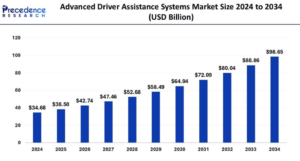

The global advanced driver assistance systems (ADAS) market size is valued at USD 38.50 billion in 2025 and is forecasted to surpass around USD 98.65 billion by 2034, accelerating at a CAGR of 11.02% from 2025 to 2034.

Advanced Driver Assistance Systems Market Key Highlights

- In 2024, the LiDAR sensors segment held a significant share of the market by component type.

- The software segment is projected to grow at a notable CAGR from 2025 to 2034.

- By vehicle type, the commercial car segment is experiencing a CAGR of 17.3%.

- The tire pressure monitoring system segment accounted for over 20.7% of the market share in 2024 by solution type.

- The autonomous emergency braking segment is expected to grow at a CAGR of 21.5% throughout the forecast period.

AI’s Impact on the Advanced Driver Assistance Systems (ADAS) Industry

AI is revolutionizing the Advanced Driver Assistance Systems (ADAS) industry by enhancing vehicle safety, automation, and real-time decision-making. AI-powered algorithms process vast amounts of sensor data from LiDAR, radar, and cameras to improve object detection, lane-keeping assistance, and adaptive cruise control. Machine learning enables ADAS to predict potential collisions and assist in real-time driving decisions, reducing human error.

AI also enhances autonomous emergency braking and driver monitoring systems, making vehicles smarter and more responsive. As AI technology advances, ADAS is expected to evolve into more autonomous and highly efficient driving solutions, paving the way for fully autonomous vehicles.

U.S. Advanced Driver Assistance Systems Market Size and Growth 2025 to 2034

The U.S. advanced driver assistance systems market size was evaluated at USD 7.80 billion in 2024 and is predicted to be surge around USD 22.36 billion by 2034, growing at a CAGR of 11.10% from 2025 to 2034.

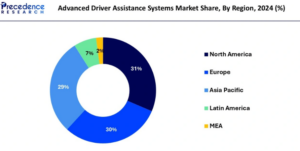

North America holds a dominant position in the ADAS market due to strict safety regulations, high consumer adoption, and the presence of key automotive manufacturers.

Europe follows closely, driven by stringent Euro NCAP safety standards and increasing government incentives for autonomous driving technology. The Asia Pacific region is witnessing rapid growth due to rising vehicle production, increasing disposable income, and government initiatives promoting vehicle safety. Countries such as China, Japan, and South Korea are leading innovation in ADAS technologies, further driving regional expansion.

North America

North America maintains a dominant position in the ADAS market, driven by stringent safety regulations and a high rate of technology adoption. The region’s robust automotive industry and consumer demand for advanced safety features contribute to substantial market growth.

Europe

Europe is experiencing steady growth in the ADAS sector, propelled by stringent safety standards and a strong automotive manufacturing base. Countries like Germany lead in revenue share, supported by a well-established automobile sector and high consumer preference for ADAS-installed vehicles.

Asia-Pacific

The Asia-Pacific region is emerging as a significant market for ADAS, with countries like China investing heavily in AI-powered autonomous driving technologies. Chinese companies such as XPeng and Huawei are at the forefront of developing driver-assistance software, aiming to emulate human driving and handle various traffic situations. Local governments in China actively support the commercialization of autonomous driving, contributing to rapid advancements in the sector

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 38.50 Billion |

| Market Size by 2034 | USD 98.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.02% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System Type, Vehicle Type, Sensor Type, Electric Vehicle, Level of Autonomy, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The Advanced Driver Assistance Systems (ADAS) market is primarily driven by the increasing focus on vehicle safety regulations and the rising demand for autonomous and semi-autonomous vehicles.

Governments worldwide are implementing stringent safety norms that mandate the integration of ADAS features such as lane departure warning, adaptive cruise control, and automatic emergency braking. The growing consumer awareness regarding road safety and the reduction of accidents through ADAS technologies are further propelling market growth.

Additionally, advancements in artificial intelligence (AI), sensor technologies, and connectivity solutions have significantly enhanced the efficiency and accuracy of ADAS, boosting adoption rates.

Market Opportunities

The rapid advancement of AI and machine learning in ADAS solutions presents significant growth opportunities. The increasing penetration of electric vehicles (EVs) and connected cars is further accelerating the need for intelligent driver assistance systems.

The emergence of 5G networks is expected to improve real-time communication between vehicles, enhancing the effectiveness of ADAS. Developing regions, including Asia Pacific and Latin America, offer significant potential as automotive manufacturers expand their production capabilities and governments introduce safety mandates.

Market Challenges

Despite strong growth prospects, the ADAS market faces challenges such as the high cost of implementation, which makes these systems less accessible for budget and mid-range vehicles.

The complexity of integrating ADAS with existing automotive systems poses technical challenges for manufacturers. Additionally, concerns over cybersecurity threats and data privacy issues hinder consumer trust in connected ADAS solutions. Weather conditions and road infrastructure also impact the accuracy and reliability of ADAS features, limiting their effectiveness in certain regions.

Advanced Driver Assistance Systems (ADAS) Companies

- Denso

- Aptiv

- Robert Bosch GmbH

- Continental AG

- Magna International

- Veoneer

- Hyundai Mobis

- ZF Friedrichshafen

- Valeo

- NVIDIA

- Intel

- Microsemi Corporation

- Nidec Corporation

- Hella

- Texas Instruments

- Infineon Technologies AG

- Hitachi Automotive

- Renesas Electronics Corporation

Segments Covered in the Report

By System Type

- Intelligent Park Assist (IPA)

- Lane Departure Warning (LDW)

- Road Sign Recognition (RSR)

- Tire Pressure Monitoring System (TPMS)

- Night Vision System (NVS)

- Automatic Emergency Braking (AEB)

- Adaptive Cruise Control (ACC)

- Adaptive Front Light (AFL)

- Blind Spot Detection (BSD)

- Cross Traffic Alert (CTA)

- Driver Monitoring System (DMS)

- Forward Collision Warning (FCW)

- Others

By Sensor Type

- Image Sensors

- Ultrasonic Sensors

- LiDAR

- Radar Sensors

- Infrared (IR) Sensors

- Laser Sensors

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

By Level of Autonomy

- L1

- L2

- L3

- L4

- L5

By Electric Vehicle

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa