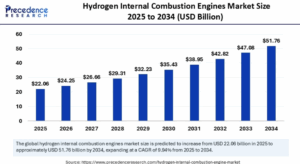

The Hydrogen Internal Combustion Engine (H2-ICE) Market is accelerating into a new era of clean mobility. As of 2024, the market is valued at USD 20.06 billion, with projections indicating growth to USD 22.06 billion in 2025 and a further surge to USD 51.76 billion by 2034, reflecting a strong compound annual growth rate (CAGR) of 9.94%. This expansion is powered by the global push for transportation decarbonization, with H2-ICE emerging as a strategic alternative to battery electric vehicles (BEVs) and fuel cell vehicles (FCVs). While BEVs lead in efficiency and FCVs boast zero-emission elegance, H2-ICE offers the comfort of familiarity, retaining the essence of the internal combustion engine while eliminating carbon emissions. However, challenges like limited hydrogen infrastructure and NOx emissions remain barriers to broader adoption.

What Makes Hydrogen Engines Different From the ICEs We Know?

At its core, an H2-ICE functions like a traditional internal combustion engine, but with a clean twist. Instead of diesel or gasoline, it burns hydrogen gas using spark ignition. Hydrogen is mixed with air, compressed, and ignited to create power, with water vapor as the primary emission. Two main types exist: port-injected engines, which are simpler but less efficient, and direct-injected engines, which offer better combustion control and power density. This combustion-based design differentiates H2-ICE from fuel cells, which convert hydrogen into electricity chemically, and from BEVs, which store electricity in lithium-ion batteries. While H2-ICEs aren’t as efficient as FCVs or BEVs, their lower costs and compatibility with existing ICE platforms make them ideal for hard-to-electrify sectors.

Why Hydrogen Engines Matter Right Now

A confluence of forces is propelling H2-ICE into the spotlight. First, global climate targets are tightening, governments demand cleaner transport, especially in sectors where electrification isn’t practical. Heavy-duty vehicles, mining equipment, and off-highway machines need power and endurance that batteries often can’t deliver. H2-ICE fills this niche with quick refueling times and reliable performance, especially in remote or rugged environments. Furthermore, because these engines are based on existing ICE designs, manufacturers can leverage current supply chains and workforce expertise, reducing transition costs and timelines.

A Global Engine: How Regions Are Steering the Hydrogen Shift

Europe led the global H2-ICE market in 2024, commanding a dominant share of 41%, driven by aggressive decarbonization policies, investment in hydrogen infrastructure, and strategic initiatives such as the EU Hydrogen Strategy and REPowerEU. Germany, the UK, and the Netherlands are spearheading pilot deployments, retrofit programs, and dedicated hydrogen refueling corridors for commercial and long-haul vehicles.

In North America, the momentum is building through U.S. Department of Energy initiatives like Hydrogen Hubs, and significant R&D efforts by companies like Cummins, which are laying the groundwork for hydrogen adoption in logistics and freight. California continues to be a testing ground for zero-emission commercial fleets, with hydrogen infrastructure expanding alongside EV charging networks.

Asia-Pacific remains a powerhouse of innovation. Japan and South Korea are heavily invested in national hydrogen roadmaps and are testing H2-ICE in buses, trucks, and construction vehicles. China, with its centralized planning and massive industrial capacity, is eyeing large-scale deployment in mining, port logistics, and public transportation, backed by strong government subsidies and regional pilot programs.

Hydrogen Internal Combustion Engines Market Coverage

| Report Attribute | Key Statistics |

| Market Size by 2034 | USD 51.76 Billion |

| Market Size in 2025 | USD 22.06 Billion |

| Market Size in 2024 | USD 20.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.94% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Power Output, Vehicle Type, Fuel Type, Ignition Type, End Use Industry, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Hydrogen Internal Combustion Engines Market Key Players

- Cummins Inc.

- Rolls-Royce plc (MTU Engines)

- Toyota Motor Corporation

- MAN Truck & Bus (Volkswagen Group)

- Deutz AG

- Yamaha Motor Co., Ltd.

- Caterpillar Inc.

- JCB

- Hyundai Motor Company

- Punch Hydrocells (Belgium)

Opportunities Are Boiling Over in the Hydrogen Engine Space

If governments and industries play their cards right, the opportunity landscape for H2-ICE is vast. Global policies like the EU Green Deal, U.S. Inflation Reduction Act, and Japan’s Hydrogen Strategy are injecting billions into hydrogen ecosystems. Retrofitting diesel engines with hydrogen-compatible technology presents a near-term path for carbon reduction in legacy fleets. Additionally, sectors like rail transport, marine shipping, and underground mining are eager for clean combustion solutions that don’t rely on fragile battery supply chains. And as green and blue hydrogen production ramps up, fuel costs are expected to drop, improving the economic case for H2-ICE.

Tech Giants Are Getting Their Hands Dirty – In the Best Way

Innovation in H2-ICE is thriving, with global players pushing boundaries. Toyota has developed hydrogen-powered race cars and is exploring commercial applications. JCB, a construction equipment giant, is already field-testing hydrogen backhoes and excavators. Cummins is working on a “fuel-agnostic engine platform”, aiming to serve hydrogen, natural gas, and conventional fuels with modular components. Technological breakthroughs include advanced direct injection systems, dual-fuel capabilities, turbocharging for higher power outputs, exhaust gas recirculation (EGR) for NOx control, and water injection to cool combustion chambers and reduce harmful emissions. These innovations are critical to enhancing performance while minimizing the ecological footprint.

No Hydrogen Without Highways: Infrastructure Remains the Bottleneck

The H2-ICE market is only as strong as its fuel supply, and hydrogen infrastructure is still catching up. Today’s hydrogen comes in different shades: green hydrogen (from renewables via electrolysis), blue hydrogen (from natural gas with carbon capture), grey hydrogen (from fossil fuels), and pink hydrogen (from nuclear energy). While green hydrogen is the ultimate goal, its high cost and limited supply delay mass deployment. Storage and distribution also pose technical hurdles, compressed gas at high pressures, liquid hydrogen at cryogenic temperatures, and cryo-compressed options are all in play, each with trade-offs. Without widespread, affordable refueling stations, fleet operators and OEMs will struggle to scale deployments, especially across regions with poor hydrogen access.

Regulators Are Watching, And They’re Getting Serious

Regulatory frameworks worldwide are aligning to support hydrogen adoption. The European Union’s CO₂ targets and Euro 7 standards push OEMs toward low-emission technologies, including H2-ICE. The U.S. EPA and California Air Resources Board (CARB) back zero-emission mandates and fund pilot programs through infrastructure bills. Japan and South Korea, long-time leaders in hydrogen policy, have set ambitious goals for vehicle deployment and hydrogen production. For H2-ICE manufacturers, aligning with these evolving standards is not just strategic, it’s essential for securing funding, compliance, and market access.

Breaking Down the Tech Battle: How Does H2-ICE Stack Up?

When you compare hydrogen engines, fuel cells, and batteries, a few themes emerge. H2-ICE offers moderate costs, fast refueling, and high durability. FCVs win on efficiency and zero emissions, while BEVs dominate in urban mobility thanks to superior energy efficiency and maturing infrastructure. H2-ICEs shine in retrofitting existing platforms and heavy-duty applications, especially where uptime is critical. Each technology has its lane,and hydrogen combustion carves out a unique, necessary path.

From Trucks to Tugboats – Where H2-ICE Is Finding a Home

Market segmentation reveals a broad horizon for H2-ICE. In terms of power output, engines under 100 kW serve small vehicles and forklifts, while those over 300 kW power mining haulers, long-haul trucks, and marine vessels. Commercial fleets, including delivery vans and buses, represent a major growth area, alongside off-highway equipment in agriculture and construction. As hydrogen production matures, green and blue hydrogen will become the fuel of choice. On the tech front, spark ignition systems dominate now, but dual-fuel configurations offer a flexible bridge for legacy diesel fleets. End-use industries range from logistics and mining to public transit and defense, anywhere reliable, clean combustion is needed.

What We Still Don’t Know Could Shape the Future

Despite progress, several knowledge gaps persist. Real-world test data is limited, especially in variable climates and load conditions. Efficiency is improving but still lags behind FCVs and BEVs, particularly in urban stop-start cycles. Durability of components, especially in high-pressure hydrogen environments, remains under scrutiny. Most importantly, NOx emissions must be controlled without compromising performance, an engineering challenge that still needs refinement.