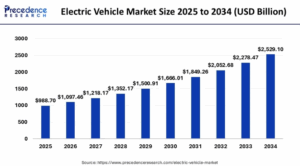

According to Precedence Research, the global electric vehicle market size is expected to attain around USD 2,529.10 billion by 2034 from USD 988.70 billion in 2025, marking a solid CAGR of 11% from 2025 to 2034.

Electric Vehicle (EV) Market Key Insights

- Asia Pacific led the market in 2024, accounting for the largest share of 49%.

- North America is expected to register the fastest growth during the forecast period, while Europe remains a key contributor to the global market.

- Based on propulsion type, Battery Electric Vehicles (BEVs) held the largest market share in 2024.

- Fuel Cell Electric Vehicles (FCEVs) are forecasted to grow significantly in the coming years.

- In terms of vehicle type, passenger cars dominated the market in 2024, whereas trucks are expected to experience substantial growth over the forecast period.

- Looking at drive type, Front-wheel Drive (FWD) vehicles captured a notable share in 2024, while All-wheel Drive (AWD) vehicles are anticipated to gain traction moving forward.

- By vehicle speed, the 100MPH to 125MPH segment led the market in 2024, while the less than 100MPH category is projected to grow rapidly.

- Among vehicle classes, low-price electric vehicles held the largest share in 2024. The mid-price segment is expected to grow at a moderate pace.

- In terms of end use, the personal use segment dominated the market in 2024, whereas the commercial use segment is set to expand significantly during the forecast period.

Regional Outlook of the Electric Vehicle Market

Asia Pacific

China remains the undisputed leader in the global EV market. In 2024, nearly half of all new car sales in China were electric, accounting for almost two-thirds of global electric car sales. The country saw a 40% year-on-year increase in EV sales, driven by government incentives, such as trade-in schemes offering substantial financial support for buyers replacing older vehicles with new EVs. The price competitiveness of battery electric vehicles (BEVs) compared to conventional cars has also played a crucial role. Plug-in hybrid electric vehicles (PHEVs) are gaining ground, with their share of the market rising to nearly 30% in 2024, while BEVs still saw a sevenfold increase in sales since 2020. Chinese automakers are also expanding abroad, with significant manufacturing announcements in Brazil, Thailand, Indonesia, and Malaysia, often in response to changing import tariffs.

India‘s EV market is expanding, though its share remains modest at around 2% of new car sales in 2024. The market is dominated by domestic OEMs like Tata, with new joint ventures and local manufacturing efforts underway. Policy support and affordable models are key drivers, but growth is still gradual compared to China.

Tata Motors – Accelerating EV Adoption in India (2022–2024)

Background

Tata Motors emerged as a dominant force in the Indian EV market between 2022 and 2024, capturing over 70% of the market share in electric passenger vehicles by mid-2023. This growth was primarily driven by its affordable, urban-focused EVs like the Tata Nexon EV, Tigor EV, and later the Tiago EV.

Key Developments

- 2022: Tata Motors sold ~30,000 EVs, doubling its volume from 2021. The Nexon EV remained the best-selling electric SUV.

- 2023: The launch of Tiago EV India’s most affordable electric hatchback (~₹8.5 lakh) was a turning point, attracting mass-market buyers.

- 2024: Tata expanded its EV portfolio with EV-specific platforms (Gen 2 and Gen 3) and invested in localized battery and motor production to reduce costs.

Strategic Partnerships

- Partnered with Tata Power to install 10,000+ EV charging stations.

- Collaborated with Tata Chemicals and Tata AutoComp for battery and component localization.

Impact

- Boosted India’s EV penetration in passenger vehicles from 1.8% (2022) to ~6% (2024).

- Strengthened India’s EV ecosystem by developing infrastructure, financing options, and service networks.

Thailand is Southeast Asia’s largest EV market, with a 13% sales share in 2024, despite a slight decline in absolute sales due to stricter lending criteria. Chinese imports dominate, but new policies are pushing for domestic production.

Indonesia saw EV sales triple in 2024, reaching over 7% market share, thanks to significant tax reductions and incentives for local manufacturing. Chinese and European brands are benefiting from these policies.

Vietnam and Malaysia are also notable, with Vietnam’s local brand VinFast nearly doubling its domestic sales share to 17% and expanding internationally, while Malaysia more than doubled its EV sales in 2024.

Europe saw a stabilization in EV sales in 2024, with about one in five new cars sold being electric. While some countries, like Norway, continue to lead in EV adoption, major markets such as Germany and France experienced stagnation or decline due to the phasing out or reduction of subsidies. Nonetheless, 14 out of 27 EU member states increased their EV sales share, and local brands and incentives continue to drive growth in smaller or emerging European markets. Turkey, for example, increased its domestic EV production by 50% and reached a 10% sales share in 2024, supported by a substantial government investment package.

United States and North America are also seeing robust growth, with the US EV market share expected to surpass 11% in 2024.

This growth is underpinned by competition among manufacturers, falling battery and car prices, and ongoing policy support. Investments in charging infrastructure and incentives are helping to accelerate adoption, particularly in states like California.

Latin America is showing impressive growth, with sales volumes and penetration rates doubling in many countries. Brazil leads with nearly 125,000 EV sales in 2024, a 6.5% market share, largely due to tax exemptions and the influx of affordable Chinese imports. Costa Rica, Uruguay, and Colombia have also achieved high sales shares, driven by government incentives and high fossil fuel prices.

Africa is at an earlier stage, but EV sales more than doubled to nearly 11,000 in 2024. While the overall market share remains below 1%, countries like Morocco and Egypt are seeing notable increases, supported by local incentives and growing availability of affordable models.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 988.70 Billion |

| Market Size by 2034 | USD 2,529.10 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Propulsion Type, Components, Vehicle Type, Vehicle Class, Top Speed, Vehicle Drive, EV Charging Point Type, V2G, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segmental Insights of Electric Vehicle Market

By Propulsion Type, battery electric vehicles (BEVs) dominated the global market in 2024, accounting for over 67% of revenue. Their popularity is driven by environmental benefits, such as reduced greenhouse gas emissions and local pollutants. Plug-in hybrid electric vehicles (PHEVs) are expected to see the fastest growth rate, thanks to their extended driving range and flexibility, as they combine electric power with conventional fuel. Fuel cell electric vehicles (FCEVs) are also gaining traction due to fast refueling and low emissions, especially as governments invest in advancing fuel cell technology.

By Vehicle Type, passenger cars hold the largest market share, supported by rising demand for affordable and compact EVs, government incentives, and growing environmental awareness. The trucks segment is projected to grow rapidly, as logistics and transportation industries seek sustainable solutions, particularly for urban delivery and heavy-duty applications.

By Drive System, front-wheel drive (FWD) EVs are most popular due to their cost-effectiveness and design flexibility, making them suitable for urban environments. All-wheel drive (AWD) EVs are expected to grow significantly, as they offer enhanced safety and performance, appealing to consumers seeking advanced driving features.

By Speed, the 100MPH-125MPH segment led the market in 2024, reflecting demand for practical, high-performance EVs suitable for both city and highway driving. However, the less than 100 MPH segment is set to lead future growth, especially in countries like India, where two- and three-wheelers are widely adopted for urban transportation.

By Price, low-price electric vehicles generated the largest market share in 2024, as consumers increasingly seek affordable options. Government incentives and rising sustainability awareness are further fueling demand for budget-friendly EVs.

Discussion about this post