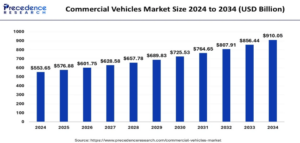

The global commercial vehicles market size is estimated at USD 576.88 billion in 2025 and projected to reach around USD 910.05 billion by 2034, growing at a CAGR of 5.20% from 2025 to 2034.

The commercial vehicles market is vital for economic development, facilitating efficient movement of goods and passengers across urban and rural areas. It includes various vehicles like LCVs, trucks, buses, and trailers, used in various industries. The market is growing due to urbanization, e-commerce, infrastructure development, and demand for last-mile delivery solutions. Technological advancements like electric and autonomous vehicles are also transforming the industry. Asia-Pacific dominates the global market, with China and India leading. North America and Europe follow, but challenges like high initial investment, fuel price fluctuations, and regulatory hurdles may impact market dynamics.

Commercial Vehicles Market Key Highlights

- North America dominated the global market with the largest market share of 44.43% in 2024.

- Asia-Pacific region is estimated to observe the fastest expansion during the forecast period.

- The light commercial vehicles segment captured the largest market share of 75.50in 2024.

- The heavy trucks product segment is expected to expand at the fastest CAGR of 5.7% between 2025 and 2034.

- The IC engine has segment has held the largest market share of 73.39% in 2024.

- The diesel segment contributed the largest market share in 2024.

North America Leads the Commercial Vehicles Market

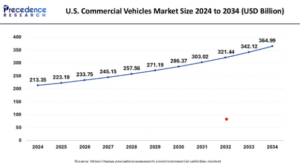

In 2024, the global commercial vehicles market was valued at approximately USD 553.65 billion, with North America emerging as the dominant region, accounting for a substantial 44.43% market share. The North American commercial vehicles market exceeded USD 246.01 billion in 2024 and is expected to expand steadily at a CAGR of 5.30%. Within this region, the United States plays a crucial role, with its market alone valued at USD 213.35 billion in 2024 and projected to reach around USD 364.99 billion by 2034, growing at a robust CAGR of 5.62% from 2025 to 2034. This dominance is driven by strong demand in freight transportation, high penetration of advanced logistics networks, and ongoing investments in road infrastructure. Additionally, the increasing adoption of electric commercial vehicles and autonomous driving technologies in the U.S. is expected to further propel market growth, positioning North America as a global leader in commercial vehicle innovation and adoption.

Commercial Vehicles Market Coverage

| Report Attribute | Key Statistics |

| Market Size in 2025 | USD 576.88 Billion |

| Market Size by 2034 | USD 910.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Propulsion Type, Power Source, Region |

Commercial Vehicles Market Trends

Strategic Alliances for Electric Vehicle Development:

- Hyundai Motor and General Motors are in advanced discussions to collaborate on electric commercial vans and pickup trucks for the North American market. This partnership aims to leverage shared technologies to reduce development costs and counter increasing competition from Chinese electric vehicle manufacturers.

Price Adjustments by Manufacturers:

- Mahindra and Mahindra have announced a price increase of up to 3% on their SUVs and commercial vehicles, effective April 2025. This adjustment is in response to rising commodity prices, higher import duties on raw materials, and supply chain disruptions.

Technological Innovations and Autonomous Vehicles:

- The industry is witnessing a shift towards direct-sales models and innovative go-to-market strategies, particularly among light commercial vehicle (LCV) manufacturers. This transformation is driven by changing customer preferences and the emergence of new business models.

Market Outlook and Economic Influences:

- Volkswagen’s truck unit, Traton, projects a subdued commercial vehicle market in 2025, attributing this outlook to persistent economic weaknesses in Europe, especially in Germany. The company forecasts sales development ranging from -5% to +5% and an operating return on sales between 7.5% and 8.5%, influenced by geopolitical factors.

Adoption of Alternative Fuels:

- In China, the rapid adoption of liquefied natural gas (LNG) trucks is reducing diesel demand, with LNG-powered trucks accounting for 42% of heavy truck sales in 2024. This transition supports China’s efforts to diversify energy sources and reduce reliance on imported oil.

Electrification Initiatives:

- Amazon has placed the UK’s largest-ever order for electric heavy goods vehicles (HGVs), adding over 140 electric trucks to its fleet. This move is part of Amazon’s £300 million investment in green transportation to achieve net-zero carbon emissions by 2040.

Challenges in Electric Vehicle Adoption:

- Despite advancements in electric truck technology, sales remain low. For instance, Scania’s electric trucks account for only 1% of its sales, highlighting challenges such as supply issues and inadequate charging infrastructure.

Product Outlook

The commercial vehicles market is segmented into Light Commercial Vehicles (LCVs), Buses & Coaches, and Heavy Trucks. LCVs, such as vans and small pickups, are widely used for last-mile deliveries and urban logistics due to their compact size, fuel efficiency, and ease of navigation in congested areas. Buses & Coaches serve both public and private transportation needs, offering mass transit solutions and contributing significantly to reducing individual vehicle usage, especially in urban and intercity travel. Heavy Trucks, including long-haul freight carriers and dump trucks, form the backbone of industrial logistics and construction operations, known for their high load-carrying capacity and long-distance travel capabilities.

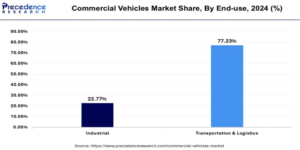

End-use Outlook

Based on end-use, the market is categorized into Industrial, Transportation, and Others. The Industrial segment covers vehicles used in sectors like construction, mining, agriculture, and manufacturing, where durable, heavy-duty performance is critical. The Transportation segment includes logistics, delivery services, and passenger transit, which rely on commercial vehicles for efficient, timely movement of goods and people. The Others category encapsulates specialized applications such as emergency services, utility maintenance, and military logistics, where customized commercial vehicle solutions are often required.

- The transportation and logistics segment reached USD 427.60 billion in 2024 and registered growth at a CAGR of 5.6%.

- The industrial segment surpassed USD 126.00 billion in 2024 and is projected to grow at a CAGR of 3.83% from 2025 to 2034.

Propulsion Type Outlook

In terms of propulsion, the market is divided into Internal Combustion (IC) Engine and Electric Vehicles. The traditional IC engine segment, powered by gasoline or diesel, remains dominant, especially in regions with well-established fuel infrastructure and long-haul travel needs. However, the Electric Vehicle (EV) segment is rapidly gaining traction due to environmental regulations, government incentives, and advancements in battery technology. These vehicles offer lower emissions and are ideal for urban usage and short-distance logistics.

By Power Source

Commercial vehicles are further classified by power source into Gasoline, Diesel, HEV/PHEV, Battery Electric Vehicle (BEV), Fuel Cell Vehicle, and LPG & Natural Gas. Diesel continues to be the most common fuel type due to its efficiency in heavy-load operations. Gasoline-powered vehicles are more prevalent in lighter vehicle categories. Hybrid Electric Vehicles (HEV/PHEV) and Battery Electric Vehicles (BEV) represent a shift toward greener transportation solutions, especially in urban delivery and passenger transport. Fuel Cell Vehicles are emerging as a promising alternative for long-distance and heavy-duty applications, offering quick refueling and extended range. LPG & Natural Gas options are also gaining popularity as cleaner-burning fuels, especially in regions focused on reducing vehicular emissions.

Segments Covered in the Report

By Product

- Light Commercial Vehicles (LCVs)

- Buses & Coaches

- Heavy Trucks

By End-use

- Industrial

- Transportation

- Others

By Propulsion Type

- IC Engine

- Electric Vehicle

By Power Source

- Gasoline

- Diesel

- HEV / PHEV

- Battery Electric Vehicle (BEV)

- Fuel Cell Vehicle

- LPG & Natural Gas

By Region

- North America: US, and Rest of North America

- Europe: UK, Germany, France, and Rest of Europe

- Asia Pacific: China, Japan, India, and Rest of Asia Pacific

- Latin America: Brazil, and Rest of Latin America

- Middle East & Africa (MEA): GCC, North Africa, South Africa, and Rest of the Middle East & Africa