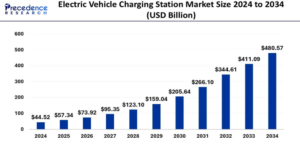

The global electric vehicle charging station market size was valued at USD 44.52 billion in 2024 and is predicted to reach around USD 480.57 billion by 2034 with a remarkable CAGR of 26.85%.

The Electric Vehicle (EV) Charging Station market is experiencing rapid growth due to global shift towards sustainable transportation and increasing adoption of electric vehicles. Governments are investing in EV infrastructure to support zero-emission goals, offering incentives and subsidies to consumers and developers. Technological advancements, such as fast-charging solutions and renewable energy integration, are accelerating market expansion. Collaborations between automakers, utility providers, and technology companies are crucial for developing comprehensive charging networks. The EV charging station market is expected to grow across residential, commercial, and public segments.

Electric Vehicle Charging Station Market Key Highlights

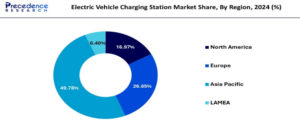

- Asia Pacific dominated the EV charging station market with the largest market share of 49.78% in 2024.

- The level 2 segment captured the largest market share of 66.24% in 2024.

- The DC charging station segment contribute the biggest market share 75% in 2024.

- The plug-in charging segment held the maximum market share of 86% in 2024.

- The residential segment captured the largest market share of 65% in 2024.

- The public chargers segment recorded more than 85% of market share in 2024.

Will Asia Dominate the Direct Lithium Extraction Market?

The global Electric Vehicle Charging Station (EVCS) market is valued at USD 44.52 billion in 2024, and it’s witnessing rapid growth driven by the global push for cleaner transportation and the rising adoption of electric vehicles. Regionally, Asia Pacific dominates the market, accounting for the largest share of 49.78% (USD 7,869 million), primarily due to strong government policies, urban expansion, and a booming EV ecosystem in countries like China, Japan, and India. Europe follows with a 26.85% share (USD 4,244.1 million), backed by stringent carbon emission regulations and ambitious climate goals set by the EU. North America holds 16.97% (USD 2,683.4 million) of the market, with significant developments driven by U.S. federal funding, private investments, and increasing consumer adoption of EVs.

Meanwhile, the LAMEA region (Latin America, Middle East, and Africa) contributes 6.40% (USD 1,012.5 million) and is slowly gaining momentum with sustainability initiatives emerging in countries like the UAE and Brazil. The market is expected to grow significantly in the coming years due to advancements in fast-charging technologies, integration with renewable energy, and expansion of smart city infrastructure. However, challenges such as high installation costs and the need for robust grid infrastructure remain. Overall, the EVCS market presents a strong opportunity for growth, innovation, and global collaboration toward a greener future.

government policies differ in various regions regarding EV charging infrastructure

Asia

- India: The Indian government has established a detailed framework for EV charging through the Ministry of Power’s guidelines, which facilitate the establishment of public charging stations without requiring licensing under the Electricity Act. Programs like FAME II provide significant subsidies for both manufacturers and consumers to enhance charging infrastructure23. State governments also offer additional incentives and are responsible for implementing local regulations and standards.

- China: As a leader in EV adoption, China has aggressively expanded its charging network through state-led initiatives. Local governments are tasked with meeting national targets for the number of charging stations, often providing financial incentives for installation in urban areas.

North America

- United States: The U.S. government supports EV charging infrastructure through initiatives like the National Electric Vehicle Infrastructure (NEVI) Formula Program, which allocates over USD 1.5 billion for charging stations. State and local governments play crucial roles in planning and permitting, with unique strategies tailored to local needs. The Joint Office of Energy and Transportation provides resources to assist in developing these strategies1.

- Canada: Similar to the U.S., Canada has implemented various funding programs aimed at expanding EV charging networks. The federal government offers incentives for both public and private charging station installations, focusing on urban areas and highways.

In 2024, the Electric Vehicle (EV) Charging Station Market exhibited significant growth, with notable differences across various segments. By level of charging, Level 2 charging stations dominated the market, accounting for $10,472.6 million, which represented 66.24% of the total share. This dominance can be attributed to their optimal balance of charging speed and installation costs, making them ideal for both public and residential applications. Level 3 charging stations, also known as DC fast chargers, followed with $4,923.6 million in revenue, capturing 31.14% of the market, highlighting the rising demand for ultra-fast charging infrastructure to support long-distance travel and fleet operations. Meanwhile, Level 1 chargers held a minimal share of 2.61% (valued at $412.8 million), primarily due to their slow charging speeds and limited application beyond personal home use.

By charging station type, AC charging stations led the market with a revenue of $10,885.4 million, accounting for 68.86% of the overall market. Their cost-effectiveness and suitability for daily urban commuting continue to drive adoption. In contrast, DC charging stations, valued at $4,923.6 million, represented 31.14% of the market, signaling steady growth fueled by the increasing deployment of fast-charging networks across highways and urban hotspots. This segmentation reflects the industry’s dynamic shift toward faster and more accessible charging solutions, aligned with the global push for EV adoption and infrastructure development.

Electric Vehicle Charging Station Market Recent Activities

- General Motors and EVgo Collaboration: General Motors, in partnership with EVgo and Pilot, has expanded its EV charging network to 130 locations across 25 U.S. states. This initiative aims to install 2,000 DC fast chargers at 500 Pilot and Flying J truck stop locations nationwide, enhancing long-distance travel convenience for EV owners.

- BYD’s Ultra-Fast Charging System: Chinese automaker BYD has introduced a fast-charging system capable of delivering 1,000 kW of power, significantly reducing charging times. BYD plans to establish over 4,000 charging stations across China to support this technology.

- U.S. Federal Funding for EV Infrastructure: The U.S. government has authorized an additional $5 billion for infrastructure projects, including the development of EV charging stations. This funding aims to support the construction of over 11,500 EV charging ports, among other infrastructure improvements