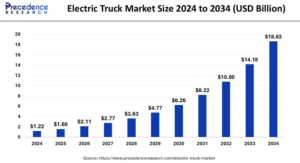

The global electric truck market size was evaluated at USD 1.22 billion in 2024 and is predicted to reach around USD 18.63 billion by 2034, growing at a CAGR of 31.34% from 2025 to 2034.

Electric Truck Market Key Points

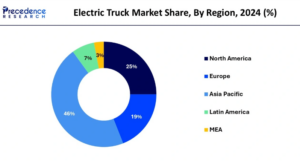

- Asia Pacific led the electric truck market in 2024.

- North America is expected to experience significant CAGR growth during the forecast period.

- Based on propulsion, the battery electric truck segment was the dominant segment in the electric truck market in 2024.

The Transformative Impact of AI on the Electric Truck Market

AI is significantly transforming the electric truck market by enhancing efficiency, performance, and sustainability. One of its key contributions is in optimizing battery management systems (BMS), where AI algorithms improve charging cycles, extend battery life, and enhance energy efficiency.

AI-driven predictive maintenance helps detect potential issues in electric trucks before they become major problems, reducing downtime and maintenance costs. Additionally, AI enables smart route optimization by analysing traffic patterns, weather conditions, and battery charge levels, ensuring efficient energy usage and longer driving ranges.

Moreover, AI is revolutionizing autonomous and semi-autonomous electric trucks, improving safety and operational efficiency in logistics and freight transport. AI-powered driver assistance systems enhance navigation, collision prevention, and adaptive cruise control, making electric trucks safer and more reliable.

Fleet management platforms integrated with AI provide real-time analytics, helping businesses optimize delivery routes and reduce operational costs. As AI continues to evolve, it is expected to accelerate the adoption of electric trucks by making them more cost-effective, intelligent, and environmentally friendly.

Electric Truck Market Growth Factors

- Government Policies and Incentives

Supportive government regulations, subsidies, and tax benefits for electric trucks are driving market growth. Many countries have implemented strict emission norms and incentives for fleet operators to switch to electric vehicles, accelerating adoption. - Advancements in Battery Technology

Improvements in battery energy density, charging speed, and cost reduction have made electric trucks more viable for commercial use. The development of solid-state and fast-charging battery technologies is further enhancing their efficiency and range. - Rising Fuel Costs and Energy Efficiency

The increasing cost of fossil fuels is pushing logistics and transportation companies to adopt electric trucks as a cost-effective and energy-efficient alternative. Lower operating costs and reduced dependency on fuel price fluctuations make electric trucks an attractive option. - Expansion of Charging Infrastructure

The growing investment in fast-charging stations and battery-swapping technology is reducing range anxiety and enabling the large-scale adoption of electric trucks. Governments and private players are focusing on expanding the EV charging network to support commercial fleet operations. - Growing Awareness of Sustainability

Environmental concerns and the push for carbon neutrality are influencing businesses to adopt cleaner transportation solutions. Many logistics and e-commerce companies are integrating electric trucks into their fleets to meet sustainability goals and reduce carbon footprints. - AI and IoT Integration

The integration of AI and IoT in electric trucks enhances fleet management, predictive maintenance, and energy optimization. AI-powered route planning, battery management, and driver assistance systems contribute to better operational efficiency and lower costs. - Increasing Adoption in E-Commerce and Logistics

The booming e-commerce and last-mile delivery sectors are driving demand for electric trucks. Companies like Amazon, UPS, and DHL are investing in electric delivery fleets to meet sustainability targets and improve cost efficiency. - Investments in Research and Development

Automakers and technology companies are heavily investing in R&D to develop high-performance electric trucks with longer range, better payload capacity, and improved durability. This innovation is making electric trucks more competitive with traditional diesel-powered vehicles. - Rising Urbanization and Smart City Initiatives

The expansion of urban areas and smart city projects is encouraging the adoption of electric trucks for cleaner and quieter urban freight transportation. Governments are promoting zero-emission zones, further driving demand for electric commercial vehicles. - Collaborations and Partnerships

Strategic collaborations between automakers, battery manufacturers, and logistics companies are fostering innovation and accelerating market penetration. Joint ventures and partnerships help improve electric truck affordability, infrastructure, and technological advancements.

Electric Truck Market: Regional Outlook

Asia Pacific

- Market Size: The Asia Pacific electric truck market was valued at USD 560 million in 2024 and is projected to reach approximately USD 8,660 million by 2034.

- CAGR: Expanding at a CAGR of 31.50% from 2025 to 2034.

- Dominance: Asia-Pacific dominated the electric truck market in 2024

- Key Drivers:

- Rapid industrialization and urbanization.

- Strict government regulations and norms against pollution and global warming.

- High investments in research and development by governments and key market players.

- Growing awareness among the people regarding environmental concerns.

- Government subsidies and incentives to market players.

- Dominant Country: China leads the electric truck market within the Asia-Pacific region.

North America

- Growth Expectation: North America is expected to develop at the fastest rate during the forecast period (2025-2034).

- Key Drivers:

- Technological advancements.

- Adoption of innovative technologies.

- Stringent government regulations and guidelines aimed at curbing pollution from fuel-based vehicles.

Africa

- Growth Expectation: Africa is expected to witness the highest CAGR of around 37.7% during the forecast period of 2025-2034.

Other Important Considerations

- Overall Market Growth: The global electric truck market is projected to grow from USD 1.60 billion in 2025 to USD 18.63 billion by 2034, exhibiting a CAGR of 31.34%.

- Key Growth Drivers Globally:

- Rising demand to reduce air pollution and improve air quality.

- Contribution towards greener transportation.

- Growing investments in research and development activities.

- Technological advancements in battery development.

- Restraints:

- Insufficient charging infrastructure for electric vehicles.

- High cost of electric trucks.

- High operating and maintenance costs compared to traditional vehicles.

- Dominant Segment: The battery electric trucks segment dominated the electric truck market in 2024, driven by the growing importance of clean energy and government emphasis on electric vehicles.

- Fastest Growing Segment: The hybrid trucks segment is the fastest-growing segment, due to the efficiency and longer battery duration of hybrid electric trucks, as well as their contribution to reducing greenhouse gas emissions

Recent Developments

- In January 2025, Aramex a global leader in logistics and transportation solutions, launched a commercial fleet of electric trucks in the UAE. Aiming for a greener future for logistics in the oil and gas industry. This is achieved through the collaboration with UAE-based Admiral Mobility. This initiative is aimed at delivering strategic sustainable logistics solutions and reducing industrial supply chain environmental impacts.

- In January 2025, Montra Electric, a manufacturer of electric three-vehicles and commercial vehicles, plans to launch their e-SCV and Electric 3W supercargo at the Bharat Mobility Global Expo 2025. This launch will bring significant growth to the electric small commercial vehicle spaces and will encourage India’s Mid-mile and last-mile mobility sectors.

Electric Truck Market Companies

- AB Volvo

- Workhorse

- BYD Company Ltd.

- Tata Motors

- Daimler AG

- Scania

- Dongfeng Motor Company

- Paccar Inc.

- Geely Automobiles Holdings Ltd.

- Man SE

Segments Covered in the Report

By Propulsion

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

By Vehicle Type

- Light Duty Electric Truck

- Medium Duty Electric Truck

- Heavy Duty Electric Truck

By Range

- Upto 150 Miles

- 151-300 Miles

- Above 300 Miles

By End User

- Last Mile Delivery

- Long Haul Transportation

- Refuse Services

- Field Services

- Distribution services

By Battery Capacity

- Less Than 50kwh

- 50-250 Kwh

- Above 250 Kwh

By Payload Capacity

- Upto 10,000 lbs

- 10,001-26,000 lbs

- Above 26,001 lbs

By Level of Automation

- Semi-autonomous

- Autonomous

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa