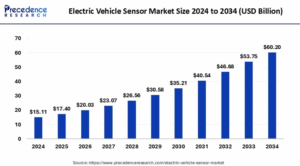

According to Precedence Research, the global electric vehicle sensor market size is evaluated at USD 15.11 billion in 2024 and is projected to attain around USD 60.20 billion by 2034 with a CAGR of 14.82%.

Electric Vehicle Sensor Key Points

- In 2024, Asia Pacific held the largest share of the electric vehicle sensor market.

- Europe is expected to witness substantial growth throughout the forecast period.

- Among product types, temperature sensors accounted for the largest market share in 2024.

- Based on propulsion type, battery electric vehicles led the market with the highest share in 2024.

What Is Driving the Growth of the Electric Vehicle Sensor Market?

The electric vehicle (EV) sensor market is experiencing substantial growth due to the global shift towards cleaner and more sustainable transportation. As electric vehicles become increasingly mainstream, the demand for advanced sensors that monitor and control various vehicle functions is rising rapidly. These sensors are crucial for enhancing vehicle performance, safety, battery efficiency, and autonomous driving capabilities. Government incentives, technological advancements, and rising consumer awareness about environmental issues are all playing key roles in boosting sensor integration in EVs.

Which Region Dominated the Market in 2024?

In 2024, Asia Pacific emerged as the leading region in the electric vehicle sensor market. The dominance is attributed to the presence of major EV manufacturers in countries like China, Japan, and South Korea, coupled with favorable government policies supporting electric mobility. The region’s strong manufacturing infrastructure and growing investments in EV technologies have also propelled demand for EV sensors. Additionally, rising vehicle production and adoption of smart mobility solutions have reinforced the region’s market leadership.

Europe is projected to witness significant growth during the forecast period. The region is strongly committed to achieving net-zero emissions and is actively promoting electric vehicle adoption through subsidies, regulations, and infrastructure development. Countries like Germany, France, and the UK are investing heavily in EV technology, which in turn is driving demand for advanced sensor solutions that comply with strict emission and safety standards.

How is AI Transforming the Electric Vehicle Sensor Market?

Artificial Intelligence (AI) is playing a transformative role in enhancing the efficiency and intelligence of electric vehicle (EV) sensors. AI algorithms are increasingly being integrated with sensor systems to enable real-time data analysis, predictive maintenance, and autonomous decision-making. These AI-powered systems allow sensors to not only collect data but also interpret it, leading to smarter vehicle operations, improved safety, and optimized battery and energy management.

AI enhances sensor accuracy, adaptability, and responsiveness by enabling advanced functions such as pattern recognition, anomaly detection, and machine learning-based diagnostics. This integration allows EVs to better predict component failures, adapt to changing driving conditions, and improve energy efficiency. As autonomous and semi-autonomous EVs gain traction, AI-driven sensor systems will become even more critical in supporting vehicle navigation, obstacle detection, and advanced driver-assistance systems (ADAS).

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 60.20 Billion |

| Market Size in 2025 | USD 17.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.82% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Propulsion, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Roles of Leading Companies in the Electric Vehicle Sensor Market

Melexis

- Specializes in advanced semiconductor and sensor solutions for automotive applications, with a focus on electric vehicles (EVs).

- Develops sensors for EV powertrains, battery management systems (BMS), and safety systems.

- Known for MEMS pressure sensors, Hall-effect sensors, and magnetic sensors, essential for current, position, and thermal management in EVs.

Continental AG

- Offers a comprehensive sensor portfolio for EVs, including high-voltage current sensor modules, battery impact detection systems, and motor position sensors.

- Developed the e-Motor Rotor Temperature Sensor and high-speed inductive Rotor Position Sensor, improving motor efficiency and battery safety.

- Focuses on solutions that protect EV batteries, optimize powertrain performance, and support advanced driver-assistance systems (ADAS).

NXP Semiconductors

- Provides a wide range of automotive sensors, such as accelerometers, pressure sensors, temperature sensors, and angular/speed sensors.

- Supplies integrated solutions for battery management systems, traction inverters, and EV charging infrastructure.

- Known for scalable, secure, and connected sensor platforms supporting both traditional and electric vehicle architectures.

Valeo

- Global leader in electrification, with expertise in thermal management and powertrain sensors.

- Manufactures sensors for battery thermal runaway detection, ADAS, and powertrain electrification.

- Supplies innovative lidar systems and sensor-based solutions for autonomous and electric vehicles.

Robert Bosch

- Leading supplier of MEMS sensors and automotive sensor technology.

- Develops a broad spectrum of sensors for EVs, including those for battery monitoring, position, speed, and environmental detection.

- Plays a pivotal role in advancing automated, electrified, and connected vehicle technologies.

Venture Capital GmbH

- Functions primarily as an investor, providing funding to startups and technology companies in the automotive sensor sector.

- Drives innovation by supporting early-stage companies developing next-generation sensor technologies for electric and autonomous vehicles.

Denso Corporation

- Supplies advanced sensors for EVs, including current sensors, temperature sensors, and battery-monitoring ICs.

- Partners with major automakers to deliver high-precision sensors for powertrain management, battery safety, and energy optimization.

- Focuses on enhancing EV efficiency, range, and safety through sensor innovation.

Renesas Electronics

- Provides scalable, integrated sensor and semiconductor solutions for EV powertrains, battery management, and charging systems.

- Offers microcontrollers, analog, and power devices, as well as solutions for motor control, inverters, and charging infrastructure.

- Develops embedded processor solutions for ADAS and autonomous driving.

Panasonic

- Supplies a broad range of automotive sensors, including inertial, temperature, and environmental sensors for EVs.

- Focuses on vehicle safety, electrification, and integrated cockpit solutions.

- Develops sensors and modules supporting both passenger and commercial electric vehicles.

Sensata Technologies Inc.

- Major supplier of sensors for current, pressure, position, and temperature monitoring in EVs.

- Provides solutions supporting battery management, motor control, and safety systems, contributing to EV reliability and efficiency.

Amphenol Advanced Sensors

- Specializes in advanced sensor technologies for temperature, pressure, and gas detection in EVs.

- Supplies sensors used in battery management, thermal management, and environmental monitoring, supporting safe and efficient EV operation.

Segmental Insights of Electric Vehicle Sensor Market

Product Type Segment

The electric vehicle (EV) sensor market is segmented mainly by sensor type. Temperature sensors hold the largest market share as of 2024. These sensors are essential for monitoring and managing the internal temperature of EVs, which is crucial for safety and performance. They are widely used in battery management, climate control, motor cooling, and power electronics. Position sensors also have a significant share, supporting functions like drive system control, electric power steering, regenerative braking, and autonomous driving features.

Motion sensors are experiencing rapid growth, mainly due to the increasing integration of IoT technologies that enable real-time vehicle monitoring and predictive maintenance.

Propulsion Segment

By propulsion type, battery electric vehicles (BEVs) are the leading consumers of sensors. BEVs rely heavily on sensors for battery monitoring, pressure and temperature control, and overall vehicle safety. The shift towards zero-emission vehicles and sustainable mobility solutions is driving this segment’s dominance.

Vehicle Type Segment

The passenger car segment dominates the EV sensor market due to high production volumes and the rapid electrification of new passenger models. Investments in electrification and growing consumer demand for advanced features like autonomous driving and enhanced safety systems are increasing the need for sophisticated sensors in passenger vehicles. Commercial vehicles are also contributing to market growth, especially in regions adopting electric fleets for logistics and public transport.