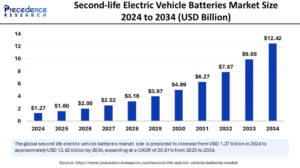

The second-life EV battery market is poised for remarkable growth over the next decade. According to Precedence Research, the market is projected to expand from US $1.60 billion in 2025 to US $12.42 billion by 2034, representing a compound annual growth rate (CAGR) of approximately 25.6%. Regional trends show Asia-Pacific leading the market due to its dominance in EV manufacturing and robust telecom infrastructure. Meanwhile, Europe is the fastest-growing region, driven by regulatory support for circular economy initiatives. China stands out for its extensive use of second-life batteries in telecom backup systems.

What Happens to EV Batteries After the Road Ends?

As the electric vehicle (EV) market accelerates globally, a critical question emerges: what happens to EV batteries after they reach the end of their automotive life? This is where second-life EV batteries enter the spotlight. These are lithium-ion batteries that have degraded to about 70–80% of their original capacity, below the threshold required for optimal vehicle performance, but still retain enough charge to serve effectively in less demanding applications. Rather than being immediately recycled, these batteries are repurposed for uses such as residential energy storage, grid support, telecom backup, and even EV-charging infrastructure. By extending battery utility beyond the road, second-life batteries offer a powerful way to maximize the value of embedded resources and promote a more sustainable, circular battery economy.

Key Drivers Behind APAC’s Leading Position

Asia Pacific leads the global second-life electric vehicle (EV) batteries market due to a unique convergence of high EV adoption, growing renewable energy integration, and robust government support. China alone accounted for nearly 60% of global EV sales in 2023, supported by approximately $45 billion annually in subsidies and tax relief programs, driving a massive battery supply pipeline. The region is experiencing a surge in xEV battery production, projected to grow from 19.2 million units in 2024 to 29.9 million units by 2029. This expansion translates into an abundant stream of retired EV batteries, each retaining 70–80% of their capacity, making them ideal for second-life applications such as energy storage.

By 2030, retired batteries in the region are expected to exceed 200 GWh per year, meeting critical storage demands for solar and wind energy systems. Governments across Asia Pacific are fueling this momentum: India provides EV subsidies of ₹1.4 billion, has lowered GST on EVs to 5%, and mandates public chargers every 25 kilometers; Thailand offers tax breaks and manufacturing incentives until 2025 to achieve 30% EV production by 2030. Meanwhile, innovative companies like South Korea’s Poen are refurbishing batteries at one-third the cost of new units and are scaling rapidly with 150% annual growth.

China’s CATL is deploying over 1,000 battery swap stations by 2025, reinforcing infrastructure to support reuse. With a forecasted reuse market value rising from USD 499 million in 2025 to USD 6.28 billion by 2033 in the region, Asia Pacific is poised to remain the global hub for second-life EV battery solutions, driven by economic scale, environmental policies, and strategic investments in circular energy ecosystems.

APAC Second-Life EV Battery Ecosystem

| Factor | APAC Situation |

| EV fleet scale | China, Japan, S. Korea, India, Australia are top EV producers Financial |

| Residual battery capacity | 70–80% capacity remains post-EV lifecycle |

| Renewables share | 60%+ of global renewables installed in APAC (2023) |

| Microgrid pilots | TEPCO, Kyocera (Japan); rural solar-storage in India |

| India subsidies (FAME) | $1.4 billion + infrastructure incentives |

| China tax incentives | RMB 520 billion program (2023–2027) |

| Indonesia battery mandates | Recycling rules |

| Corporate adoption | Poen: $9M revenue in 2023, +150%, sells at ⅓ cost |

| Cost comparison | Second-life packs ~33% of new battery cost |

Why Repurposing Matters More Than Ever

The importance of repurposing EV batteries lies not just in cost-efficiency but in broader strategic gains. Extending the usable life of batteries delays recycling, conserves raw materials, and supports global sustainability goals. It enables manufacturers, utilities, and governments to reduce the environmental footprint associated with battery production and disposal. This approach aligns with the growing global momentum around circular economy principles, where products and materials are reused and revalorized to minimize waste and maximize lifespan. By adopting second-life strategies, stakeholders can significantly reduce the strain on mineral extraction, lower lifecycle emissions, and gain additional return on investment from existing battery assets.

Green, Smart, and Profitable, The Triple Win

Second-life batteries offer several noteworthy benefits across environmental, economic, and energy infrastructure domains. Environmentally, they help reduce dependence on mining for scarce resources such as lithium and cobalt, lower the carbon footprint associated with manufacturing new batteries, and mitigate hazardous waste by delaying disposal. Economically, they are often more cost-effective than newly manufactured battery energy storage systems (BESS), providing a more accessible solution for energy storage in residential, commercial, or industrial contexts. For EV owners, they create residual value, extending the return on investment from their vehicles. On the energy infrastructure front, these batteries are increasingly used to support renewable energy integration, balance grid loads, and provide backup power. They also play a vital role in EV-charging stations by stabilizing power demand and avoiding excessive grid strain.

What’s Holding It Back?

Despite the optimism, the sector faces several key challenges. Technically, the performance of used batteries can be highly variable, posing safety risks and uncertainties in reliability. Currently, there is no universally accepted standard for testing or grading second-life batteries, which complicates quality assurance and deployment at scale. Economically, second-life systems must remain cheaper than new BESS even after accounting for costs related to diagnostics, transportation, and disassembly. The design of modern EV batteries, such as cell-to-pack configurations that use adhesives, further complicates disassembly and repurposing. Regulatory issues also pose barriers, with many regions lacking specific frameworks for battery repurposing. While the European Union is making progress with initiatives like battery passports and extended producer responsibility rules, most countries are still in early stages of regulatory development.

Technology to the Rescue, How Innovation is Driving Scale

Technological advancements are playing a pivotal role in overcoming these hurdles. Innovations in state-of-health (SOH) diagnostics now allow for rapid testing of used batteries, sometimes even while still installed in vehicles. Automation is also being introduced into the disassembly process, which can significantly reduce costs and labor. Industry-wide standardization efforts are underway to establish protocols for grading, safety, and system integration. Meanwhile, major original equipment manufacturers (OEMs) like GM, Volvo, and MAN are partnering with recyclers, utilities, and telecom firms to pilot second-life battery projects and explore scalable business models.

What’s Powering the Push?

Several key drivers are propelling the market forward. The ongoing boom in electric vehicle adoption is rapidly creating a supply of end-of-first-life batteries. The push toward renewable energy integration has created a rising demand for flexible, decentralized energy storage, an ideal use case for repurposed EV batteries. Governments and policymakers are also stepping in with recycling mandates, circular economy incentives, and energy resilience programs. On the economic side, second-life batteries are often eligible for grants and subsidies, making them an attractive choice for cost-conscious energy projects.

Discussion about this post