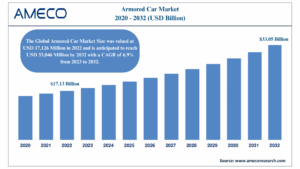

Ameco Research projects the global armored car market to experience steady growth till 2032 amid rising geopolitical tensions, increasing crime rates, and growing demand for secure transportation across military, commercial, and civilian domains. The global armored car market was valued at USD 17.13 billion in 2022 and projected to reach USD 33.05 billion by 2032, growing at a compound annual growth rate (CAGR) of 6.9% between 2023 and 2032.

What is Driving the Armored Car Market Growth?

An armored car, also referred to as an armored vehicle, is specifically designed to protect personnel and valuables from hostile threats such as ballistic attacks, explosions, and forced intrusions. These vehicles are built using bulletproof glass, reinforced steel plating, blast-resistant floors, and high-end surveillance and countermeasure systems.

Increasing instability in several regions, high-profile terror threats, and organized crime have elevated the need for such protection. From transporting military personnel in conflict zones to safeguarding cash-in-transit services and VIP movements, the armored car market is becoming integral to global security infrastructure.

The modern armored car market encompasses a wide variety of vehicles ranging from military-grade transport vehicles to civilian SUVs retrofitted with armor, catering to diverse applications such as government defense, private security, law enforcement, and banking logistics. Ongoing technological advancements in lightweight armor materials, blast mitigation systems, and autonomous defense capabilities are expected to shape the future growth trajectory of the market.

Key Market Drivers

1. Rising Demand for Military and Defense Applications

Government defense budgets are consistently increasing across North America, Europe, Asia-Pacific, and the Middle East, where defense modernization programs are in full swing. The demand for light tactical armored vehicles, infantry mobility platforms, and mine-resistant ambush protected (MRAP) vehicles is rising sharply.

2. Increasing Security Threats to High-Value Targets

With growing threats to VIPs, diplomats, executives, and celebrities, the use of civilian armored cars has surged. Luxury armored SUVs and sedans are now widely used by private security firms and high-net-worth individuals.

3. Growth in Banking and Cash-in-Transit Industry

The financial services sector remains a major consumer of armored transport. Armored cars are critical for moving large sums of cash and assets between banks, ATMs, and financial institutions.

4. Technological Advancements in Armor Materials

The evolution of lightweight composite materials, modular armor systems, and AI-powered surveillance is driving innovation. These technologies enhance vehicle protection while maintaining mobility and fuel efficiency.

Segmentation Overview

By Vehicle Type

- Light Commercial Vehicles (LCVs) – Often used for cash-in-transit and executive protection

- Medium/Heavy Commercial Vehicles – Used in military logistics and defense transport

- SUVs and Sedans – Gaining popularity in VIP transport and private security

By Application

- Military & Defense – Largest share, with extensive procurement across NATO countries and Asian defense forces

- Banking & Financial Services – One of the oldest and most reliable consumers of armored cars

- Law Enforcement – SWAT, riot control, and patrol units are deploying modern armored solutions

- Personal Security – Increasingly popular among politicians, celebrities, and corporate executives

Regional Insights: Asia-Pacific Leads, North America Follows

Asia-Pacific

The Asia-Pacific armored car market is projected to witness the fastest growth, driven by border tensions, terrorism, and internal security challenges in countries such as India, China, Pakistan, and Southeast Asian nations. The rise of indigenous defense manufacturing under initiatives like “Make in India” and China’s aggressive defense spending continue to boost market expansion.

North America

The U.S. continues to be a major contributor, supported by substantial military spending and federal investments in homeland security. Additionally, a well-established private security industry contributes significantly to civilian armored vehicle sales.

Europe

Countries like Germany, France, and the UK are ramping up their defense budgets amid growing threats from Eastern Europe and rising terrorist activities. The European armored car market is being driven by both military procurement and civilian adoption.

Middle East & Africa

This region is witnessing increasing demand due to ongoing conflict zones and unstable political environments. Nations such as Saudi Arabia, UAE, and Israel are leading consumers of high-end armored transport solutions.

Competitive Landscape: Leading Players and Strategic Moves

The armored car market is moderately consolidated, with a mix of global defense contractors, specialty vehicle manufacturers, and luxury vehicle armorers competing for market share.

Key Market Players Include:

- BAE Systems

- INKAS Armored Vehicle Manufacturing

- Oshkosh Corporation

- Streit Group

- Elbit Systems

- General Dynamics

- Plasan

- Textron Inc.

These companies are investing heavily in next-generation technologies, including electric armored vehicles, drone countermeasure integration, and AI-powered surveillance and threat detection systems.

Recent Developments

- BAE Systems introduced lightweight armor kits compatible with electric military vehicles.

- INKAS launched an armored electric SUV aimed at the civilian market.

- Streit Group expanded its manufacturing footprint in the UAE to meet growing regional demand.

- General Dynamics secured major contracts from the U.S. military for advanced troop carriers and armored logistics vehicles.

Emerging Technologies and Market Trends

- Electric Armored Vehicles (EAVs): The shift toward sustainable defense technologies is pushing manufacturers to develop hybrid and fully electric armored vehicles, especially for urban law enforcement and VIP transport.

- Active Protection Systems (APS): Armored cars are increasingly equipped with APS to intercept and neutralize threats like RPGs and guided missiles before impact.

- AI & IoT Integration: Vehicle telemetry, predictive maintenance, facial recognition, and real-time threat alerts powered by artificial intelligence are becoming standard in premium armored car offerings.

- Modular Armoring Systems: To address diverse customer needs, manufacturers now offer modular kits that can be adapted based on the threat level and application—allowing for faster customization and deployment.

Challenges in the Market

Despite strong growth prospects, the armored car market faces several challenges:

- High initial investment and maintenance costs

- Complex export regulations and government approval processes

- Weight-performance trade-offs in advanced armor materials

However, increased funding, public-private partnerships, and innovation in material science are helping overcome these barriers.

Armored Car Market Positioned for Long-Term Growth

As global security concerns escalate, the armored car market is expected to see sustained demand across both government and civilian sectors. With technological innovations paving the way for smarter, lighter, and more secure vehicles, manufacturers are well-positioned to capitalize on a growing need for protection in an increasingly unpredictable world.

Between 2023 and 2032, the market will be shaped by:

- Government defense procurement

- Civil unrest and terrorism threats

- VIP and asset protection demand

- Breakthroughs in armor material and AI integration

Companies that invest in innovation, regulatory compliance, and region-specific product strategies will lead the next wave of growth in the global armored car market.

Discussion about this post