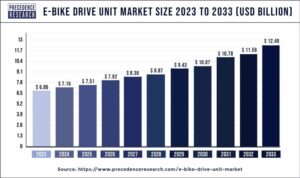

The global e-bike drive unit market size is estimated at USD 7.16 billion for 2024 and is projected to hit around USD 12.49 billion by 2033 with a CAGR of 6.38% from 2024 to 2033.

An electrical drive is defined as an electronic device that regulates particular motor parameters in order to precisely and controllably transform electrical energy into mechanical power. It is made up of a complex electronic system or a mix of many technologies designed to regulate motion. These units are growing in popularity in the market due to the increased concerns about sustainability and the energy resources crisis. The demand for e-bikes and rising fuel prices are some of the reasons leading to the growth of the market. Infrastructure limitations can hinder progress however, technological advancements, continuous development, and government support will be able to mitigate the issue.

Key Insights

- Asia Pacific dominated the market with the major market share of 93.97% in 2023.

- By Product, the hub motors segment has contributed the largest market share of 69.02% in 2023.

- By Product, the mid-drive motors segment is expected to expand at the fastest growth of 5% over the forthcoming years.

- By Application, the OEM segment has generated the biggest revenue share of 93.2% in 2023.

Regional Stance

The Asia-Pacific e-bike drive unit market is dominating the market, driven by urbanization, traffic congestion, and government incentives. China is the largest market, and hub motors are popular because they are simple and inexpensive. Japan, South Korea, and India are also seeing an increase in e-bike adoption.

The Asia Pacific E-bike drive unit market size is calculated at USD 6.73 billion for 2024 and is estimated to surpass around USD 11.73 billion by 2033, poised to grow at a CAGR of 6.36% from 2024 to 2033.

Europe is fastest fastest-growing region in the e-bike drive unit market. Urbanization, riding culture, legislative backing, well-developed infrastructure, environmental concerns, and technology are all contributing to the growth of the European e-bike drive units industry. Cities experience traffic congestion and air pollution, making e-bikes an appealing alternative. Europe’s riding culture appeals to a diverse variety of bikers, while legislation and incentives encourage electric mobility. Europe’s well-developed infrastructure encourages e-bike use, and top manufacturers are constantly improving e-bike components to boost performance and attractiveness.

Report Highlights

Global E-bike Drive Unit Market Production (Thousand Units), by Product

| Product | 2019 | 2020 | 2021 | 2022 | 2023 |

| Hub Motors | 46,313.15 | 46,069.21 | 47,392.01 | 48,978.99 | 50,842.61 |

| Mid-Drive Motor | 10,180.08 | 10,236.35 | 10,643.76 | 11,117.93 | 11,663.67 |

Hub Motors is dominating the products segment of the e-bike drive unit market. Hub motors are a type of electric motor seen in e-bikes, usually positioned in the wheel hub. They are basic, inexpensive, and unobtrusive, appealing to riders who desire a conventional appearance. Some motors use regenerative braking technology, which captures energy when braking and converts it into electricity to replenish the battery. Hub motors require little maintenance since they have fewer working components, saving both time and money. They are compatible with a variety of bicycle designs, making them a popular choice among e-bike producers.

The fastest-growing product in the e-bike drive unit market is mid-drive motors. Mid-drive motors are electric motors found in e-bikes at the bottom bracket where the pedals join to the frame. They have various advantages over hub motors, including increased efficiency, better weight distribution, greater hill climbing, longer range, simpler maintenance, and higher performance. Mid-drive motors use the bike’s gears to optimize power delivery, resulting in improved performance over steep terrain. They are also more energy efficient, easier to maintain, and have better acceleration and hill climbing capabilities.

Application Outlook:

The OEM segment held the largest share of the e-bike drive unit market in 2023. The rising emphasis over increasing longevity of automotive parts plays a crucial role in the expansion of the segment. The OEM drive unit offers advantages, including reliability, enhanced performance and superior quality while compared to aftermarket units. Owing to the precise design, OEM drive units for e-bikes are observed to fit seamlessly into the original structure. The installation process of OEM drive unit also offers modifications, that potentially results in less complications. Moreover, the focus on less maintenance requirements for e-bikes creates a potential for the segment to expand.

Scope of E-bike Drive Unit Market

| Report Highlights | Details |

| CAGR | 6.38% from 2024 to 2033 |

| Global Market Size in 2023 | USD 6.86 Bn |

| Global Market Size by 2033 | USD 12.49 Bn |

| Asia Pacific Market Size in 2023 | USD 6.44 Bn |

| Asia Pacific Market Size by 2033 | USD 11.73 Bn |

| Largest Market | North America |

| Fastest Growing Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America and Middle East & Africa |

Market Dynamics:

Drivers: Increasing demand for electric bicycles

Convenience, accessibility, sustainability, cost-effectiveness, health advantages, urbanization, technical improvements, and legislative backing all contribute to the growing demand for e-bikes. E-bikes provide a sustainable and handy method of transportation, particularly for short to medium distances, while also being ecologically benign due to their zero emissions. They are also less expensive to buy and maintain, resulting in huge savings on fuel. As cities become increasingly crowded, e-bikes can help alleviate traffic and parking demand. Technological improvements and government legislation are also helping to drive e-bike usage throughout the world.

Rising fuel prices

Rising fuel prices are driving up demand for e-bikes, as consumers look for cheaper alternatives to gasoline and diesel. E-bikes are more fuel efficient and cost less to charge than gasoline, making them desirable to commuters. They are also seen as sustainable and ecologically beneficial since they promote climate change awareness and reduce carbon emissions.

Restraints: Charging infrastructure

The broad adoption of e-bikes confronts obstacles such as restricted availability, compatibility with various battery shapes and sizes, expensive installation and maintenance costs, and poor charging speeds. These limitations may limit the widespread usage of e-bikes, particularly for daily commuting and longer excursions. The absence of easily available charging infrastructure can further limit the availability of charging choices, particularly for riders who want speedy recharges during lengthy rides or commutes. Thereby, the concerns associated with continuously changing infrastructure act as a restraint for the e-bike drive unit market.

Maintenance

E-bike maintenance is critical for achieving peak performance and lifespan. It entails appropriate battery maintenance, which includes storing the battery in a cool, dry location, avoiding overcharging, and according to manufacturer instructions. Regular maintenance of the drive unit, including the motor and components, is required. E-bikes require regular brake maintenance, which includes inspecting pads, adjusting cables, and monitoring tire pressure. Regular examination of the frame, bolts, and chain is also required. Professional service is advised for any overlooked concerns.

Opportunity: Regulatory support

Regulatory assistance is critical for the e-bike business since it helps manufacturers and retailers. Countries create legislation defining e-bikes and provide incentives and subsidies to encourage uptake. Governments invest in infrastructure upgrades, such as dedicated bike lanes and charging stations, to make e-bikes more accessible. Regulations also enable e-bikes to use public places, boosting local economies and encouraging a healthy lifestyle. Some cities allow e-bikes to be transported on public transportation, making them more practical for longer journeys. This regulatory support by the government will boost the growth of the e-bike drive unit market in the future.

E-bike Drive Unit Market Manufacturers

- Yamaha Motor Corporation

- MAHLE GmbH

- Robert Bosch GmbH

- Panasonic

- Shimano

- Giant Bicycles

- Brose Fahrzeugteile SE & Co. KG

- Continental AG

- Bafang Electric (Suzhou) Co., Ltd

Recent Developments:

- In December 2023, The Intra Drive E-Bike System, which includes a small motor and gearbox, provided 600 watts of peak output and an eight-speed drivetrain for a variety of e-bike models.

- In September 2023, Yamaha announced the PWseries C2 eBike drive unit, which is a lightweight and adaptable motor suited for urban and commuter use. The PWseries C2 expands on the company’s popular line of compact high-torque drive units, which have been known for smooth power delivery for the previous 30 years.

- In June 2023, Pinion unveiled an e-bike motor with an integrated gearbox, which might change the way we think about e-bike gearboxes.

Market Segmentation

By Product

- Mid-Drive Motors

- Hub Motors

By Application

- OEMs

- Aftermarket

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa