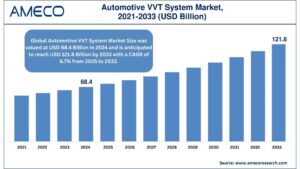

The Automotive VVT System Market is rapidly evolving as global automakers intensify efforts to improve engine efficiency, reduce emissions, and meet stringent regulatory standards. According to Ameco Research, the Automotive VVT System Market Size reached USD 68.4 billion in 2024 and is projected to soar to USD 121.8 billion by 2033, reflecting a CAGR of 6.7% from 2025 to 2033. This article explores key market trends, regional dynamics, and strategic drivers shaping the Automotive VVT System Market, inviting readers to delve into the detailed Ameco Research Automotive VVT System Market Report for deeper insights.

Automotive VVT System Market Size & Outlook

The robust automotive VVT system market outlook signals sustained demand fuelled by rising consumer preference for fuel-efficient passenger vehicles, tighter emission norms globally, and increasing vehicular production across emerging economies. The projected doubling of market value from 2024 to 2033 captures an ecosystem shift toward advanced variable valve timing (VVT) technologies across both gasoline and diesel engine segments.

What is VVT System and why is it important?

VVT stands for Variable Valve Timing, a technology used in internal combustion engines to optimize the timing of the intake and exhaust valves. In simpler terms, it adjusts when and how long the engine’s valves open and close—based on engine speed, load, and other driving conditions.

Why is VVT Important?

- Improved Fuel Efficiency: By optimizing the combustion process, VVT helps burn fuel more efficiently. This translates to better mileage, which is a major selling point for today’s fuel-conscious consumers.

- Enhanced Engine Performance: VVT allows for smoother acceleration and higher torque output at both low and high RPMs, giving drivers a more responsive vehicle.

- Lower Emissions: VVT helps reduce carbon monoxide (CO), nitrogen oxides (NOx), and unburned hydrocarbons, making vehicles more compliant with global emission standards such as Euro 6, BS-VI, and EPA regulations.

- Supports Downsizing Trends: Automakers are downsizing engines to meet environmental standards while maintaining power output—and VVT makes that possible without compromising performance.

- Crucial for Hybrid & Turbocharged Engines: In modern powertrains—especially hybrids and turbocharged engines—VVT plays a key role in maintaining optimal power-to-efficiency balance.

Automotive VVT System Market Growth Drivers

1. Emission Norms & Fuel Efficiency Regulations

Governments worldwide are implementing strict standards like Euro 7, CAFE in the U.S., and China 6, compelling OEMs to adopt advanced engine management systems such as VVT to deliver cleaner, more efficient vehicles. The automotive VVT system market growth is closely linked to these emission control mandates.

2. R&D and Innovation in Valve Train Technology

Automakers are pivoting towards advanced variants such as continuous VVT, electric cam phasers (e-VVT), and AI-enhanced adaptive systems. Continuous VVT leads the product-type segment, offering smoother performance and better fuel efficiency, bolstering market share globally.

3. Hybridization and Electrification Transition

While pure electric vehicles reduce the relevance of VVT, the rise in hybrids means VVT systems remain crucial in optimizing internal combustion engines. Innovations like Toyota’s VVT-iE for hybrid engines and Bosch’s AI-optimized actuators reflect next-gen automotive VVT system market trends.

4. Growing Passenger Vehicle Demand

Asia-Pacific’s booming auto industry—with countries like China, India, and Japan leading—drives the majority of VVT system adoption, given surging passenger car production and fuel-cost mitigation priorities.

Regional Breakdown: Where the Automotive VVT System Market Is Heading

Asia-Pacific: Market Dominance & Rapid Uptake

Asia-Pacific emerged as the largest and fastest-growing region in 2024, with countries like China, India, and Japan driving broad VVT adoption through expanding OEM production, regulatory pressures, and consumer demand for fuel-efficient engines. Emerging economies are also ramping investments in automotive technologies to support emission goals.

North America & Europe: Mature Demand and Deep Expertise

North America and Europe contribute solid automotive VVT system market share, supported by high vehicle ownership rates, regulatory rigor, and established Tier-1 suppliers such as BorgWarner, Eaton, Bosch, and Continental. Continuous innovation and system customization for Euro Norms and ICE efficiency further fuel market appetite.

Latin America & MEA: Emerging Markets with Upside

While current uptake lags, Latin America and the Middle East & Africa are gradually embracing VVT systems, driven by rising passenger vehicle sales and growing focus on vehicle performance and compliance. OEM partnerships and aftermarket expansion may accelerate market share in these regions in the coming years.

Automotive VVT System Market Segment Highlights

- By Valve Train: DOHC/Continuous VVT systems dominate due to performance advantages, especially in gasoline segments.

- By Fuel Type: Gasoline engines account for over 75% of demand, given their higher prevalence in passenger vehicles.

- By Method: Cam phasing and combined cam phasing & changing systems lead product innovation, especially in hybrid and performance model deployments.

- By Vehicle Type: Passenger vehicles represent over 65% of VVT integration, followed by light and heavy commercial vehicles, while EV penetration remains limited for ICE-based systems.

Competitive Landscape & Industry Leaders

The automotive VVT system market is moderately concentrated, with major global players such as Hitachi Automotive Systems, DENSO Corporation, Schaeffler AG, Robert Bosch GmbH, BorgWarner Inc., Aisin Seiki, and Eaton Corporation dominating due to technical complexity and the cost-intensive nature of VVT production. These firms are increasingly integrating electrified, AI-driven, and modular VVT technologies to stay ahead in the market report insights.

Automotive VVT System Market Trends & Future Outlook

1. Electric Cam Phaser (e-VVT) Adoption

Electric cam phasers are rapidly gaining traction, especially in hybrid vehicles, enabling smoother engine start-stop cycles and improved fuel economy. Regulatory incentives and consumer demand for hybrids make this a key Automotive VVT System Market Trend.

2. AI-Driven Timing Controls

AI-enhanced algorithms and embedded sensors are enabling real-time VVT calibration based on driving conditions, enhancing torque, reducing fuel consumption, and increasing engine lifespan—key for future market growth.

3. Modular & Cost-Competitive Solutions

OEMs and suppliers, especially in Asia, are launching modular remanufactured kits and cost-optimized VVT systems—offering high-value performance at lower price points to scale adoption in budget vehicles.

The automotive VVT system market stands at the cusp of a transformative growth phase—from USD 68.4 billion in 2024 to USD 121.8 billion by 2033, at a robust CAGR of 6.7%. Driven by emission regulations, consumer demand for efficiency, and technological innovation in valve train systems, the industry is set to expand across all regions—with Asia-Pacific leading the charge.

For a comprehensive deep dive into segmentation, competitive benchmarking, and regional insights that can inform strategic decisions, you may explore more in the Automotive VVT System Market Report by Ameco Research.

Discussion about this post