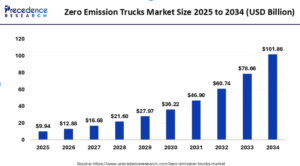

Precedence Research estimates the global zero emission trucks market size was USD 7.68 billion in 2024 and is projected to hit around USD 101.86 billion by 2034, at a CAGR of 29.5% over 2025–2034. Meanwhile, U.S. ZET deployment crossed 42,500 units by June 2024, including 12,851 new vehicles added since December 2023.

Quick Insights (2024–2034 Forecast)

- Global Market: USD 7.68 billion in 2024 → USD 101.86 billion by 2034 (CAGR 29.5%)

- U.S. Fleet Size: ≈ 42,500 ZETs deployed by mid-2024

- New Deployments: 12,851 units added since Dec 2023 (88% cargo vans)

- Share in New U.S. Sales: ZETs made up 2.6% in H1

- Leading States: California (6,313), Texas (4,155), Florida (3,744)

- Dominant Segment: Battery-electric cargo vans (≈86%)

- Fuel-cell Growth: Still under 50 deployed units (≈44 units in US)

What’s Powering This Surge in Demand?

Zero-emission trucks (ZETs) have shifted from experimental prototypes to serious commercial contenders. Global cities are increasingly adopting zero-emission zones (ZEZs), pushing logistics operators to electrify their fleets. Additionally, Total Cost of Ownership (TCO) for electric trucks is narrowing against diesel due to declining battery prices, favorable tax incentives, and operational cost savings.

Investments in fast-charging infrastructure, green hydrogen hubs, and megawatt charging systems (MCS) further enable high-mileage freight transport without emissions. Startups and incumbents alike are entering the fray, scaling manufacturing and offering innovative financing models to support fleet transition.

Expert Insight

“Fleet electrification is no longer a future scenario, it’s a current imperative. We’re seeing government subsidies and carbon taxes change the economics in favor of zero-emission trucks. The next five years will be pivotal in shaping which OEMs lead the charge,”

— Dr. Aarya Menon, Principal Consultant – Sustainable Mobility, Precedence Research

Regional Outlook

Asia Pacific continues to lead the global zero-emission trucks market, with China accounting for more than 80% of all medium- and heavy-duty zero-emission truck (ZET) sales in the first half of 2024. The market momentum in China has been driven by an aggressive government policy mix including subsidies of up to ¥95,000 (~USD 13,300) per electric truck, the development of high-capacity battery production hubs, and vast charging and hydrogen refueling corridors. In the first half of 2025 alone, China recorded a 175% year-over-year increase in electric heavy truck sales, reaching over 76,000 units—approximately 25% of all new heavy truck sales in the country. Projections from CATL suggest that by 2028, up to 50% of heavy trucks sold in China could be electric, supported by rapid improvements in battery technology and decreasing total cost of ownership.

In Europe, the zero-emission truck market is expanding steadily due to urban low-emission zones, carbon neutrality targets, and public-private infrastructure initiatives. Electric truck registrations nearly tripled in 2023, surpassing 10,000 units. Countries like Norway and Sweden are leading adoption, with electric heavy-duty trucks making up 7.8% and 6.5% of their respective national truck markets as of 2024. Infrastructure investment is robust, with European joint ventures like Milence (Volvo, Daimler, and Traton) planning to deploy over 1,700 high-capacity fast-charging stations across the continent to support commercial EV logistics.

In North America, the U.S. ZET market is in its early stages but gaining traction. Zero-emission trucks accounted for approximately 2.6% of new truck sales in the first half of 2024. As of mid-2024, the U.S. fleet included over 42,500 ZETs, with major states like California, Texas, and Florida leading deployments. Regulatory policies such as California’s Advanced Clean Trucks (ACT) rule and the U.S. EPA’s 2027–2032 heavy-duty emission standards are expected to catalyze further adoption. Additionally, initiatives like the $250 million investment by nonprofit Climate United to lease 500 electric Class 8 trucks at California ports are accelerating the market in drayage and freight corridors.

Elsewhere in the world, particularly in India and Latin America, adoption is at a nascent stage but is accelerating due to urban pollution concerns and fuel price volatility. India has announced 10 key highway corridors for zero-emission logistics vehicle deployment as part of its broader net-zero 2070 goal. Southeast Asia and parts of South America are receiving increasing imports of light-duty BEVs from China-based OEMs, targeting last-mile and municipal service markets.

Zero Emission Trucks Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 29.50% |

| Market Size in 2024 | USD 7.68 Billion |

| Market Size in 2025 | USD 9.94 Billion |

| Market Size by 2034 | USD 101.86 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Vehicle Type, By Source, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Innovation & Company Updates

- Amazon (UK): Placed Britain’s largest-ever electric HGV order, over 140 Mercedes-Benz electric trucks plus 8 Volvo heavy lorries to be deployed next 18 months, backed by the UK’s zero-emission HGV program.

- Fortescue–Liebherr: $2.8 billion battery-electric fleet deal to convert two-thirds of mining vehicles, using 6 MW fast-charging trucks; validation begins in 2025 across Australia.

- Nikola: Delivered 112 hydrogen fuel-cell trucks in H1 2024, operating 14 refueling stations , though faced bankruptcy in early 2025, impacting rollout risks.

- Windrose Technology: A Chinese startup expanding into U.S. via new Georgia plant, targeting long-haul Class 8 EVs with charging infrastructure partnerships.

Key Challenges & Cost Pressures

- High Upfront Price: ZETs can cost 2–3x higher than diesel models; small fleets struggle to finance upgrades without leases or subsidies.

- Infrastructure Gaps: Grid capacity, charging station availability, and hydrogen refueling remain insufficient in non-urban corridors.

- Operational Constraints: Battery weight reduces payload; range anxiety and variable charging rates still deter adoption for long-haul.

- Policy Uncertainty: Legislative pushback, such as New York’s proposed delay on ACT rule (postponed to 2027), may slow momentum.

Segmental Overview

By vehicle type, light-duty trucks, such as electric cargo vans and last-mile delivery vehicles, dominate the current ZET landscape. These vehicles are particularly well-suited for urban delivery routes with shorter distances and frequent stops. In fact, they represent nearly 86–99% of all ZET deployments in regions like the U.S. and China. Fleet operators such as Amazon, FedEx, and IKEA have integrated hundreds of electric light-duty trucks into their logistics networks due to the combination of reduced maintenance, lower fuel costs, and compliance with city-level emissions regulations.

Medium-duty trucks are the fastest-growing segment in terms of deployment. These trucks are increasingly being used in regional logistics, utility services, and municipal operations. Their adoption is supported by stronger battery ranges and growing incentives for mid-sized commercial operators. Many cities in the U.S. and Europe have begun electrifying municipal fleets such as garbage trucks and street maintenance vehicles.

Heavy-duty trucks, which are essential for long-haul freight and cross-border logistics, remain the most challenging segment to electrify. However, China has made major inroads in this area, where thousands of electric heavy trucks have been deployed for mining and industrial uses. In Europe and North America, companies like Volvo, Nikola, and Daimler are piloting battery-electric and hydrogen fuel cell trucks with ranges exceeding 300 miles. The lack of charging infrastructure on intercity highways and concerns over battery weight are key constraints, but infrastructure developments and battery energy density improvements are expected to unlock growth in this segment by 2027 and beyond.

When viewed by propulsion type, battery-electric trucks (BEVs) account for more than 99% of the global ZET fleet today. They dominate in light- and medium-duty categories, especially in urban and regional delivery. However, hydrogen fuel cell electric vehicles (FCEVs) are gaining ground in the heavy-duty segment. FCEVs offer rapid refueling and lower weight penalties, making them ideal for long-distance and high-payload operations. While FCEV adoption is currently under 1% of total ZETs globally, pilot programs across Germany, California, and South Korea indicate growing momentum.

Discussion about this post