Millions of Americans went to the polls to vote for the 47th President of the United States. The results were emphatic: a second Trump administration and a Republican-controlled Senate. The fate of the House of Representatives has not yet become clear, but early signs indicate it is likely to remain in Republican hands. While this election will impact many aspects of the global economy, what do these results entail for one of the world’s biggest automotive markets?

The current state of the US auto industry

The Biden presidency saw massive increases in electrification in the US. According to IDTechEx’s report. “Plug-in Hybrid and Battery Electric Cars 2025-2045: Technologies, Players, Regulations, Market Forecasts”, battery electric vehicle (BEV) sales increased from 240,000 in 2020 at the beginning of the Biden administration to almost 1.2 million in 2023. Much of this growth has been fuelled by government support, with upcoming regulations (both nationwide and at a state level) to further boost EV sales. IDTechEx highlights 3 key legislative areas where the Trump administration could significantly alter the course of electrification in the US.

Inflation Reduction Act

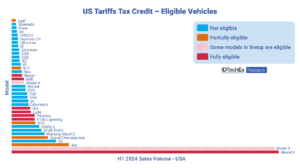

Inflation Reduction Act (IRA) was a landmark bill signed in 2022 that unlocked enormous amounts of federal funding, including (among other green energy policies) tax credits and incentives of up to US$7,500 per electric vehicle. The IRA has drawn repeated criticism from Trump, who labeled it “the biggest tax hike in history”. While a full repeal of the IRA is unlikely, with both houses of Congress in Republican hands, Trump’s leverage to modify the IRA will be increased. However, some key allies of Trump have been big beneficiaries of the IRA. Elon Musk’s Tesla has reportedly earned over US$1.8 billion (as of 2023) in tax credits, and many Tesla models are fully or partially eligible for the US$7.5k tax credit. Overall, the impact of the Trump administration on the IRA is as of yet unclear, but with both houses in Republican hands, his power to effect change is greater than it otherwise would have been.

IDTechEx research has collated the best-selling electric models in the US and highlighted which of these are eligible for the US$7.5k tax credit. Vehicles eligible include some of the best-selling models. Source: IDTechEx

EPA GHG Standards to 2032 for light and heavy-duty

The Environmental Protection Agency (EPA) also announced the light vehicle greenhouse gas (GHG) emissions regulations through 2032. These emissions standards were designed to encourage automakers to sell a minimum share of EVs to reach compliance, and they set a maximum permitted fleet average of gCO2/mile. Under the Trump administration, these are likely to be delayed and/or softened. Regulations for medium/heavy-duty commercial vehicles are also likely to be softened. Additionally, the upcoming administration will set the regulations beyond 2032, and a Republican government is likely to make these future limits less onerous. For context, by 2035, the EU will enforce a 100% zero-emissions car and light-duty market. With the result of the US election, it is exceedingly unlikely the US market will approach anything near that by 2035.

The EPA CO2 limits from 2021 up to 2035. The current regulations run until 2032, and the Trump administration could soften and delay these regulations. Source: IDTechEx

The end of CARB?

Since 1967, the California Air Resources Board (CARB) has had a waiver to set its own GHG standards independently of the EPA. Other states are allowed to decide to adopt either EPA or CARB rules, and the CARB targets are often stricter. As reported in IDTechEx’s research, 12 other states have so far signed up to California’s 2035 100% Zero-Emissions Vehicle (ZEV) target. This is a much more ambitious goal than the EPA, and the 13 states collectively represent almost a third of US car sales. However, the Republicans have long been opposed to this waiver, and a Trump administration is expected to work towards ending this waiver, which would negate this ZEV target. Any attempt to change it will require legal challenges that will ultimately go to the Supreme Court. This situation may be further affected by the 2024 ruling regarding the Chevron Deference, which now states that judges do not need to defer to federal agencies (such as the EPA) when interpreting statutes. In summary, it is a complex legal situation, but with the potential for the Trump administration to attempt to end the CARB waiver and, in turn, the only ZEV mandate in the US.

The 13 states that have so far signed up for the CARB 2035 ZEV mandate. Roughly a 3rd of the US auto market is within these states, but if the Trump administration is successful in repealing the CARB waiver, this mandate could be removed, and the emissions standards in the US could be standardized. Source: IDTechEx

Foreign trade policy – bipartisan support for tariffs

One of the few areas of convergence between the two parties concerned trade tariffs on Chinese EVs. Biden raised the import duty to 100%, and the Trump administration is likely to maintain or even increase these. Trade tariffs have also been implemented on Li-ion cells, which are likely to remain. IDTechEx’s “Li-ion Battery Market 2025-2035: Technologies, Players, Applications, Outlooks and Forecasts” report highlights just how much of the global Li-ion production is based in China. Chinese companies have a particular dominance in the anode and electrolyte but also a large market share in cells, cathodes, separators, and Cu current collectors. Increased tariffs require US firms to bring battery production and critical materials onshore. IDTechEx explores the outlook for one of the key materials, lithium, in its “Direct Lithium Extraction 2025-2035: Technologies, Players, Markets and Forecasts” reports.

The overall outlook for the auto industry: A slower transition, but a transition nonetheless

At this early stage, policy direction has yet to be ironed out. The coming weeks and months will shed more light on the new administration’s approach, but the key trends discussed here are likely to slow and reduce federal funding for EVs as well as delay and soften the introduction of EPA emissions regulations. Increased protectionism is likely to continue, encouraging a strong domestic supply chain of lithium-ion batteries as well as critical materials. With pure BEV sales already at 10% in the US and major OEMs pouring billions into EV production and development, the election result is unlikely to spell the end of the EV transition in the US but is likely to slow adoption as regulations soften.

Other uncertainties include the future of the NEVI (National Electric Vehicle Infrastructure), which has dedicated billions to rolling out charging infrastructure. If NEVI is scaled back or ended altogether, the approach to EV infrastructure in the U.S. may shift towards greater private sector involvement. This involves relying less on direct federal investment than under the current administration. Overall, this could bring faster infrastructure development through private-public partnerships and regulatory easing, benefiting companies like Tesla. However, reduced direct federal funding might create disparities in access and lead to regional gaps in infrastructure, affecting the overall speed and equity of the EV transition. IDTechEx covers the US charging market and globally in its research report “Charging Infrastructure for Electric Vehicles and Fleets 2025-2035: Markets, Technologies, and Forecasts”.

To find out more about these IDTechEx reports, including downloadable sample pages, please visit www.IDTechEx.com/Research/EV.