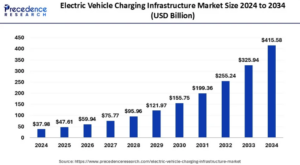

The global electric vehicle charging infrastructure market size is projected to attain around USD 415.58 billion by 2034 from USD 37.98 billion in 2024 with a CAGR of 27%.

Electric Vehicle Charging Infrastructure Market Key Points

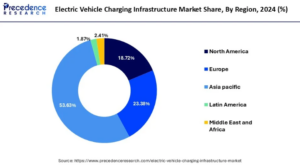

- The Asia Pacific region holds the dominant position in the global market, accounting for the largest share of 53.63%.

- Among charger types, the fast charger segment leads with a substantial market share of 89.5%.

- The slow charger segment is anticipated to grow at a robust CAGR of 26.1% throughout the forecast period.

- In terms of connector type, the Combined Charging System (CCS) segment captured the largest share at 40.07%.

- The “others” segment under connector type is projected to witness strong growth, with a CAGR of 26.7% during the forecast period.

- Based on application, the commercial segment contributes the majority share, accounting for 90.31% of the market.

- The residential segment is expected to expand significantly, registering a solid CAGR of 25.5% over the forecast period.

Role of AI in EV Charging Infrastructure

Artificial Intelligence (AI) plays a transformative role in enhancing the efficiency, reliability, and scalability of electric vehicle charging infrastructure. One of its key contributions is smart energy management AI algorithms analyse real-time data from the grid, weather patterns, and user behaviour to optimize when and how EVs are charged. This helps reduce strain on the power grid during peak hours and enables dynamic pricing, encouraging users to charge during off-peak times, thereby improving energy distribution and cost-effectiveness.

Additionally, AI enhances the user experience and operational efficiency of charging networks. It supports predictive maintenance by identifying issues in chargers before they fail, and guides users to the nearest available and functional charging stations using real-time data.

AI also powers charging station load balancing, allowing multiple EVs to charge simultaneously without overloading the system. In fleet management and commercial applications, AI enables automated scheduling and route optimization, ensuring vehicles are charged efficiently to meet operational needs. As EV adoption rises, AI will be key to building a smart, responsive, and sustainable charging ecosystem.

Electric Vehicle Charging Infrastructure: Overview

Electric Vehicle Charging Infrastructure refers to the network of systems and equipment that provide electric power to recharge charging stations EVs. It includes (public and private), power supply systems, connectors, software platforms, and grid integrations that ensure efficient, accessible, and scalable charging capabilities for EV users.

Types of Charging Stations:

- Level 1 Charging (AC):

- Uses a standard 120V outlet.

- Slow charging—ideal for home use.

- Adds about 3–5 miles of range per hour.

- Level 2 Charging (AC):

- Requires a 240V outlet.

- Common in homes, commercial buildings, and public spaces.

- Adds about 15–25 miles of range per hour.

- Level 3 Charging / DC Fast Charging (DCFC):

- Uses direct current (DC) and high power (50kW–350kW).

- Primarily for commercial/public stations and long-distance travel.

- Can charge an EV up to 80% in 20–40 minutes.

Charger Types:

- Slow Chargers – Lower power, cost-effective, ideal for overnight charging.

- Fast Chargers – High power output for quick charging at commercial hubs.

- Ultra-Fast Chargers – Emerging tech offering super quick charges for long-range EVs.

Connector Standards:

- CCS (Combined Charging System): Widely adopted in Europe and North America.

- CHAdeMO: Japanese standard, used by Nissan and Mitsubishi.

- Type 2 (Mennekes): Standard in Europe for AC charging.

- Tesla Supercharger: Proprietary to Tesla, now opening to other brands in some regions.

Applications:

- Residential Charging – Home garages or parking lots.

- Commercial Charging – Offices, shopping centers, restaurants.

- Public Charging Networks – Highway corridors, urban centers.

- Fleet & Depot Charging – For logistics, ridesharing, public transit, etc.

Key Challenges:

- Grid Load & Power Supply Constraints

- Charger Availability & Standardization

- High Initial Installation Costs

- Rural & Underserved Area Accessibility

Emerging Trends:

- AI & IoT Integration for smart charging, demand forecasting, and dynamic pricing.

- Renewable Energy Integration (e.g., solar-powered charging stations).

- Battery Swapping Stations as an alternative to charging.

- Wireless Charging under development for added convenience.

- Vehicle-to-Grid (V2G) Technology enabling EVs to return power to the grid.

Regional Outlook of the Electric Vehicle Charging Infrastructure Market

Asia Pacific

Asia Pacific

- Market Size: The Asia Pacific electric vehicle charging infrastructure market was valued at USD 20.37 billion in 2024 and is expected to reach around USD 213.61 billion by 2034.

- Growth Rate: Projected to grow at a CAGR of 26.70% during the forecast period of 2025 to 2034.

- Key Trends:

- China has the most EV charging stations globally, with plans to construct roughly 600,000 more.

- South Korea aims to build 3,000 rapid charging stations for electric vehicles.

- Japan is dealing with unused charging poles due to slow electric vehicle adoption.

Europe

- Growth: Expected to grow with the highest CAGR in upcoming years.

- Key Drivers:

- Government initiatives supporting the e-vehicle industry.

- Innovations in charging infrastructure models.

- EU target to install 1 million charging points on public places by 2024 and 3 million by 2029.

- Leading countries in electric vehicle adoption include France, Netherlands, Germany, Norway, and the U.K.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 37.98 billion |

| Market Size in 2025 | USD 47.61 billion |

| Market Size By 2034 | USD 415.58 billion |

| Growth Rate from 2025 to 2034 | CAGR of 27% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Charger Type, Connector Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segments of the Electric Vehicle Charging Infrastructure Market

By Charger Type

Slow Charger: These are typically used for overnight charging at home or in public parking lots. They provide a standard AC power supply and are suitable for vehicles that are parked for extended periods. Slow chargers are cost-effective and widely available but take longer to fully charge a vehicle.

Fast Charger: Fast chargers, including rapid and ultra-fast chargers, provide DC power directly to the vehicle’s battery, significantly reducing charging time. They are often installed along highways and in public charging stations where quick top-ups are necessary. Fast chargers are more expensive to install and require higher power capacity but offer the convenience of faster charging.

Electric Vehicle Charging Infrastructure Market, by Charger Type, 2022-2024 (USD Billion)

| Charger Type | 2022 | 2023 | 2024 |

| Slow Charger | 2.6 | 3.2 | 4 |

| Fast Charger | 21.7 | 27.1 | 34 |

By Connector Type

CHAdeMO: This is a fast-charging standard primarily used in Japan and some European countries. CHAdeMO connectors can charge vehicles up to 100 kW, making them suitable for quick charging sessions. However, they are less common in North America compared to other standards.

Combined Charging System (CCS): CCS is a widely adopted fast-charging standard that combines AC and DC charging capabilities. It supports charging speeds up to 350 kW, making it one of the fastest options available. CCS is widely supported by major automakers and is becoming the global standard for fast charging.

Others: This includes other connector types like Tesla’s proprietary Supercharger network, which is exclusive to Tesla vehicles, and Type 2 (Mennekes) connectors used for slower AC charging.

Electric Vehicle Charging Infrastructure Market, by Connector Type, 2022-2024 (USD Billion)

| By Connector | 2022 | 2023 | 2024 |

| CHAdeMO | 6.5 | 8 | 9.8 |

| Combined Charging System (CCS) | 9.4 | 11.9 | 15.2 |

| Others | 8.3 | 10.4 | 13 |

By Application

Commercial: Commercial charging infrastructure includes public charging stations, workplace charging, and fleet charging solutions. These are designed to support businesses and public services, such as taxis, buses, and delivery vehicles. Commercial charging stations often offer fast charging options to accommodate high usage and quick turnaround times.

Residential: Residential charging infrastructure is primarily used for personal vehicles and includes home charging stations. These are typically slow chargers that can be installed in garages or driveways, providing convenience for overnight charging. Residential charging is essential for widespread EV adoption, as it allows vehicle owners to charge their cars at home.

Electric Vehicle Charging Infrastructure Market, by Application, 2022-2024 (USD Billion)

| By Application | 2022 | 2023 | 2024 |

| Commercial | 21.9 | 27.3 | 34.3 |

| Residential | 2.4 | 3 | 3.7 |

Electric Vehicle Charging Infrastructure Market Companies

- ABB

- BP Chargemaster

- ChargePoint, Inc.

- ClipperCreek, Inc.

- Eaton Corp.

- General Electric Company

- Leviton Manufacturing Co., Inc.

- SemaConnect, Inc.

- Schneider Electric

- Siemens AG

- Tesla, Inc.

- Webasto SE