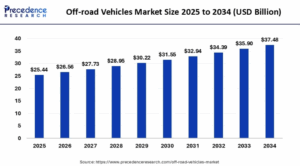

The global off-road vehicles market size reached USD 24.37 billion in 2024, and is projected to hit around USD 37.48 billion by 2034, growing at a CAGR of 4.40% from 2025 to 2034. . This growth is driven by strong consumer demand in developed markets like North America and Europe, combined with industrial and agricultural uptake in emerging economies across Asia Pacific and Latin America. North America, with its recreational vehicle culture and robust defense spending, currently holds the largest market share. However, the Asia Pacific region is anticipated to exhibit the highest growth rate due to increasing mechanization of agriculture, infrastructure expansion, and favorable policy support. The long-term forecast suggests significant gains for manufacturers that invest in electrification, automation, and sustainable designs.

What Are Off-road Vehicles and Why Are They Booming?

Off-road vehicles (ORVs) are built to operate on rugged, unpaved terrain such as sand, gravel, rocks, snow, or mud. Unlike standard road vehicles, these machines feature enhanced suspension systems, all-terrain tires, skid plates, and reinforced frames. They are designed to tackle difficult terrains where regular vehicles would fail.

These vehicles range from recreational machines like ATVs (All-terrain Vehicles) and dirt bikes to highly functional utility units like UTVs (Utility Task Vehicles), 4x4s, snowmobiles, dune buggies, and even tracked vehicles used in mining or military operations. With growing interest in outdoor adventure, eco-tourism, military modernization, and smart agriculture, the ORV market is witnessing explosive growth.

What’s Driving the Global Off-road Vehicle Market?

- Adventure Tourism & Outdoor Recreation: Millennials and Gen Z are increasingly opting for off-grid experiences, driving demand for ATVs and dirt bikes in destinations like Canada, Australia, and the U.S.

- Defense & Military Applications: Countries are investing in ORVs for reconnaissance, rapid deployment, and patrolling across rough terrains.

- Smart Agriculture & Forestry: ORVs are proving essential in farms, plantations, and forests where heavy equipment cannot operate.

- Construction & Mining Use Cases: Rugged terrains in resource extraction zones make ORVs indispensable.

- Technological Advancements: Integration of AI, telematics, GPS, and electrification has redefined the capabilities of ORVs.

Are Electric Off-road Vehicles a Game Changer?

Electric off-road vehicles (E-ORVs) are gaining serious traction across both commercial and recreational segments. These battery-powered alternatives offer numerous benefits: quieter operation, zero emissions, lower maintenance, and eligibility for green subsidies. As emission standards tighten and noise restrictions are enforced in environmentally sensitive zones, electric ORVs are becoming a logical choice. Companies like Polaris, Tesla, and Volcon have introduced electric ATVs, UTVs, and off-road trucks that rival or even surpass traditional models in performance. Moreover, battery technology has improved significantly, delivering longer range and better durability in harsh conditions. The shift toward electrification is no longer a question of “if,” but “when.”

What Technologies Are Transforming the ORV Industry?

Technology is at the heart of the modern ORV transformation. Advanced telematics and GPS allow real-time location tracking, route optimization, and preventive maintenance alerts, features highly valued in fleet management. Terrain-adaptive suspension systems enhance ride quality and vehicle control, especially over rocks, snow, or marshlands. ADAS (Advanced Driver Assistance Systems) like rollover protection, collision avoidance, and dynamic traction control are being incorporated to boost safety. AI-powered off-road autonomy is being piloted in sectors like agriculture and mining, where vehicles can operate with minimal human input. On the materials side, carbon fiber, aluminum alloys, and composite plastics are being used to make vehicles lighter and more efficient.

Why North America Dominates the Off-road Vehicles Market

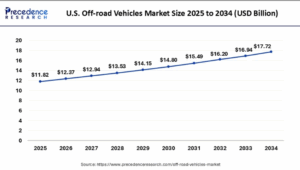

U.S. Off-road Vehicles Market Size

The U.S. off-road vehicles market size was USD 11.3 billion in 2024 and is expected to expand around USD 17.72 billion by 2034, at a CAGR of 4.6%.

Rich Off-roading and Recreational Culture

North America, especially the United States and Canada, has long embraced off-roading as a popular recreational activity. This deep-rooted culture is supported by a vast natural landscape that includes deserts, forests, mountains, and snow-covered trails, making it ideal for off-road adventures. In the U.S. alone, there are over 1,200 dedicated off-road parks and trails, with extensive networks in states like Utah, Colorado, and California. The region hosts high-profile off-road events such as the Baja 1000, King of the Hammers, and GNCC Racing, drawing global participants and spectators. This strong recreational base translates directly into high consumer demand for ATVs, UTVs, dirt bikes, and snowmobiles.

Utility-driven Demand in Agriculture and Forestry

Apart from recreational use, off-road vehicles in North America play a crucial role in agriculture, forestry, and rural utility operations. Farmers and ranchers frequently use UTVs (Utility Task Vehicles) and ATVs (All-Terrain Vehicles) for fence inspections, crop monitoring, livestock herding, and transporting supplies across rugged terrain. In the U.S. Midwest and Canada’s prairie provinces, ORVs are indispensable tools on farmlands and forests. According to estimates, millions of UTVs are actively used across North American farms for daily operations, with some states even offering insurance and tax benefits for ORVs used in agriculture.

Massive Military and Defense Procurement

The defense sector is a major consumer of ORVs in North America. The U.S. Department of Defense, with an annual budget exceeding $850 billion, regularly contracts with manufacturers for light tactical ORVs, quad bikes, and special operations vehicles. These are used for quick deployments, patrolling remote areas, and transporting equipment in difficult terrains. Key players such as Polaris Government & Defense and General Dynamics supply military-grade UTVs with ruggedized features, adding substantial volume to the market. This institutional demand significantly boosts domestic manufacturing and R&D investments in the sector.

Strong Government Support and Funding Initiatives

The U.S. and Canadian governments actively support ORV-related infrastructure and regulations. One notable initiative is the Recreational Trails Program (RTP) in the U.S., which allocates federal gas tax revenues to fund the development and maintenance of ORV trails. Since its inception, RTP has funded thousands of miles of multi-use and motorized vehicle trails. Additionally, states like Arizona, Utah, and Oregon provide grants for off-road vehicle clubs and organizations to maintain trail networks. ORV registration programs in these states also contribute funds for safety awareness and environmental stewardship, making the market more sustainable.

Off-road Vehicles Market Segments

What Are the Different Types of Off-Road Vehicles?

The Off-road Vehicle Market is categorized into several product types, each engineered to handle rugged terrains and unconventional driving conditions. All-Terrain Vehicles (ATVs) are among the most popular, designed for solo or dual riders and equipped with low-pressure tires for enhanced traction across rough landscapes. Utility Terrain Vehicles (UTVs), also known as side-by-sides, offer greater load-carrying capacity and are often used in agriculture, construction, and search-and-rescue missions. Their ability to carry multiple passengers and gear makes them ideal for both commercial and recreational purposes. Snowmobiles are specialized vehicles that traverse snow-covered terrains using a ski and track system. These are vital in snow-prone regions for both transportation and winter sports. Lastly, Three-Wheelers, though less common in modern off-road markets, are still used in niche applications for maneuverability in tight or uneven spaces. Each type brings unique strengths tailored to specific geographic and usage demands.

Where Are Off-Road Vehicles Commonly Used?

Off-road vehicles serve multiple applications, each driven by different end-user needs. In the utility segment, they’re extensively used in farming, forestry, mining, and other industrial sectors for their durability and ability to navigate challenging landscapes. The sports application has seen growing traction with ATVs and UTVs designed for competitive racing and trail riding, which is popular among off-road enthusiasts. Recreational use is another significant segment, as more consumers engage in adventure tourism and outdoor activities like camping, hunting, and trail exploration. Lastly, the military segment is adopting off-road vehicles for transporting personnel, equipment, and surveillance systems across challenging terrains, particularly in border patrol and reconnaissance operations. The multi-purpose nature of these vehicles highlights their versatility across both commercial and personal domains.

What Propulsion Types Are Powering Off-Road Vehicles?

The Off-road Vehicle Market is also segmented based on propulsion type, with traditional fuels still dominating but newer alternatives emerging. Gasoline-powered vehicles remain the most common due to their high availability, performance efficiency, and mature infrastructure. These are widely used in recreational and utility applications. Diesel-powered off-road vehicles are preferred in industrial and military contexts where high torque and fuel efficiency are essential. However, the growing focus on sustainability is driving interest in electric off-road vehicles, which offer a quieter ride, zero emissions, and lower maintenance costs. Electric models are increasingly gaining traction, particularly among eco-conscious consumers and in regions implementing stricter emission norms. As battery technology and charging infrastructure improve, this segment is poised for significant growth in the coming years.

Who Are the Major Players in the Off-road Vehicle Market?

- Arctic Cat Inc. (Textron Inc.)

- ARGO

- BRP

- Deere & Company

- Electra Meccanica

- Harley-Davison, Inc.

- Honda Motor Co., Ltd.

- SSR Motorsports

- Taiga Motors Inc.

- Yamaha Motor Co., Ltd.

What Challenges Does the Off-road Vehicle Market Face?

Despite its strong growth, the ORV market is not without challenges. Safety is a major concern, particularly among younger or inexperienced riders. Accidents resulting in injury or fatality remain a critical issue for regulators and manufacturers. Environmental degradation, such as soil erosion, noise pollution, and disruption to wildlife—is another pressing issue, leading to tighter land access regulations. Seasonal variability also limits ORV usage in some regions, affecting rental and sales cycles. Furthermore, the high cost of electric ORVs and advanced features puts them out of reach for price-sensitive consumers in developing countries. Lastly, compliance with a patchwork of global and regional regulations adds complexity to manufacturing and distribution.

What Opportunities Lie Ahead for Stakeholders?

The future of the off-road vehicle market is bursting with opportunities for both existing players and new entrants. Adventure tourism continues to gain traction, opening doors for ORV rentals, guided tours, and off-road resorts. Electric ORVs are expected to penetrate even deeper into commercial sectors, especially agriculture, where noise-free and emission-free operation is beneficial. Subscription and pay-per-use models are emerging, enabling wider access without heavy upfront investment. The integration of artificial intelligence, drone support, and 5G communication will usher in an era of autonomous off-road operations in remote industrial settings. Companies that align with sustainability, automation, and localized innovation will be the ones to watch.

Discussion about this post