of VVT systems for OEMs.

Mitsubishi Electric Corporation

Mitsubishi Electric plays an important role in supplying electronic VVT actuators and control systems. The company serves as a prominent solution provider in the Asian automotive market, helping automakers meet regulatory requirements through precision timing technologies.

DENSO Corporation

A major supplier and innovator, DENSO is closely affiliated with Toyota and holds a significant share of the VVT system market. Known for its high-efficiency and electronically controlled VVT solutions, DENSO contributes to the success of advanced combustion systems like Mazda’s SkyActiv technologies.

Robert Bosch GmbH

Bosch is a technological powerhouse in the automotive sector and a front-runner in European VVT innovations. It focuses on intelligent VVT solutions that use AI and modular actuator designs, enabling manufacturers to meet emissions and performance demands across global markets.

Schaeffler AG

Schaeffler specializes in mechanical and hydraulic VVT components including cam phasers and adjusters. The company offers advanced system solutions for light vehicles and is actively expanding presence in emerging markets by providing efficient and cost-effective VVT modules.

Toyota Motor Corporation

Toyota is both a manufacturer and technological innovator in VVT systems, with proprietary technologies like VVT-i and VVT-iE. These systems are widely used across Toyota’s vehicle lineup to enhance fuel efficiency, power delivery, and emissions control, especially in hybrid applications.

Honda Motor Co., Ltd.

Honda is known globally for its VTEC (Variable Valve Timing and Lift Electronic Control) system, a pioneering VVT technology. The company continues to refine and evolve its variable valve timing systems, integrating them into both performance and eco-friendly vehicles.

Discussion about this post