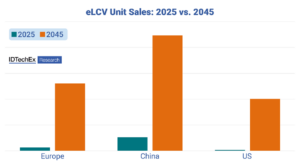

Government regulation has been key to the electrification of light commercial vehicles (LCVs) to date. It has led to electric LCVs (eLCVs) making up over 5% of annual sales. IDTechEx’s new report, “Electric Light Commercial Vehicles 2025-2045: Markets, Players, Forecasts”, expects this trend to continue – with regulation being a key driver for eLCV market growth in the short- and medium-term future. IDTechEx forecasts that eLCVs will constitute the bulk of the market and total over 11 million units by 2045.

As governments stretch to meet their Paris Agreement goals and other sustainability targets, global demand for light-duty road freight is set to more than double between 2020 and 2050. A growing global population, rising income levels, and a booming e-commerce industry all factor into this increase in demand. As such, there is an imminent need for zero-emission logistics solutions to be rolled out quickly. While an eLCV is still more expensive than a diesel variant and thus less desirable for end-users, governments have responded by passing a whole host of measures to foster eLCV adoption.

Common regulations applied for this purpose include purchase grants/subsidies, local restrictions on emitting vehicles entering designated areas, as well as mandating outright bans on the sale of fossil fuel LCVs. All three are used to some degree worldwide, but IDTechEx’s new report lays out how a handful of regions have been far more proactive than others in fuelling the EV transition.

Europe

Europe has been the most enthusiastic in legislating LCV emissions out of all the global regions. Its most well-known measure is the EU’s planned 2035 ban on all combustion engine cars and LCVs. The UK is even considering moving its own ban forward from 2035 to as early as 2030! Both these policies will place significant pressure on OEMs as well as LCV operators and fleets to electrify quickly.

Fossil fuel bans will accelerate the already fast rate of adoption in the European market. Much of the growth so far has itself been a result of regulation. Individual European countries institute their own purchase grant programs, varying anywhere from €3,000-€10,000. Most major cities also have local bans on fossil fuel LCVs operating within designated areas, often the city centers. LCV operators are, therefore, forced to use zero-emission models, with any additional upfront cost having to be attributed as simply the cost of doing business.

China

Despite its regulations being more relaxed than Europe’s, China is the clear world leader in eLCV adoption. This stems from the country’s strong track record in electrification across virtually all mobility sectors. The Chinese eLCV market is now incredibly populated, with all the major automotive groups and LCV OEMs having models in production. IDTechEx’s “Electric Light Commercial Vehicles 2025-2045: Markets, Players, Forecasts” report dives into each of these models with detailed information and market data.

Even still, its government is strengthening its already advantageous position through new regulation. It has long discussed plans to introduce a ban on combustion engine vehicles, although the government has stated that up to half of vehicles could still be hybrids. While this is yet to happen and would be targeted for a later year than Europe’s ban, it is indicative of continuing growth in the future. And just like Europe, China has its own purchase grant programs and local zero-emission zones to further the transition.

US

In stark contrast to both Europe and China, there is no combustion engine ban on the horizon for the US market. This follows an extended period of slower electrification in the country, with governments hesitant to invest in technological or infrastructure development (California being the exception).

This is beginning to change though, and the Inflation Reduction Act of 2022 was a major step in the right direction for eLCVs. For the first time, the federal government provided grants for the purchase or lease of a non-combustion LCV. This should offer the boost that US-based fleets require to kickstart adoption – as the US lags behind the rest of the developed world at <1% eLCV penetration.

That being said, the Inflation Reduction Act also provides financial incentives for plug-in hybrid LCVs. These cannot generate the same emissions reductions as a battery-electric vehicle, and the IDTechEx report expects that they are unlikely to be the dominant long-term powertrain option.

IDTechEx Outlook

The electrification of LCVs is going to be of critical importance if governments are to meet their stated aims. As it stands today, governments are ramping up efforts in this area, encouraging manufacturers and purchasers to increase their presence in the market through new regulation. In light of this and the ever-growing demand in road freight, IDTechEx is forecasting rapid expansion of the eLCV market out to over 11 million units in 2045.

“Electric Light Commercial Vehicles 2025-2045: Markets, Players, Forecasts” highlights the transformation that lies in the near future for LCVs. It provides more in-depth analysis of regulation – and goes further into sales trends, key players, and total costs of ownership too. 20-year granular forecasts broken down by region and powertrain provide critical insight into the key markets driving this change within the industry.